Five years after the Paris Settlement, carbon intensive company's capex nonetheless dwarfs clear vi

Five years after the Paris Settlement, carbon intensive company’s capex nonetheless dwarfs clear vitality funding.

5 years in the past, the Paris local weather settlement was signed. On the time, Local weather Motion Tracker discovered that present insurance policies put the world on monitor to be 3.6°C hotter by 2100 in comparison with pre-industrial instances.[1] Whereas many international locations pledged to strengthen insurance policies it was estimated that these efforts would nonetheless lead to a (detrimental) enhance of two.7°C.[2]

Nonetheless, as 2020 attracts to an in depth, China has dedicated to carbon neutrality by 2060 whereas U.S. president-elect Biden has pledged to rejoin the Paris settlement. As well as, 127 international locations representing 63% of emissions are contemplating or have adopted net-zero carbon targets, together with the European Union (EU), South Africa, Japan, South Korea and Canada. Now, an optimistic evaluation places the world on monitor for two.1°C of heating, bringing the Paris settlement’s “beneath 1.5°C” aim inside attain. This bodes properly for the 2021 local weather summit going down within the UK.

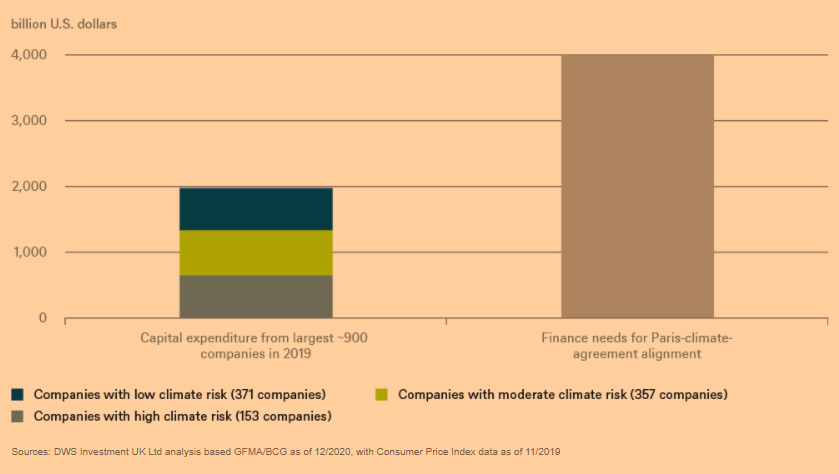

Capital expenditures (capex) can be utilized as a tough proxy to measure whether or not local weather commitments are on monitor. The Local weather Coverage Initiative estimates $579 billion of local weather finance was undertaken by growth banks, monetary establishments, governments and households with corporates investing 183 billion {dollars}.[3]

Compared, our Chart of the Week appears in any respect capex from the biggest ~900 corporations in 2019. A DWS evaluation discovered that out of the overall of $2 trillion capex, the 150 corporations with the very best local weather dangers undertook $651 billion in capex with an financial lifetime of roughly 22 years, which endangers the local weather and escalates stranded-asset danger as insurance policies inevitably grow to be stronger. Whereas the pandemic-induced collapse in oil demand has led listed oil corporations to cancel greater than $54 billion in tasks[4] and a few European vitality corporations are committing to net-zero carbon targets, evaluation exhibits that none are but aligned.[5]

By way of Local weather Motion 100+, 545 buyers (together with DWS) with $52 trillion in property underneath administration are partaking with main corporations.[6] Beginning in 2021, some 160 corporations can be publicly assessed primarily based on their emission reductions, capex, governance, disclosures and lobbying. Traders have a key position to assist all corporates redirect as a lot of their capex as potential towards the ~$Four trillion per yr capex wanted for a renewable and resource-efficient society.[7]

Initially revealed by DWS, 12/11/20

1 . Local weather Motion Tracker, December 2020. https://climateactiontracker.org/publications/global-update-paris-agreement-turning-point/

2 . CarbonBrief, October 2018. https://interactive.carbonbrief.org/impacts-climate-change-one-point-five-degrees-two-degrees

3 . CPI November 2019, Panorama of Local weather Finance 2017/2018 http://www.climatepolicyinitiative.org/wp-content/uploads/2019/11/2019-International-Panorama-of-Local weather-Finance.pdf

4 . Duff and Phelps July 2020 www.duffandphelps.com/-/media/property/pdfs/publications/valuation/capex/capex-cut-tracker-july-14.pdf

5 . TPI October 2020 www.transitionpathwayinitiative.org/publications/60.pdf

6 . http://www.climateaction100.org/

7 . GFMA/BCG December 2020 https://www.gfma.org/gfma-and-bcg-publish-report-on-climate-finance-markets-and-the-real-economy/

This info is topic to alter at any time, primarily based upon financial, market and different issues and shouldn’t be construed as a suggestion. Previous efficiency isn’t indicative of future returns. Forecasts are primarily based on assumptions, estimates, opinions and hypothetical fashions that will show to be incorrect.

DWS Funding GmbH as of 12/8/20

R-080266-1 (12/20)

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.