Paul Tudor Jones is tremendous bullish on Bitcoin proper now and should give the crypto the identical 5% weighting as gold, commodities and money.

Two years in the past this month, the billionaire hedge fund supervisor stated that gold was his favourite commerce within the subsequent 12 to 24 months because of geopolitical disruptions, amongst different elements. The yellow steel “has every thing going for it,” he informed Bloomberg.

It was name. Over the subsequent 12 months, the gold worth surged from round $1,330 an oz to $1,730, and in August 2020 it will definitely hit its all-time excessive of $2,073—a 55% improve from the day Jones introduced his bullishness.

This week he made an analogous name in response to runaway inflation, saying he’d go “all in” on not simply gold but in addition crypto and commodities if the Federal Reserve refuses to step in and tame rising shopper costs. (For the file, the Fed did simply that, leaving charges at historic lows for now.)

“If [the Fed governors] say, ‘We’re on the trail, issues are good,’ then I might simply go all in on the inflation trades. I’d in all probability purchase commodities, purchase crypto, purchase gold,” Jones informed CNBC.

He added that he needed “5% in gold, 5% in Bitcoin, 5% in money, 5% in commodities.”

Jones’s feedback come just some weeks after fellow billionaire hedge fund guru Ray Dalio shocked buyers by saying he’d relatively personal Bitcoin than authorities bonds. Investing in bonds has grow to be “silly,” he stated, since yields are at present decrease than the speed of inflation.

Like Jones, Dalio has historically been a fan of gold, and as of Bridgewater’s most up-to-date submitting, his fund had a $277 million place in SPDR Gold Shares (GLD) and a $143 million place within the iShares Gold Belief (IAU). The fund additionally held comparatively small positions in numerous corporations concerned in treasured steel mining, together with Barrick Gold, Newmont, Agnico-Eagle Mines and Wheaton Treasured Metals.

With Inflation on the Rise, Buyers Might Not Be In a position to Afford Shunning Gold and Bitcoin

I feel each Paul Tudor Jones and Ray Dalio are proper to allocate funds to gold in addition to its digital cousin Bitcoin. Some buyers attempt to make it an both/or debate, however usually I consider there’s sufficient room in most portfolios for each property, to not point out publicity to commodities.

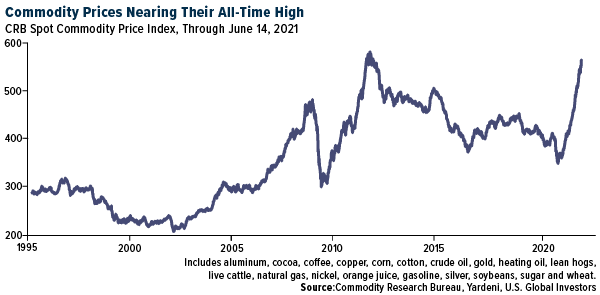

I’ll present you why in a second, however for now, there shouldn’t be any query that inflation is right here, transitory or not. A basket of commodities, together with gold, is near touching and exceeded its all-time excessive set in 2011 as shortages, labor shortage and a mounting backlog of orders elevate costs for every thing from aluminum to wheat.

click on to enlarge

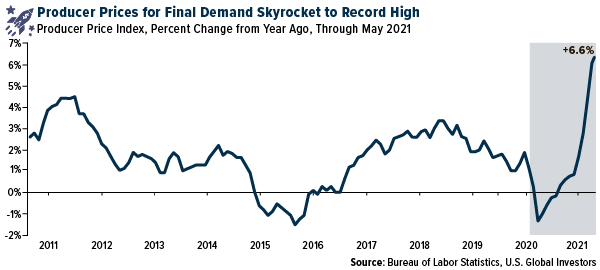

In consequence, costs acquired by producers for completed items and companies rose on the quickest tempo on file final month. The ultimate demand index superior 6.6% in Might, the most important improve ever since 12-month information started to be collected in late 2010.

click on to enlarge

Looking for a haven, then, makes loads of sense to me at the moment. Shares have to this point shrugged off larger inflation, however it’s vital to acknowledge that rising shopper costs are sometimes a self-fulfilling prophecy, whatever the Fed’s actions. Many buyers could not be capable of afford shunning gold and Bitcoin.

Gold and Crypto Beat Tech Shares

Even when inflation weren’t such a priority, gold and Bitcoin have carried out nicely sufficient in current months to justify having them in your portfolio.

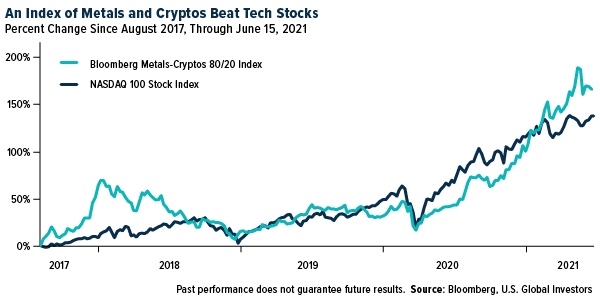

In reality, in line with a current report by Bloomberg commodity strategist Mike McGlone, a easy 80/20 index of metals and cryptos has crushed the tech-heavy Nasdaq-100 since August 2017, when the Bloomberg Galaxy Crypto Index was launched.

When mixed at a 20% weight with the Bloomberg All Metals Index, Mike’s metals-cryptos 80/20 index has been very aggressive in opposition to and ended the interval larger than the Nasdaq-100. What’s extra, it did that with decrease volatility.

click on to enlarge

“Volatility is relative, and when mixed with gold, Bitcoin has been much less dangerous than the S&P 500, which ought to maintain the quasi-currency’s outperformance in 2021,” Mike writes.

That’s to not say that Bitcoin is risk-free. Removed from it. However when used prudently with gold, it may assist defend buyers from probably rocky market volatility triggered by higher-than-expected inflation.

Initially printed by US Funds, 6/17/21

All opinions expressed and information offered are topic to vary with out discover. A few of these opinions will not be applicable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. World Buyers doesn’t endorse all data provided by this/these web site(s) and isn’t answerable for its/their content material. Beta is a measure of the volatility, or systematic threat, of a safety or portfolio compared to the market as an entire.

The Commodity Analysis Bureau (CRB) Index acts as a consultant indicator of in the present day’s international commodity markets. The CRB measures the aggregated worth route of varied commodity sectors and is designed to isolate and reveal the directional motion of costs in total commodity trades. The producer worth index (PMI) for ultimate demand measures change in costs acquired by home producers for items, companies and building bought for private consumption, capital funding, authorities and export. The Nasdaq 100 Index is a basket of the 100 largest, most actively traded U.S corporations listed on the Nasdaq inventory change. Bloomberg Galaxy Crypto Index (BGCI) is designed to measure the efficiency of the most important cryptocurrencies traded in USD. The S&P 500 is a inventory market index that tracks the shares of 500 large-cap U.S. corporations.

Holdings could change day by day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. World Buyers as of (03/31/2021): Barrick Gold Corp., Newmont Corp., Wheaton Treasured Metals Corp.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.