Commodities rallied

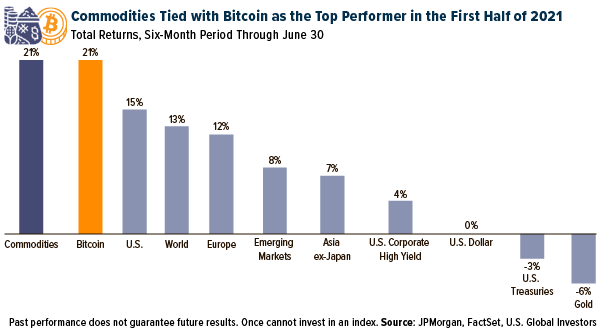

Commodities rallied 21% within the first half of 2021, making them the highest performing asset group forward of U.S., European, rising market and non-Japan Asian shares. The broad-based index of power, agriculture, industrial metals and valuable metals rose the identical quantity as high-flying Bitcoin, which pulled again after hitting its all-time excessive of greater than $63,000 on April 13.

click on to enlarge

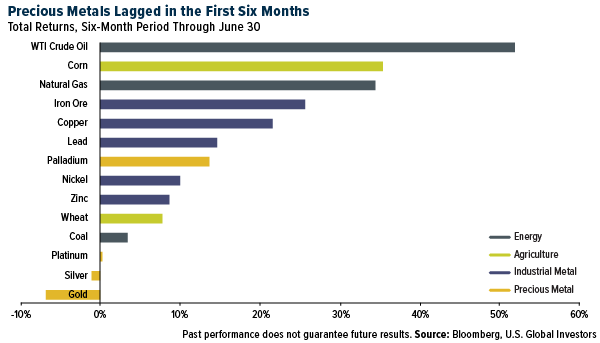

Among the many commodities we observe, West Texas Intermediate (WTI) crude oil was the primary performer, up almost 52% on higher-than-expected demand and tight provide, whereas valuable metals lagged, with silver down 1% and gold down greater than 6%.

click on to enlarge

This represents a virtually full reversal from the value motion we noticed in 2020. In accordance with our Periodic Desk of Commodity Returns, valuable metals had been final yr’s winners—silver surged near 48%, gold 25%—and oil was the massive loser, slipping as a lot as 20%.

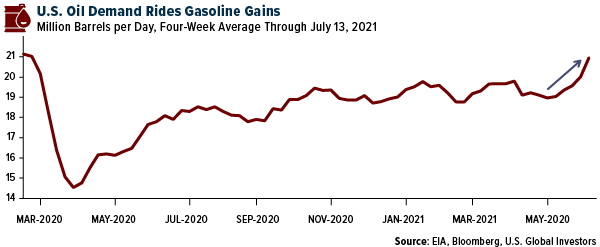

However urge for food for threat has modified now that vast segments of the economic system are reopening. Demand for gas has elevated as Individuals act on pent-up wanderlust: Earlier this month, a higher variety of folks flew on business jets within the U.S. than on the identical day in 2019, earlier than the pandemic. And within the days main as much as the busy Fourth of July vacation weekend, fuel stations throughout the nation had been reportedly operating out of fuel.

After a Exceptional Turnaround, Oil Demand Units a New Document

The final six months had been a worthwhile time to put money into the oilfield. The S&P Oil & Fuel Exploration & Manufacturing Choose Trade Index gained roughly 65%.

We participated with numerous corporations, together with ConocoPhillips, Valero Power, Phillips 66 and Halliburton, amongst others. Earnings for the second quarter aren’t anticipated till subsequent month, however we imagine traders can be happy. In April, Moody’s forecast that oil corporations’ earnings might rise by a median charge of 50% in comparison with final yr—although it’s value noting that that is off a really low base.

Manufacturing corporations needs to be properly positioned going ahead so long as they’ll preserve capital self-discipline and working effectivity. Bloomberg experiences that U.S. oil consumption hit a brand new document seasonally-adjusted excessive throughout the week ended July 2. “Whereas gasoline and diesel demand have returned to pre-pandemic ranges, a surge in petroleum use for merchandise comparable to plastic, asphalt, lubricants and different industrial wants is propelling the restoration,” the article reads.

click on to enlarge

Gold Fundamentals Stay Strong

It’s no secret gold had a tough six months, however a retrace of the bull market could possibly be within the works attributable to sturdy fundamentals.

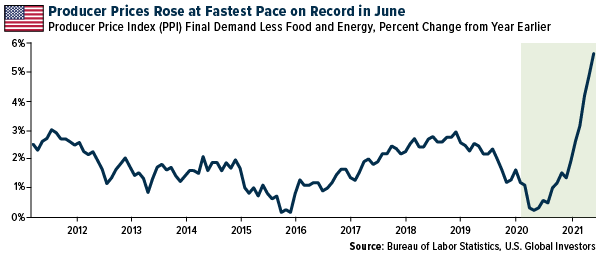

To me, inflation is trying like a higher threat than Powell & Co. are admitting to publicly. Anybody who’s shopped for a brand new automobile prior to now few months is aware of that costs are heading sharply up. The associated fee to eat out jumped 0.7% in June from the earlier month, the largest such improve since January 1982. The producer worth index (PPI) for closing demand, excluding unstable meals and power, skyrocketed 5.6% in comparison with the identical month final yr, representing the quickest tempo since data started in 2011.

click on to enlarge

Buyers searching for a haven might have to look elsewhere than authorities bonds. The 30-year Treasury yield at the moment trades under 2%, even much less once you consider inflation, which means traders are successfully paying the U.S. authorities to carry its debt. As I stated final month, gold is the last word contrarian funding proper now. The steel stays extraordinarily undervalued in comparison with the S&P 500. The present local weather undoubtedly feels risk-on, however I imagine it’s solely sensible to carry round 10% in gold and gold mining shares to assist soften the impression of a worsening pandemic, debt disaster or another potential shock. I additionally suggest not more than a 1% to 2% allocation to Bitcoin and Ether, in addition to crypto mining shares.

Initially revealed by US Funds, 7/19/21

All opinions expressed and information offered are topic to alter with out discover. A few of these opinions will not be acceptable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all data provided by this/these web site(s) and isn’t liable for its/their content material.

The S &P Oil & Fuel Exploration & Manufacturing Choose Trade Index represents the oil and fuel exploration and manufacturing phase of the S&P Complete Market Index. The oil and fuel exploration and manufacturing phase of the S&P TMI contains the next sub-industries: Built-in Oil & Fuel, Oil & Fuel Exploration & Manufacturing, and Oil & Fuel Refining & Advertising and marketing. The Producer Worth Index (PPI) measures costs obtained by producers on the first business sale. The index measures items at three levels of manufacturing: completed, intermediate and crude. The S&P 500 Inventory Index is a widely known capitalization-weighted index of 500 widespread inventory costs in U.S. corporations.

Frank Holmes has been appointed non-executive chairman of the Board of Administrators of HIVE Blockchain Applied sciences. Each Mr. Holmes and U.S. International Buyers personal shares of HIVE. Efficient 8/31/2018, Frank Holmes serves because the interim government chairman of HIVE.

Fund portfolios are actively managed, and holdings might change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of of U.S. International Buyers Funds as of 6/30/2021: ConocoPhillips, Valero Power Corp., Phillips 66, Halliburton Co.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.