Right now, China is the dominant participant in uncommon earth metals. ETF traders can play this energy with the VanEck Vectors Uncommon Earth/Strategic Metals ETF (REMX).

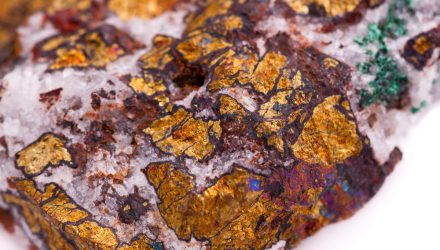

“They (uncommon earth metals) are so particular as a result of they’ve chemical and bodily properties which can be very helpful for a really big selection of applied sciences,” defined Rebecca Abergel, assistant professor of nuclear engineering on the College of California, Berkeley, and a school scientist on the Lawrence Berkeley Nationwide Lab, in a Market.org article.

China’s dominance in uncommon earth metals introduced a priority on the peak of the commerce wars with the U.S., sparking considerations that China may use its energy available in the market as leverage. Uncommon earth metals might be present in smartphones, computer systems, electrical automotive batteries, and a bunch of different shopper electronics.

“Chinese language mining and processing operations now management about 80% of the world’s world output in processed rare-earth metals,” mentioned Eric Chewning, a accomplice at consulting agency McKinsey & Co. and former U.S. deputy assistant secretary of protection for industrial coverage.

REMX, which is up 21% year-to-date, seeks to copy the value and yield efficiency of the MVIS® International Uncommon Earth/Strategic Metals Index. The fund usually invests at the least 80% of its whole property in securities that comprise the fund’s benchmark index.

The index contains corporations primarily engaged in quite a lot of actions which can be associated to the manufacturing, refining, and recycling of uncommon earth and strategic metals and minerals. The fund is displaying its energy, gaining over 160% the previous 12 months.

Can the USA Catch Up?

Earlier this 12 months, U.S. president Joe Biden signed an government order to evaluation provide chains for crucial supplies, together with uncommon earth metals.

It actually will not be straightforward.

“For these minerals to go from a gap within the floor to an electrical motor, you want huge expertise and experience, which barely exist out of China,” mentioned Constantine Karayannopoulos, chief government of Neo Efficiency Supplies, one of some Western corporations in a position to course of uncommon earths and make magnets.

“Many producers will discover it tough to compete head-to-head towards China on value with out some stage of ongoing authorities help,” he added.

For extra information and knowledge, go to the Past Fundamental Beta Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.