Volume has been astronomical in Canadia

Volume has been astronomical in Canadian crypto ETFs after the launch of Ether ETFs on Tuesday.

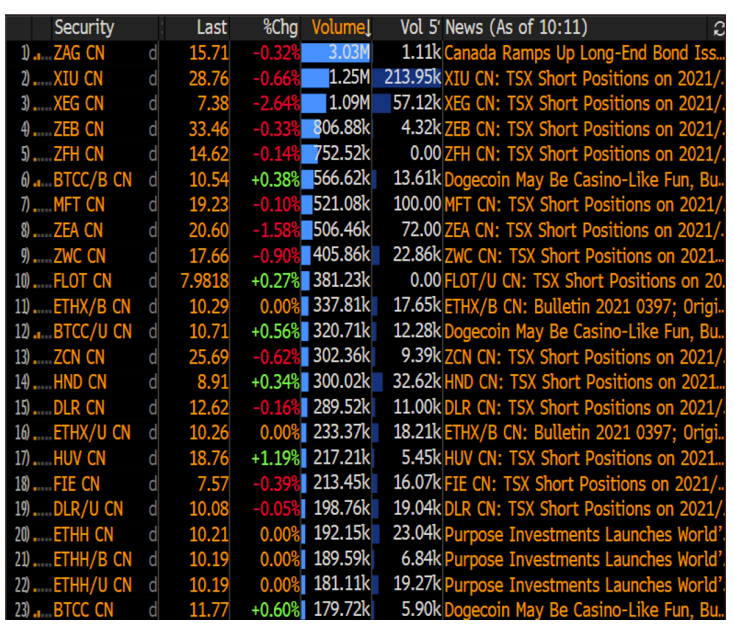

Bloomberg senior ETF analyst Eric Balchunas posted a screenshot to his Twitter feed on Tuesday that exposed one-third of the 25 most actively traded ETFs on the Toronto Inventory Alternate have been cryptocurrency funds.

Supply: Eric Balchunas, Bloomberg

The Objective Bitcoin ETF, Canada’s first-to-market Bitcoin ETF that launched in February, was essentially the most actively traded crypto ETF. Its non-currency-hedged share class (BTCC.B) had the sixth highest quantity of any ETF on the TSX, adopted by the fund’s U.S. dollar-denominated share class (BTCC.U), within the 12th highest quantity slot. The fund’s currency-hedged share class, BTCC, was the 23rd most actively traded class.

In the meantime, the CI Galaxy Ethereum ETF was essentially the most closely traded of the three new Ethereum ETFs. ETHX.B, traded in Canadian {dollars}, noticed the 11th highest buying and selling quantity of the day, with the U.S. dollar-denominated share class, ETHX.U, not far behind with the 16th highest quantity.

The Objective Ether ETF, Objective’s sister fund to BTCC, additionally noticed excessive volumes, with the Canadian greenback share class, ETHH; the non-currency-hedged share class, ETHH.B; and the U.S. dollar-denominated ETHH.U a share class buying and selling with the 20th, 21st, and 22nd highest volumes, respectively.

Collectively, reported Balchunas, these eight share courses already exhibited increased buying and selling quantity than the most important ETF buying and selling in Canada, the $9.eight billion iShares S&P/TSX 60 Index ETF (XIU.CN).

“Fast takeaway: Sht [sic] is gonna get loopy once they approve this stuff within the US,” he added in a later tweet, referencing the eight functions nonetheless sitting earlier than the SEC.

For extra info, please go to our Crypto Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.