Key Takeaways

Capital Group, one of many largest managers of lively mutual funds within the U.S., has filed paperwork to launch its first ETFs, with plans to launch six merchandise within the first quarter of 2022.

Capital Group, one of many largest managers of lively mutual funds within the U.S., has filed paperwork to launch its first ETFs, with plans to launch six merchandise within the first quarter of 2022.- The pending ETFs might be totally clear every day, not like some just lately launched merchandise from Capital Group’s friends that reveal holdings on a month-to-month or quarterly foundation.

- Capital Group’s ETFs will leverage current groups behind extensively held mutual funds, akin to American Funds Development Fund of America (AGTHX), however the ETFs might be complementary merchandise reasonably than clones.

Basic Context

Capital Group’s entry into the ETF market, albeit late, might be a key milestone for lively ETFs. The asset supervisor behind the favored suite of American Funds mutual funds right now filed preliminary paperwork to launch 5 fairness ETFs and one fastened revenue product, with an anticipated launch late within the first quarter of 2022. The agency’s fairness ETFs, which might be listed underneath the identify Capital Group reasonably than American Funds to keep away from probably confusion, will be part of actively managed ETFs from well-known suppliers, together with American Century, Constancy, Invesco, JPMorgan, and T. Rowe Worth. Actively managed ETFs symbolize simply 2% of fairness ETF property and 4% of general property, in accordance with CFRA knowledge, however these fairness ETFs gathered 9% of the flows 12 months so far as of mid-August. Capital Group is presently one in all few top-tier lively managers to not supply an index-based or lively ETF different as traders have more and more shifted away from simply proudly owning lively mutual funds. We expect Capital Group’s efforts may assist validate all actively managed ETFs in an business the place many individuals consider them as simply passively replicating the S&P 500 Index.

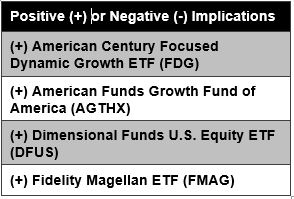

The pending ETFs will surprisingly be totally clear. A few of the established corporations that launched lively fairness ETFs prior to now 18 months did so utilizing a construction that delayed the disclosure of fund administration’s funding selections by a semi-transparent construction. American Century Centered Dynamic Development ETF (FDG 84) and Constancy Magellan ETF (FMAG) are some examples.

Capital Group beforehand licensed the usage of a semi-transparent construction, however the agency’s pending ETFs will reveal the complete portfolio and weights every day. We don’t foresee the every day disclosure to be a significant problem, as managers of Capital Group’s mutual funds have traditionally taken a long-term method utilizing reasonable turnover, in accordance with CFRA Analysis, however mutual fund traders would possibly marvel why they know a lot much less about what they personal. Going totally clear can even allow the agency to supply two ETFs – Capital Group World Development Fairness (CGGO) and Capital Group Worldwide Focus Fairness ETF (CGXU) – that make investments primarily in non-U.S. shares in addition to give its U.S. choices such flexibility. Asset managers can solely spend money on U.S. shares with the permitted semi-transparent ETF buildings.

Up to now, we keenly targeted our consideration on the agency’s 13F filings to grasp what shares have been collectively purchased and offered every quarter. For instance, Capital Group decreased its stake in Tesla (TSLA 706) and JPMorgan (JPM) by 8.9% and 6.0%, respectively, within the second quarter whereas boosting its share depend in CVS Well being Corp (CVS ) and Utilized Supplies (AMAT) 34% and 15%, respectively, in accordance with knowledge on Capital IQ’s platform.

The brand new ETFs are supposed to enhance reasonably than clone current American Funds. For instance, the pending Capital Group Development ETF (CCGR) appears like American Funds Development Fund of America, which launched practically 50 years in the past and manages roughly $280 billion in property throughout numerous share lessons. CFRA believes the four-star rated AGTHX, which is a retail class of the mutual fund, has robust reward potential and incurs modest prices relative to the broader U.S. fairness mutual fund class. Whereas three of the portfolio managers of CCGR are additionally on the staff that runs AGTHX, Capital Group careworn to CFRA that the ETFs can be run individually to provide shoppers a option to have the extra tax-efficient construction in a taxable account or the mutual fund in a retirement account.

Although the agency plans to initially supply one fastened revenue ETF, we anticipate extra to return. Capital Group Core Plus Revenue (CGCP) is slated to launch by the tip of first quarter 2022 and might be run by the identical three portfolio managers as American Funds Strategic Bond Fund (ANBAX 11 **). We anticipate the pending ETF to speculate primarily in funding grade bonds however have some excessive yield publicity given its give attention to present revenue.

Holly Framsted, Head of ETFs at Capital Group, instructed CFRA that the primary six merchandise would be the starting of the corporate’s ETF franchise of merchandise. We anticipate Capital Group will increase its lineup over the following few years to offer an ETF different for shoppers throughout dozens of methods. There’s presently a variety of actively managed taxable and tax-exempt mutual funds provided by American Fund throughout numerous funding types, akin to short-term, excessive yield, and rising markets.

A key unknown is how Capital Group costs the merchandise. Whereas AGTHX and ABNDX respectively cost 0.61% and 0.57% expense ratios, that are beneath every of their CFRA mutual fund peer averages, they’re much less engaging in comparison with a few of the newly launched lively ETFs as a result of mutual funds’ inclusion of distribution and different administration prices. For instance, this summer season Dimensional U.S. Fairness ETF (DFUS) and JPMorgan ActiveBuilders U.S. Massive Cap Fairness ETF (JUSA) started buying and selling with expense ratios of 0.11% and 0.17%, respectively. Given Capital Group’s scale, we’d anticipate CCGR, CGCP, and their future ETF siblings to cost a lot decrease charges than the retail variations of similar-sounding mutual funds to attraction to a extra cost-conscious ETF investor base.

Conclusion

Whereas the ETF business is 28 years previous, we expect there stays numerous room for development, significantly within the still-burgeoning actively managed area. Capital Group has the relationships inside the wealth administration market, the deep pockets to competitively worth the merchandise, and the power to generate alpha by safety choice to garner investor curiosity. Nevertheless, in 2022 they might want to educate traders about what makes their merchandise stand out in an ever-crowded but concentrated ETF market.

Todd Rosenbluth is Director of ETF & Mutual Fund Analysis at CFRA.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com