By VanEck Webinar

By VanEck

Webinar Replay: Making Sense of Rising US Fairness Valuations – Watch Now.

I’ve written often about market valuation in latest months, and for good purpose. It’s no secret {that a} small variety of shares have accounted for a disproportionate quantity of the market’s return. Increasingly U.S. inventory traders are dealing with a tough determination: do you keep on benchmark and search little or no alpha, or do you underweight mega-cap, massive tech shares in favor of different potential alternatives available in the market?

The danger of allocating to off-benchmark publicity has rewarded far fewer than it has punished over time, significantly in massive cap U.S. shares the place the market is arguably most effective. S&P Dow Jones Indices not too long ago launched their SPIVA® (S&P Indices Versus Energetic) outcomes for Q2 2020 and located that for the trailing 5 years, much more actively managed U.S. massive cap funds underperformed the S&P 500 Index than outperformed. By way of June 30, 2020, 78% of funds underperformed for the five-year trailing interval, 71% underperformed for the three-year trailing interval, and 63% of funds underperformed for the one-year trailing interval. That final stat is notable as a result of properly over half of energetic massive cap funds didn’t outperform the S&P 500 Index in a interval that included important market volatility, an setting the place energetic administration supposedly has the higher hand.

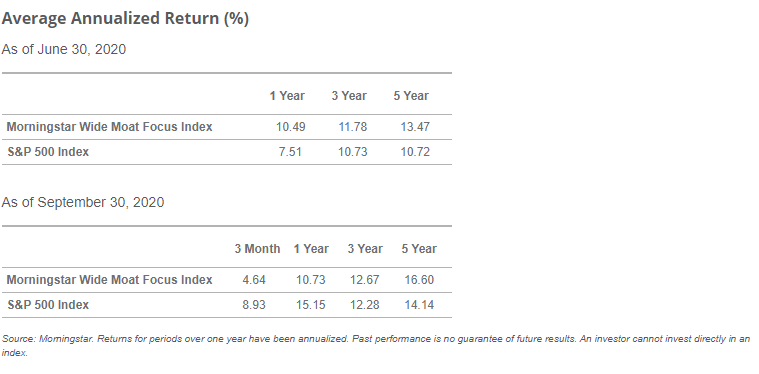

For the one-, three-, and five-year interval cited within the SPIVA report, the Morningstar® Large Moat Focus IndexSM (the “Index”) outperformed the S&P 500 Index, although there was underperformance within the final three months pushed by inventory choice in a number of sectors, most notably industrials and tech.

Influence of Moats and Valuations

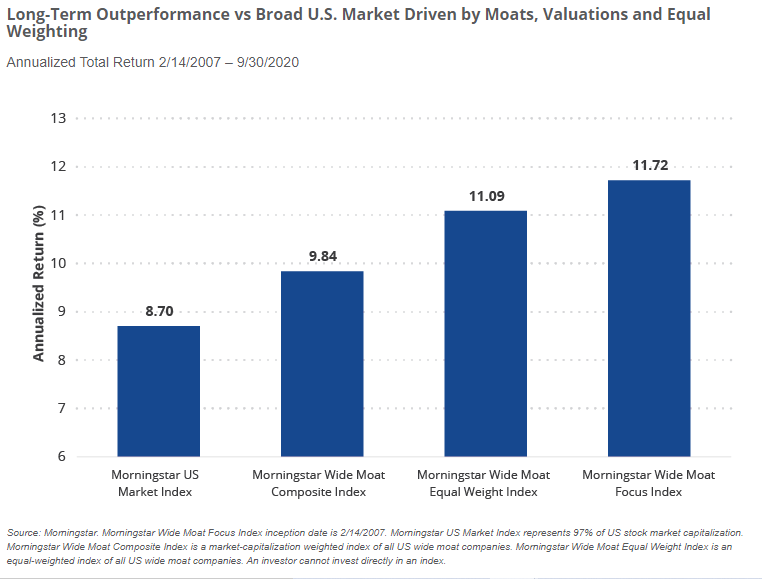

Regardless of near-term headwinds, Morningstar’s valuation-driven funding philosophy has delivered outperformance versus the broad market since its inception in February 2007. Morningstar strategist, Andrew Lane, not too long ago printed a paper analyzing the influence of the Index’s three main methodology options: financial moats, equal weighting and valuations. Over its historical past, every of those three options has incrementally improved the Index’s annualized outperformance.

