Prepared by Scott Opsal Funding types typically have an inh

Prepared by Scott Opsal

Funding types typically have an inherent tendency to outperform in both bullish or bearish market environments. One cohort attracts consumers when the fairness market is working greater and optimism prevails, whereas different types draw curiosity when the market is weak, fear abounds, and security is the need of the day. Such a behavioral bias is constructed into some elements by design, others accrue their directional bias as a secondary results of financial or cyclical forces.

There isn’t a “official listing” of bullish or bearish elements, so we should infer these tilts by inspecting model efficiency in periods when the market is exhibiting clear indicators of bullish or bearish sentiment. The pandemic-induced swings throughout 2020 had been distinctive of their pace and magnitude, offering glorious knowledge factors for analyzing model efficiency throughout excessive phases of market actions. The 12 months additionally skilled a 3rd window of acute model efficiency following Pfizer’s announcement of an efficient COVID-19 vaccine, and we examined all three strikes in a seek for model and issue tendencies. We additionally studied the 2016-2019 market cycle that offered three extra market swings for consideration.

Fashion Cycles in 2020

As we overview issue and magnificence returns for 2020, it happens to us that the entire is way much less attention-grabbing than the sum of its elements. The virus panic of 2020 offered excessive examples of bear and bull strikes inside a single 12 months, and this 12 months’s round-trip gives a chance to check the reliability of favor characterizations. The S&P 500 returned 18.4% for 2020, a pleasant revenue that few might need anticipated at the hours of darkness days of March, however not extraordinary within the broad span of market historical past. Nevertheless, the swings in issue returns had been considerably wider in each instructions. We examined the relative worth motion of types and elements utilizing distinguished ETFs to characterize every theme, parsing the comparative efficiency of types through the speedy selloff pushed by the virus pandemic and the equally speedy restoration fueled by huge fiscal and financial stimulus. (Observe: the phrases “model” and “issue” have delicate variations in which means, however as a result of our roster of pattern ETFs contains each sorts we’ll use these phrases interchangeably.)

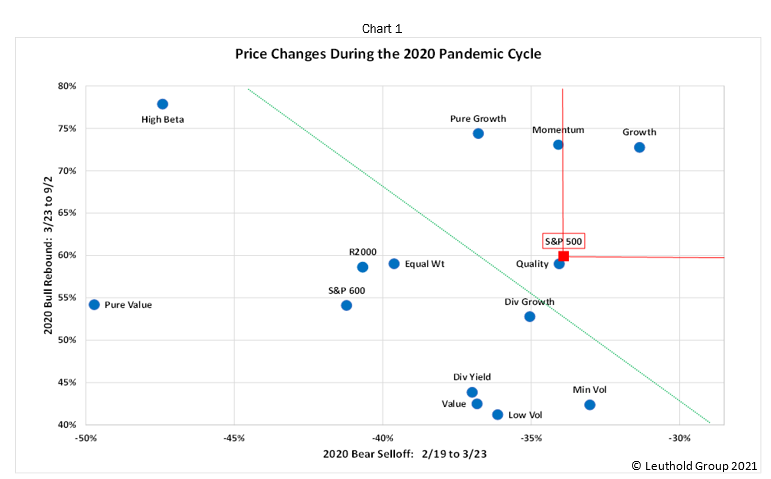

Chart 1 depicts model efficiency through the pandemic selloff of February and March on the horizontal axis, matched towards the bull rebound from late March to early September on the vertical axis. Wanting first on the bear leg from the market’s excessive level on February 19th by means of the low of March 23rd (studying proper to left), we discover simply two elements outperforming the S&P 500 on the best way down.

Minimal Volatility makes excellent sense, however Development was an sudden chief within the robust down transfer. It appears that evidently investor enthusiasm for the Social/Cellular/Cloud (SMC) phenomenon was robust sufficient to hold the day. Not solely do these corporations present glorious income progress, most of the mega-caps are additionally wildly worthwhile and generate large free money flows. This mixture of gross sales progress and profitability grew to become the brand new definition of “security” through the COVID-19 panic, and SMC corporations grew to become a refuge when the severity of the contagion was unknown and financial shutdowns grew to become commonplace.

That solely two elements outperformed is a notable and sudden final result. Typical risk-on performs akin to Excessive Beta, Small Cap, and the Equal Weight S&P offered off arduous, as anticipated. Nevertheless, a number of defensively tilted types additionally underperformed in a time after we would anticipate their specific attributes to supply a level of safety. Dividend and Low Volatility methods underperformed, and the failure of defensive types to supply a secure haven within the storm is perhaps essentially the most peculiar facet of the selloff.

