Clean energy-sector associated trade traded funds have been neglected of the broad market rally Wed

Clean energy-sector associated trade traded funds have been neglected of the broad market rally Wednesday because the presidential election outcomes remained too near name and Republicans showing to struggle off Democratic opponents within the Senate.

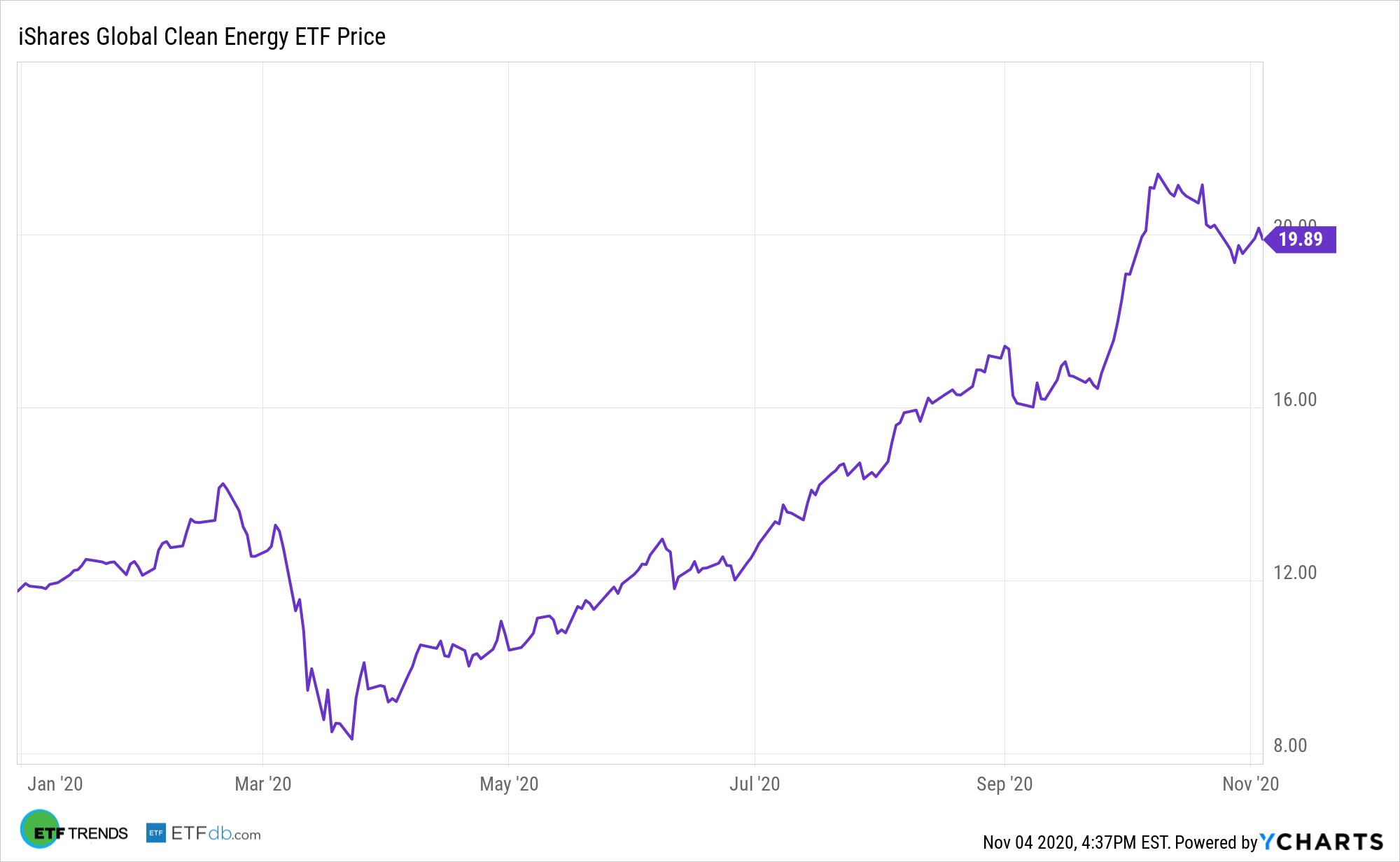

The iShares World Clear Vitality ETF (ICLN) fell 1.3% Wednesday.

Renewable or clear vitality shares have rallied forward of the elections in anticipation of elevated spending to fight local weather change ought to the Democratic occasion achieve the higher hand within the election. Nonetheless, the chance of a so-called Blue Wave, the place Democrats management each the White Home and Congress, has diminished, together with bets on inexperienced vitality shares because of the unclear outcomes.

Whereas the result of the presidential race continues to be unclear, a Biden victory may doubtless include a Republican-controlled Senate, which might hinder efforts to handle local weather change, promote clear vitality and roll again fossil-fuel subsidies.

“Maybe the most important conclusion to be drawn at this stage is that there’s solely a small chance that current oil & gasoline tax incentives can be eliminated within the U.S. — even when Biden emerges because the winner,” Artem Abramov, Head of Shale Analysis at Rystad Vitality, stated in a be aware, in response to Bloomberg.

“There was some anticipation of a Democratic sweep and the potential for main local weather reform,” Raymond James Analyst Pavel Molchanov advised Bloomberg, including that even when Democratic nominee Biden wins, and not using a Democratic Senate “he’ll must depend on government motion, tinkering across the edges, quite than something game-changing or transformative.”

Biden beforehand pledged to spend $2 trillion to fight local weather change by shifting America’s vitality coverage away from the oil business in the direction of renewable vitality. He additionally outlined plans to curb carbon emissions from the ability grid by 2035, together with spending to extend the inexperienced vitality infrastructure.

For extra info on the renewables house, go to our renewable vitality class.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.