On Friday, China introduced it could add liquidity to spice up the flagging restoration of the nation’s financial system, in keeping with the Wall Road Journal.

Whereas fears of inflation are starting to calm down within the Chinese language monetary sectors, they’re being changed by issues that the economic system’s restoration is slowing down too quickly.

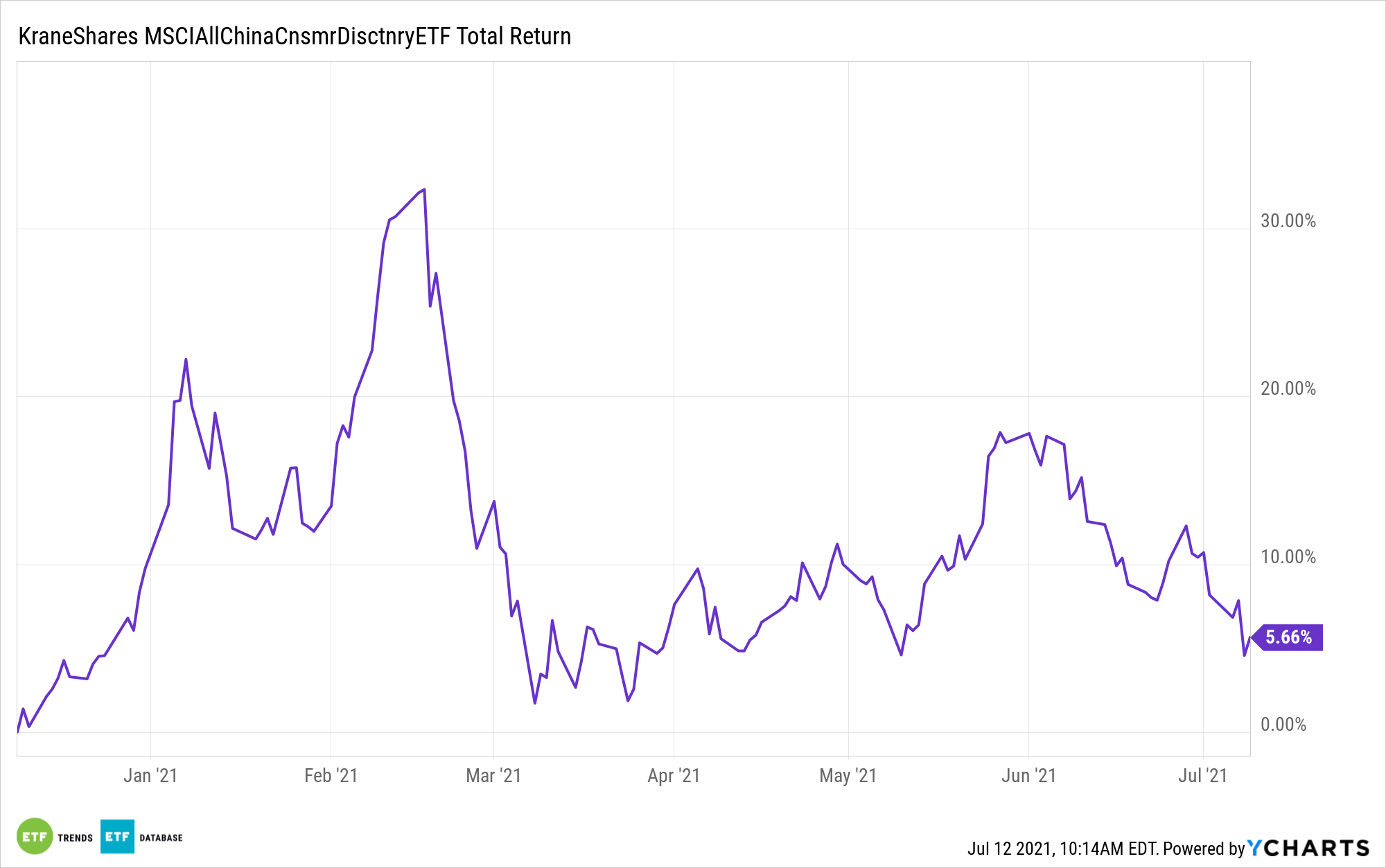

Elevated liquidity tends to result in a rise in client spending. As such, the KraneShares CICC China Shopper Leaders Index ETF (KBUY) stands to profit from the transfer.

China’s Central Financial institution Intervenes

The Individuals’s Financial institution of China, China’s central financial institution, introduced that it could be reducing the reserve requirement by half a p.c starting July 15, basically releasing up $154 billion (1 trillion yuan).

The final time the financial institution had stepped in to assist the economic system was in April of 2020 on the peak of the Covid pandemic.

The transfer is one that appears aimed to helped smaller companies in China which have been hit hardest by the downturn in Chinese language consumerism all through the pandemic.

Shopper-price inflation rose 1.1%, lacking the 1.2% aim for June and nonetheless far beneath the three% benchmark that authorities had set for the tip of the 12 months.

Underperformance alerts a sluggish home client sector and an under-performing economic system, with room for financial leverage by the federal government and banks to spice up spending.

Elevated Chinese language Home Spending Advantages KBUY

KBUY tracks the CICC China Shopper Leaders Index, which invests within the publicly traded, Chinese language-based corporations that make up the buyer industries in China. These embody attire and clothes, accommodations, eating places, residence home equipment, meals and beverage, and duty-free items.

As extra liquidity strikes into the Chinese language economic system, these industries all stand to profit drastically.

KBUY’s index selects the highest 30 corporations ranked by their long-term working revenue and money stream, market cap, long-term return on fairness, and long-term gross revenue. These corporations are included within the index and weighted by free-float market cap, with no singular firm representing greater than 15% of the underlying index.

As of finish of June, the sector breakdown for KBUY was a 62.69% allocation in client staples and 40.45% allocation in client discretionary.

KBUY carries an working expense of 0.69%.

For extra information, info, and technique, go to the China Insights Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.