Leverage-hungry merchants can place themselves between massive cap stability and small cap momentum with the Direxion Each day Mid Cap Bull 3X Shares (MIDU).

MIDU seeks day by day funding outcomes, earlier than charges and bills, of 300% of the day by day efficiency of the S&P MidCap 400 Index. The fund, below regular circumstances, invests not less than 80% of its web belongings (plus borrowing for funding functions) in monetary devices, equivalent to swap agreements, and securities of the index, ETFs that monitor the index, and different monetary devices that present day by day leveraged publicity to the index or ETFs that monitor the index.

The index measures the efficiency of 400 mid-sized corporations in the US. With the additional leverage, MIDU has been doling out massive beneficial properties, up 63% year-to-date.

Even with out the leverage, the mid cap-focused S&P 400 index is up 19%. Each home and worldwide buyers may very well be clever to take notice.

“Overseas buyers actively take part in U.S. fairness markets, however like their American counterparts, the worldwide buyers are typically a fan of massive caps,” a Nasdaq article stated. “Which means they’re lacking out on alternatives with smaller shares, together with mid caps.”

“As buyers look over their fairness market publicity, they could discover that giant cap inventory positions are too massive for speedy development and small caps too inclined to unstable short-term strikes,” the article added additional. “Center-capitalization shares, typically known as the market’s candy spot, may also help buyers obtain improved risk-adjusted returns.”

As for Giant- and Small-Cap Choices…

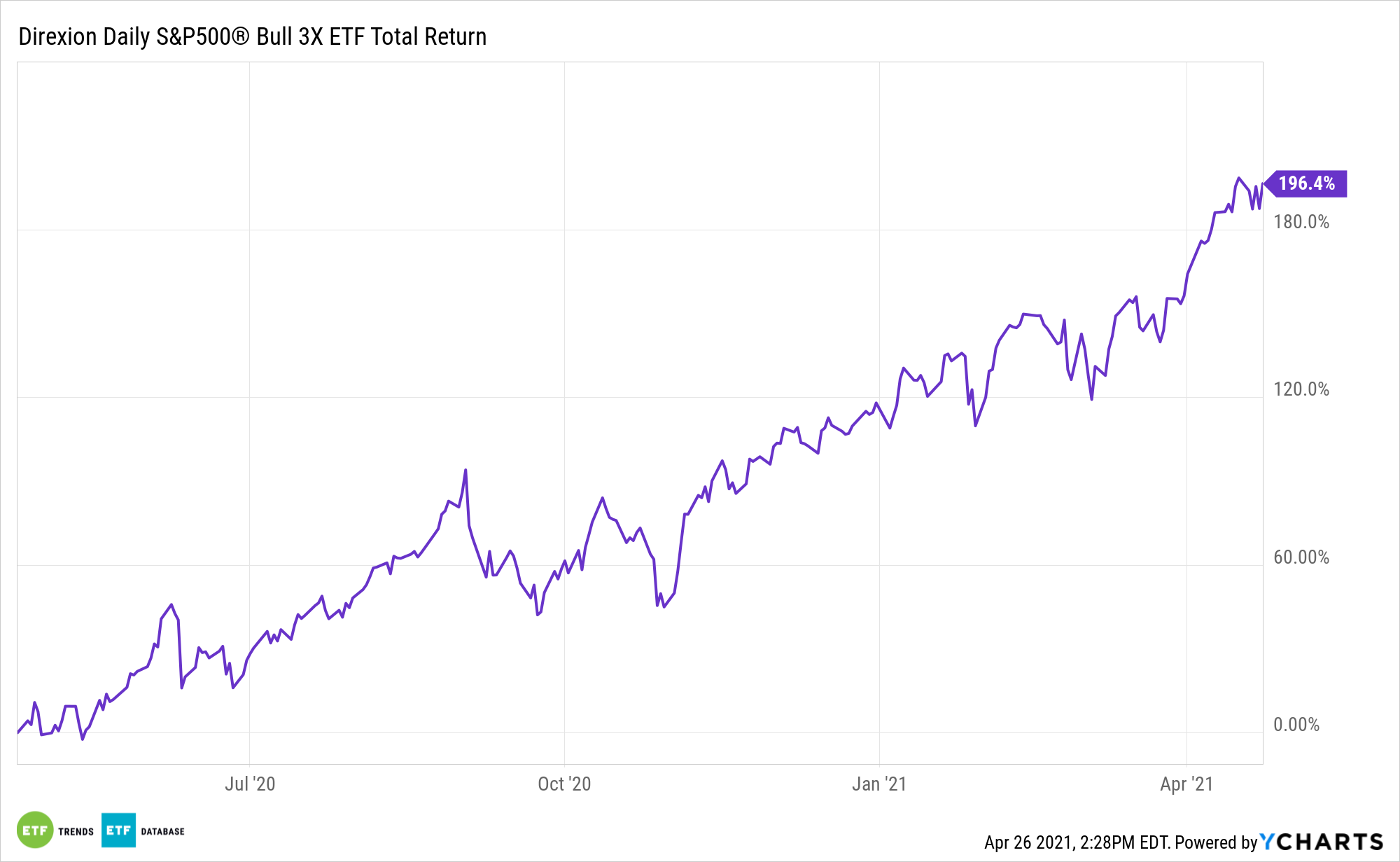

Direxion additionally gives large- and small-cap leveraged choices for merchants to think about. For these searching for publicity to massive caps, there’s the Direxion Each day S&P 500® Bull 3X Shares ETF (SPXL).