First, and never unusual available in the market, the Index applies an equal-weighted method, which permits every Index constituent to contribute to its complete return versus these indexes that favor bigger, extra liquid firms. Subsequent, and harder to copy, is Morningstar’s proprietary financial moat scores and honest worth assessments. Firms that obtain Morningstar’s broad financial moat ranking are members of an unique membership that possess aggressive benefits that Morningstar believes will enable them to take care of returns on invested capital in extra of their weighted common price of capital for 20 or extra years into the long run.

Nevertheless, Morningstar doesn’t essentially view financial moat scores as predictive of efficiency. As a result of broad moat firms are extensively sought by traders, they have an inclination to commerce at larger multiples and are sometimes tough to search out “on sale,” as Lane places it. That is the place Morningstar’s valuation framework is available in: the Index targets these broad moat firms buying and selling at engaging valuations. This mix of equal weighting, broad financial moat scores and engaging valuations is what has pushed extra returns all through the Index’s historical past.

High Valuation Alternatives

With valuations high of thoughts, it’s price highlighting just a few of probably the most undervalued shares within the Index. If Morningstar’s conviction is rewarded by means of the market realizing its present mispricing and inventory costs rising towards honest worth, the Index will profit.

Wells Fargo & Co. (WFC): 48% Low cost to Truthful Worth

Wells Fargo is a good instance of a long-time index constituent that hasn’t been eliminated or seen its place scaled again in years. It was added in June 2016 and has remained since. This factors to the persistent relative attractiveness of its market value relative to its Morningstar-assigned honest worth. It’s also one of many extra generally cited firms in questions we obtain right here at VanEck from traders and potential traders. The financial institution has been topic to years of adverse headlines, however in line with Morningstar, it stays one of many high deposit gatherers within the U.S. The financial institution has simply out-earned its price of fairness for many years and continues to take action as we speak, and Morningstar considers its broad moat ranking to be steady.

Wells Fargo earns its broad moat ranking based mostly on price benefits and switching prices. Morningstar cites the financial institution’s measurement and main market share in lots of enterprise items through which it competes. It has the most important retail department community within the U.S., aiding its deposit gathering success. Its price benefits stem from a low-cost deposit base, glorious working effectivity and conservative underwriting. Notably, Wells Fargo fared higher than lots of its friends throughout the world monetary disaster.

As of October 2, 2020, Wells Fargo was buying and selling at a 48% low cost to its $46 per share honest worth estimate, assigned by Morningstar. That is regardless of a lower within the financial institution’s honest worth from $50 per share in mid July 2020, following earnings outcomes and factoring a 50% likelihood of a Biden victory in November and implementation of his proposed tax plan. Morningstar believes the financial institution will face short- and mid-term headwinds by means of long-term low rates of interest, price earnings pressures, and potential will increase in pandemic-driven credit score losses. Nevertheless, it additionally believes the financial institution will focus closely on reducing bills in 2021 and 2022, warranting its honest worth evaluation.

Boeing Co. (BA): 37% Low cost to Truthful Worth

Boeing has additionally generated its justifiable share of headlines in latest months. It was a notable addition to the Index in March when it was buying and selling at an all-time low of roughly 70% low cost to its Morningstar honest worth estimate. The aerospace and protection agency noticed its Index weight elevated in June as a result of it remained attractively priced on the time.

As of October 2, 2020, Boeing traded at a 37% low cost to its $264 per share Morningstar honest worth estimate. Its honest worth displays an assumption by Morningstar that Boeing will obtain an up to date airworthiness directive from the FAA for its 737 MAX mannequin early within the fourth quarter of 2020. The tougher variable to foretell is the influence the worldwide pandemic may have on industrial airways. Morningstar believes extreme near-term decline in income might be adopted by a pointy rebound in air visitors after a COVID-19 vaccine is accessible and well-distributed by mid-2021.

Because of the grounding of the 737 MAX, a requirement backlog exists. Morningstar believes an trade shift towards slender physique aircrafts (737 MAX is a slender physique plane) will improve within the close to time period as wide-body plane demand recovers extra slowly due to their use in longer haul journeys, which would require a dependable vaccine earlier than returning to pre-pandemic ranges.

Biogen Inc. (BIIB): 29% Low cost to Truthful Worth

Biogen has been an Index constituent since December 2015, although its weighting has scaled down and again up at numerous instances based mostly on altering valuation dynamics. Its present low cost isn’t its lowest traditionally, however it’s at present fairly undervalued in line with Morningstar.

Biogen earns a large moat ranking from its specialty-market-focused portfolio and novel, neurology-focused pipeline. Its management in a number of sclerosis (MS) and neurodegenerative ailments paired with its oncology collaboration with Roche have pushed returns on invested capital above its price of capital, and Morningstar forecasts they may stay properly above for not less than one other 10 years.