After bottoming on March 23rd, equities started a rebound that carried the market to new highs in September, erasing the results of the springtime collapse. The vertical axis of Chart 1 reveals worth efficiency for the restoration cycle, and we observe that the outperforming types all come from the roster of typical bull market winners that efficiently delivered on their upside potential. Security and Dividends lagged whereas Small Caps virtually saved up with the S&P 500, which was nonetheless being pushed by the SMC giants that saved the Development issue powering greater.

We once more word the restricted variety of types that outperformed the market through the restoration leg;

Development (represented by two dots) , Excessive Beta, and Momentum. Contemplate this for a second; the S&P 500 outperformed most elements on the best way down and on the best way again up! This seemingly incongruous result’s defined by the truth that Development is the one model that outperformed the market throughout each legs of this 12 months’s curler coaster trip. Referring once more to Chart 1, the crimson strains anchored on the S&P 500 sq. point out that Development was the one model that beat the S&P on the best way down (proper of the crimson line) and on the best way up (above the crimson line). The Development model is of such nice significance to the S&P 500 that its energy alone was sufficient to carry the broad market’s efficiency above most types and elements in 2020.

Lastly, the diagonal inexperienced line defines the breakeven factors for geometric returns. Kinds that land to the higher proper had a constructive cumulative efficiency whereas these to the decrease left did not get well their bear losses over the summer time. The S&P 500 landed solidly within the black, accompanied by Development, High quality, and Momentum. Most types, nonetheless, didn’t get well their losses by the point the market took a breather in September. We see each defensive themes (Volatility and Dividend methods) and aggressive themes (Excessive Beta and Small Caps) lagging through the mixed cycle.

The Pfizer Vaccine Rally

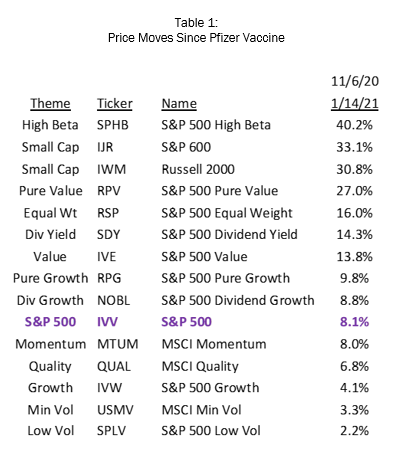

Fashion efficiency took heart stage as soon as once more on November 9th as Pfizer introduced its profitable vaccine. This rally has seen IVV’s worth leap 8.1% by means of January 14th, and issue returns are clearly dominated by the bullish, pro-cyclical, risk-on performs. Small Caps, Excessive Beta, and Worth have outperformed properly, reflecting the financial optimism provided by a possible re-opening of the economic system sooner or later this 12 months. Defensive types path the S&P 500 by just a few share factors, however one of the best issue worth strikes have been greater than triple that of the general market.

Desk 1 additionally signifies that the S&P 500 has underperformed nearly all of types through the vaccine rotation. Traditionally, elements have outperformed the Core S&P over time, however of late the robust bias towards Giant Development has hindered the success of factor-based investing. This is among the few strikes lately the place elements, as an entire, have generated extra returns over the broad market.