SPXL, below regular circumstances, invests not less than 80% of its web belongings (plus borrowing for funding functions) in monetary devices, equivalent to swap agreements, and securities of the index, ETFs) that monitor the index, and different monetary devices that present day by day leveraged publicity to the index or ETFs that monitor the index.

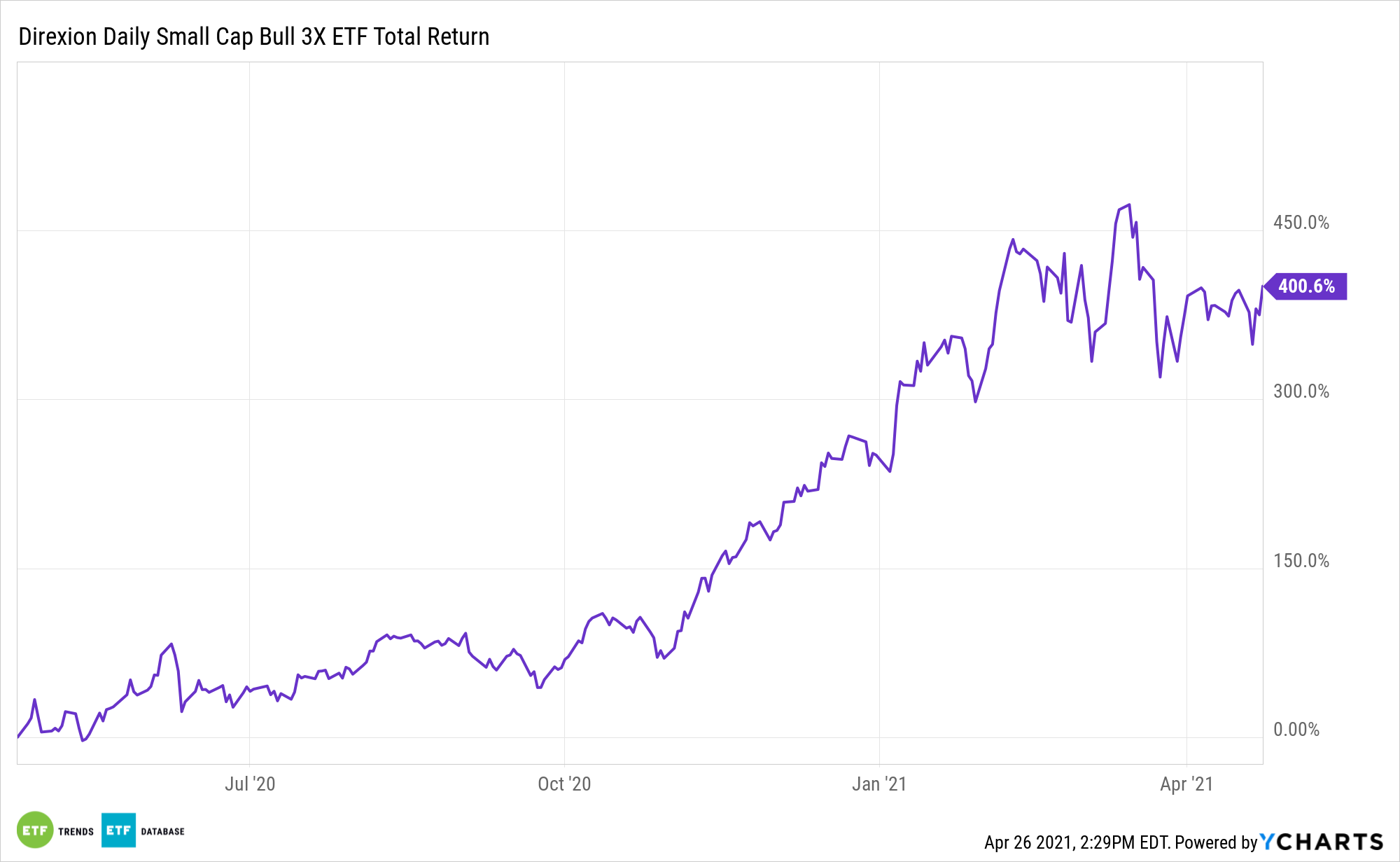

Merchants basking in market volatility can go for the excessive beta actions of small caps. The Direxion Each day Small Cap Bull 3X Shares (TNA) tracks the Russell 2000 Index and seeks day by day funding outcomes equal to 300% of the day by day efficiency of the index.

For extra information and data, go to the Leveraged & Inverse Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.