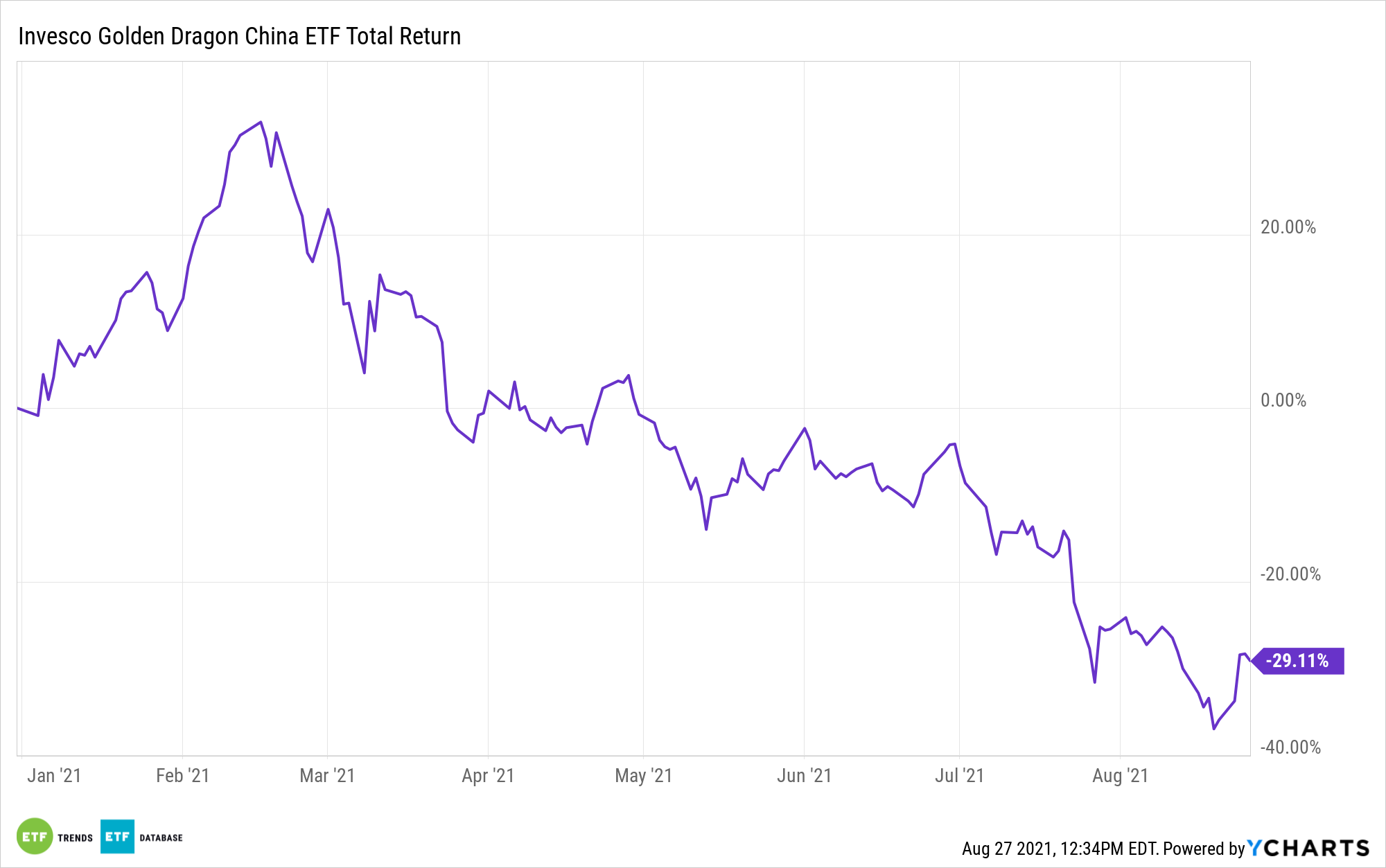

One of essentially the most distinguished tales involving worldwide equities is the droop of Chinese language web shares (amongst others in that nation) prompted by heavy-handed regulatory insurance policies by the Chinese language Communist Social gathering (CCP).

The Invesco Golden Dragon China ETF (PGJ), which tracks the NASDAQ Golden Dragon China Index, and different trade traded funds heavy on once-soaring Chinese language development shares are languishing in consequence.

Nevertheless, some traders are shopping for the dip and doing so in devoted style. That is lending help to a latest rally in Chinese language web names, one which helped PGJ surge 12.45% for the week ending Aug. 26. There’s been assist in the type of sturdy earnings from JD.com (NASDAQ:JD) and Pinduodo (PDD).

These “corporations reported wholesome gross sales will increase within the second quarter and highlighted their contributions to Chinese language society. Their efficiency took a few of the focus away from Beijing’s widening regulatory crackdown, which has turned many traders off the once-hot web sector,” stories Xie Yu for the Wall Avenue Journal.

JD.com is the biggest holding in PGJ at 10.49% as of Aug. 25, whereas Pinduodo checks in at practically 8%, in line with Invesco knowledge.

Some main PGJ holdings are additionally occurring a allure offensive of types. Maybe it is to get Beijing off their backs, allay skittish traders’ issues, or each. Regardless of the motivation, it is working, as highlighted by PGJ’s torrid efficiency over the past a number of days.

Just lately Tencent Holdings “mentioned it will make investments the equal of $7.7 billion to advertise ‘frequent prosperity’ in China. The videogaming and social-media large beforehand had earmarked an identical sum to fund analysis in areas comparable to science and carbon neutrality which can be strategically vital to Beijing,” in line with the Journal.

The social prosperity challenge is related to traders as a result of Chinese language web corporations have created huge quantities of wealth for a small quantity, laying to bear huge revenue equality on the planet’s second-largest economic system whereas stoking hypothesis the CCP may pursue revenue redistribution.

For its half, JD.com, one of many largest on-line retailers in China, says it relishes the chance to be a greater company steward. Because the Journal notes, Chinese language regulators are taking intention at a apply whereby the likes of JD.com and Alibaba (NYSE:BABA) power retailers to completely promote on one platform — a coverage seen as anti-competitive.

Loads of Chinese language web companies are saying they’re up for extra competitors, however they’re going to should pay greater than lip service to that with a purpose to get Beijing off their backs. That is vital for PGJ traders as a result of the ETF allocates over 78% of its weight to shopper discretionary and communication providers shares.

For extra information, info, and technique, go to the Nasdaq Funding Intelligence Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com