Semiconductors are within the highlight like by no means earlier than this yr. A worldwide chip scarcity is pinching an array of industries, from car producers to smartphone producers.

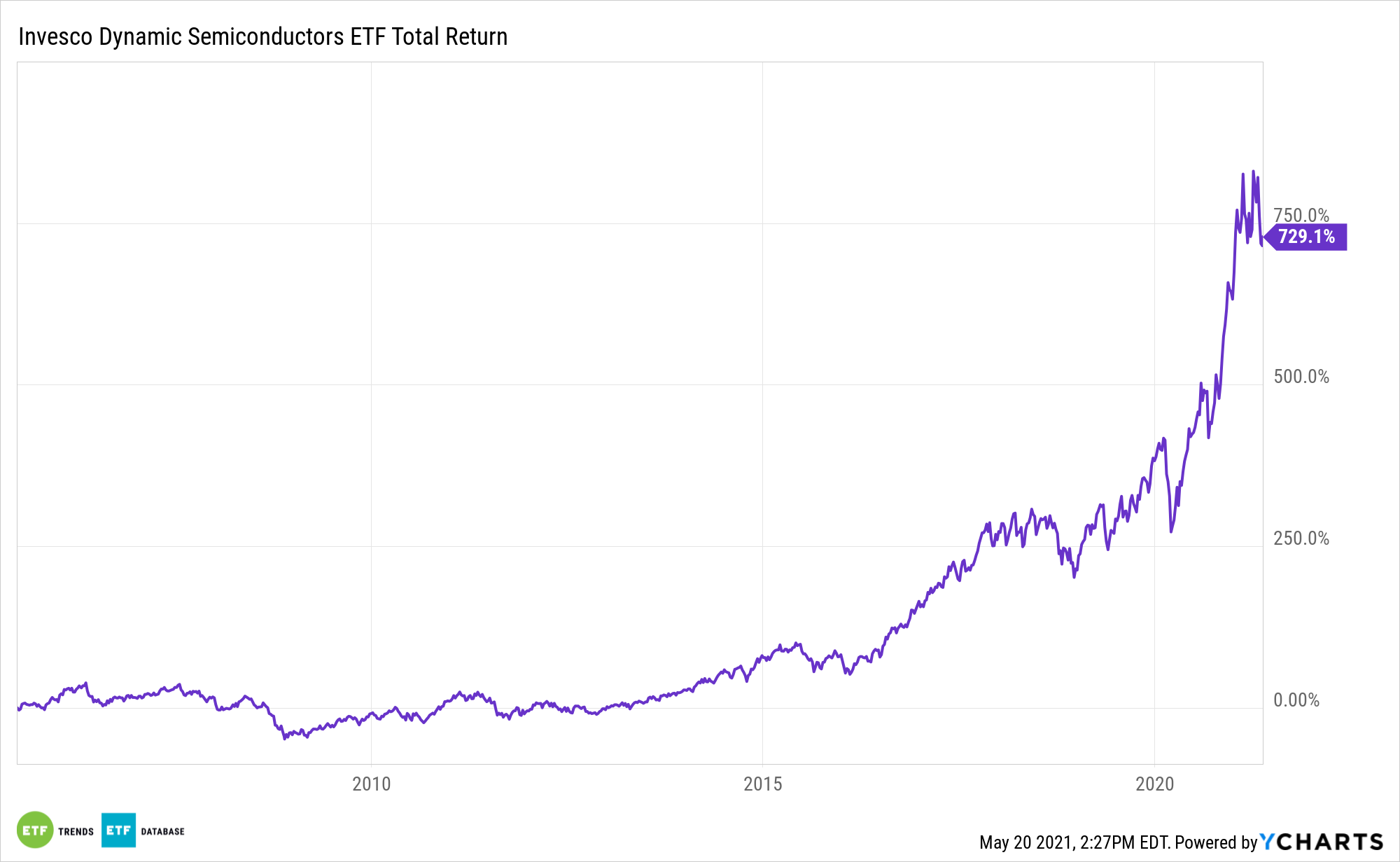

Even with the availability shortfall, the Invesco Dynamic Semiconductors ETF (PSI) is greater by 7% year-to-date. PSI follows the Dynamic Semiconductor Intellidex Index, which relies on the value momentum, earnings momentum, high quality, administration motion, and worth components.

Whereas the dearth of chips is weighing on semiconductor names, some market observers see trade income returning to pre-coronavirus pandemic ranges later this yr.

“Chip trade income ought to return to pre-pandemic ranges this yr, because of sturdy demand and pricing, and profit from higher visibility into 2022, supporting semiconductor credit score profiles,” mentioned Fitch Scores in a current notice.

Capability Will increase May Assist ‘PSI’ Good points

Chip foundries, together with people who service PSI parts, wish to increase capability and output to satisfy calls for being created by disruptive applied sciences, together with 5G, synthetic intelligence, and information facilities.

“We anticipate structurally greater stock via the chip provide chain over time, and extra strategic engagement between bigger clients and chipmakers to scale back dangers associated to future provide constraints,” in response to Fitch. “The numerous uptick in trade capital spending is principally devoted to modern capability, which is used for cutting-edge expertise resembling 5G, web of issues and synthetic intelligence.”

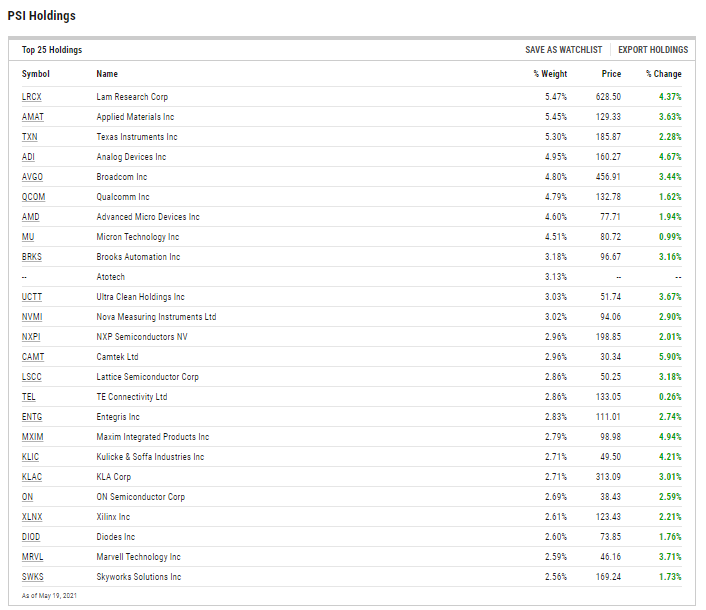

PSI’s 32 holdings have a mean market capitalization of $58.28 billion. The fund additionally gives traders leverage to a rally in smaller shares. Over 46% of the ETF;s holdings are categorised as mid- and small-cap equities.

That technique has served long-term PSI traders effectively. Since inception, the fund is thrashing the S&P 1500 Composite Semiconductor Index by 248 foundation factors, as of April 30.

As for the near-term impression for some PSI parts, foundries wish to add capability for chips.

“Foundries are additionally including trailing-edge capability, the applied sciences on which semiconductor merchandise for cyclical finish markets, together with automotive and industrial, extra acutely affected by the chip scarcity,” provides Fitch. “Auto producers have considerably reduce auto unit manufacturing, citing the scarcity of chips, the content material of which has elevated sharply over time but additionally meaningfully heightens provide chain complexity. Shortages have additionally turn into extra widespread for different finish markets, starting from shopper electronics, house home equipment and development gear.”

For extra information, data, and technique, go to the ETF Schooling Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.