The 2016-2019 Cycle

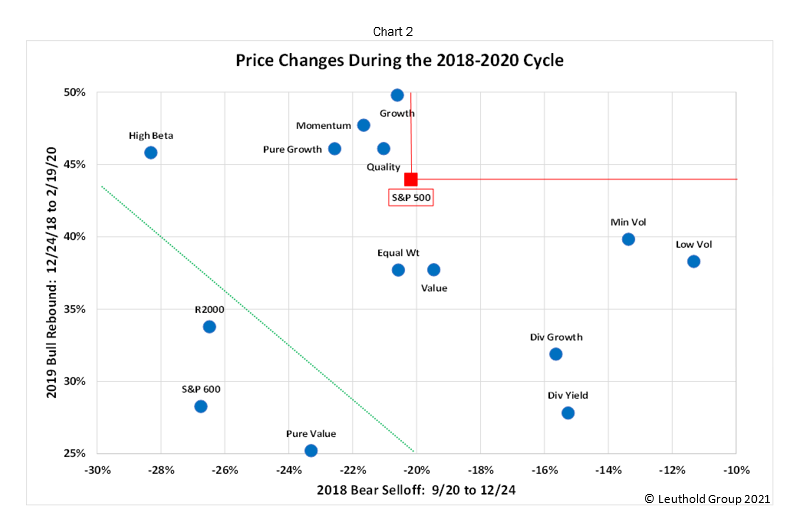

We choose up extra knowledge factors for our research by including the 2016-2019 market cycle. Equities drifted sideways throughout 2015 earlier than promoting off in early 2016. Some would argue that February 2016 marks the start of the Development model’s great surge that carried into 2020, and we use that date to set the primary leg of this cycle. The market ran arduous into early 2018, then topped out and waffled for eight months till a brisk selloff that bottomed on December 24th. Equities put in a fast low close to Christmas 2018 and rallied to new highs earlier than the pandemic hit in February 2020. Chart 2 pairs up the December 2018 selloff with the 2019 rebound that ended with the COVID-19 panic in February 2020.

Studying proper to left, we discover that defensive elements (Dividend and Volatility methods) offered some shelter through the bear selloff. Small Caps and Excessive Beta trailed, and even Momentum and Development took a breather from their exceptional runs. 5 elements outperformed the S&P 500 with a number of others only a smidge behind, slotting the broad index close to the center of the pack. It seems that types and elements behaved as anticipated through the late 2018 bear decline.

The 2019 advance recouped this selloff and saved roaring forward, with IVV gaining 44% because the Development increase regained its energy throughout these 14 months. Studying from prime to backside, the bullish cohort of Development, Momentum, and Excessive Beta posted robust positive aspects whereas the “secure and secure” basket additionally recovered however was not in a position to sustain with the broad market. The suitable, even-handed habits of types and elements throughout this cycle is illustrated by the truth that no dot falls within the higher proper quadrant outlined by the crimson strains; that’s, no issue outperformed on the best way down and on the best way again to new highs.

The Broad Image

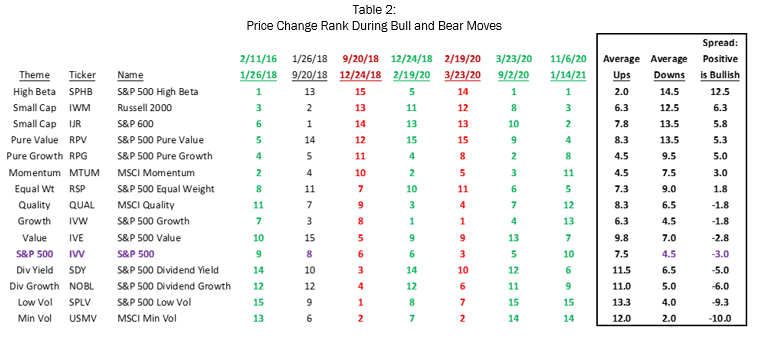

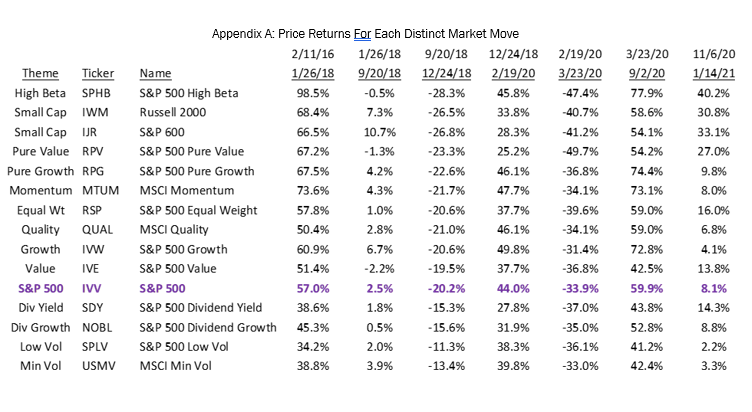

Desk 2 consolidates our findings by rating every model’s worth change throughout six distinct market legs since 2016, excluding home windows the place the market basically drifted sideways. The 4 bull legs in inexperienced and the 2 bear legs in crimson are averaged within the far-right columns, and the unfold denotes the distinction in rankings between regimes; a constructive unfold suggests the model has a bullish tilt whereas a unfavourable unfold suggests a bearish bias. Absolutely the worth strikes underlying Desk 2 are proven in Appendix A.

We summarize our conclusions from Desk 2 within the following feedback, noting elements which have behaved erratically or opposite to their implied temperament, contrasted with people who precisely mirror their underlying nature; that’s, elements that ain’t misbehavin’.

Excessive Beta: As anticipated, essentially the most bullish issue.

Small Caps: The S&P 600 and Russell 2000 are each strongly bullish, however their weak efficiency within the 2019 bull transfer was a notable exception.