Biogen’s honest worth estimate was decreased in June from $413 per share to $389 per share, reflecting Morningstar’s Tecfidera (MS remedy) forecast paired with will increase to anticipated generic competitors following trade litigation. A lot of Biogen’s honest worth estimate is based on pipeline approvals in numerous segments, a few of that are at present anticipated to be delayed based mostly on latest coronavirus-related remedy delays.

VanEck Vectors Morningstar Large ETF (MOAT) seeks to copy as carefully as doable, earlier than charges and bills the value and yield efficiency of the Morningstar Large Moat Focus Index.

Initially printed by VanEck, 10/8/20

Vital Disclosures

The data offered doesn’t contain the rendering of customized funding, monetary, authorized, or tax recommendation. Sure statements contained herein could represent projections, forecasts and different ahead trying statements, which don’t mirror precise outcomes, are legitimate as of the date of this communication and topic to alter with out discover. Data supplied by third social gathering sources are believed to be dependable and haven’t been independently verified for accuracy or completeness and can’t be assured. The data herein represents the opinion of the writer(s), however not essentially these of VanEck.

This commentary will not be supposed as a advice to purchase or to promote any of the sectors or securities talked about herein. Holdings will range for the MOAT ETF and its corresponding Index. For an entire record of holdings within the ETF, please click on right here: https://www.vaneck.com/etf/fairness/moat/holdings/.

An investor can’t make investments instantly in an index. Returns mirror previous efficiency and don’t assure future outcomes. Outcomes mirror the reinvestment of dividends and capital features, if any. Sure indices could take into consideration withholding taxes. Index returns don’t symbolize Fund returns. The Index doesn’t cost administration charges or brokerage bills, nor does the Index lend securities, and no revenues from securities lending had been added to the efficiency proven.

Truthful worth estimate: the Morningstar analyst’s estimate of what a inventory is price.

Value/Truthful Worth: ratio of a inventory’s buying and selling value to its honest worth estimate.

The Morningstar® Large Moat Focus IndexSM was created and is maintained by Morningstar, Inc. Morningstar, Inc. doesn’t sponsor, endorse, concern, promote, or promote the VanEck Vectors Morningstar Large Moat ETF and bears no legal responsibility with respect to that ETF or any safety. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar® Large Moat Focus IndexSM is a service mark of Morningstar, Inc.

The Morningstar® Large Moat Focus IndexSM consists of U.S. firms recognized as having sustainable, aggressive benefits and whose shares are attractively priced, in line with Morningstar.

Efficient June 20, 2016, Morningstar applied a number of modifications to the Morningstar Large Moat Focus Index development guidelines. Amongst different modifications, the index elevated its constituent rely from 20 shares to not less than 40 shares and modified its rebalance and reconstitution methodology. These modifications could lead to extra diversified publicity, decrease turnover and longer holding durations for index constituents than underneath the principles in impact previous to this date.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC and/or its associates and has been licensed to be used by Van Eck Associates Company. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P International, Inc., and/or its associates. All rights reserved. Redistribution or replica in entire or partly are prohibited with out written permission of S&P Dow Jones Indices LLC. For extra data on any of S&P Dow Jones Indices LLC’s indices please go to www.spdji.com. S&P® is a registered trademark of S&P International and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their associates nor their third social gathering licensors make any illustration or guarantee, categorical or implied, as to the power of any index to precisely symbolize the asset class or market sector that it purports to symbolize and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their associates nor their third social gathering licensors shall have any legal responsibility for any errors, omissions, or interruptions of any index or the info included therein.

An funding within the VanEck Vectors Morningstar Large Moat ETF (MOAT®) could also be topic to dangers which embrace, amongst others, investing in fairness securities, client discretionary, financials, well being care, industrials and knowledge expertise sectors, medium-capitalization firms, market, operational, index monitoring, licensed participant focus, no assure of energetic buying and selling market, buying and selling points, passive administration, fund shares buying and selling, premium/low cost danger and liquidity of fund shares, non-diversified, and focus dangers, which can make these investments unstable in value or tough to commerce. Medium-capitalization firms could also be topic to elevated dangers.

Investing includes substantial danger and excessive volatility, together with doable lack of principal. An investor ought to think about a Fund’s funding goal, dangers, prices and bills rigorously earlier than investing. To acquire a prospectus and abstract prospectus for VanEck Funds and VanEck Vectors ETFs, which include this and different data, name 800.826.2333 or go to vaneck.com. Please learn the prospectus and abstract prospectus for VanEck Funds and VanEck Vectors ETFs rigorously earlier than investing.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.