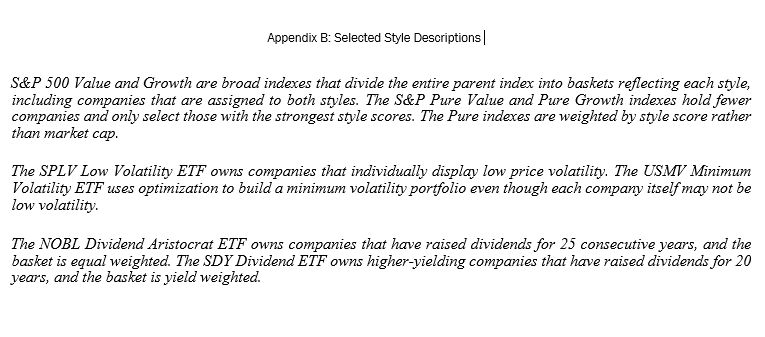

Pure Development and Pure Worth: Unusually, each seem to prosper in stronger markets. Pure Development has been constantly glorious in up markets, whereas Pure Worth has been extra erratic. This sudden final result may very well be the results of the overwhelming Development bias seen in equities since 2016, and/or the results of the actual methodology S&P makes use of to assemble these “Pure” model indexes. Extra analysis is so as right here.

Momentum: Scores as a bullish issue, but in addition ranked properly within the pandemic selloff early in 2020. This issue ought to be neither bullish nor bearish by design, and might carry out properly so long as the market strikes in prolonged traits. Momentum crashes, the place the market reverses shortly, are this model’s Achilles heel. However, its 5 top-5 rankings are finest within the discipline.

Equal Weight S&P: As with Small Caps, this issue tends to be bullish, however as a result of its constituents are the identical because the core S&P 500 it experiences extra muted swings.

Development: The general unfold sits close to impartial, the results of just lately robust efficiency in any market situation! Development ranked #1 within the 2019 bull transfer and likewise #1 within the pandemic fright of early 2020. We imagine Development’s distinctive efficiency lately, pushed by the SMC titans, has overwhelmed the information and makes it tough to discern its true market cycle desire.

High quality: This presumably “secure” model additionally scores about impartial, however its two worst rankings are each in up markets. We suspect High quality deserves a defensive moniker, however much less so than both Low Volatility or Dividends.

Worth: This index represents the standard definition of S&P 500 Worth, and scores higher in weak markets. This habits appears odd, in that Worth is usually thought of a bullish model that advantages from professional -cyclical financial energy and a rising tide that lifts all boats. As with its Development counterpart, we suspect the current domination of mega cap progress corporations has muddied the indicators right here.

Dividends: Dividend Yield and Constant Dividend Development each have a transparent bearish tilt, reflecting the notion that dividends present an anchor to windward in low-return markets. Dividend Yield carried out worse than anticipated through the pandemic bear market, as a result of many higher-yield corporations had been additionally most uncovered to the chance of an prolonged financial shutdown and a extreme drop in GDP.

Volatility: Low Volatility and Minimal Volatility methods rank as essentially the most defensive elements, performing properly in down markets however normally citing the rear throughout bull advances. That is by design, and the outcomes are assembly expectations.

Analysis Takeaways

Funding types and elements are typically interpreted as having an inherent desire for both bullish or bearish market environments. The theoretical tilt of every model relies on its design and its sensitivity to financial, revenue, and valuation cycles. Nevertheless, idea and observe don’t all the time agree, and we should look to precise efficiency to verify our impressions.

Issue sensitivity is finest analyzed throughout excessive market strikes, the place investor sentiment is well discernable. The final 5 years provided a number of robust up legs dominated by the Giant Development model, interrupted by two bear markets, after going years with out a pronounced selloff. Our evaluation of clearly outlined bull and bear strikes during the last 5 years sheds some mild on the cyclical predisposition of every issue and provides to our understanding of the character of particular person types.

Excessive Beta, Small Caps, Volatility, and Dividends all show a constant habits, exhibiting a desire for sure market circumstances and performing as we might anticipate. Momentum, Development, and High quality constantly outperformed, and we suspect the overwhelming efficiency of Social/Cellular/Cloud giants throughout this era has muddied the sign. Recall that the Core S&P 500 Index outperformed nearly all of elements in 2020 although a lot of the elements themselves are drawn from the S&P 500. Likewise, the efficiency patterns of Development and Worth are unclear, once more seemingly because of the impression of huge progress corporations which have obscured the standard market tilts that will in any other case affect returns for the rank-and-file corporations included in every model.

Initially printed by The Leuthold Group

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.