For the previous 20 years, the Port of Los Angeles

For the previous 20 years, the Port of Los Angeles has been the busiest seaport within the Western Hemisphere, liable for exporting commodities equivalent to soybeans and uncooked cotton and importing all the things from furnishings to electronics. In 2020, container quantity reached 9.2 million 20-foot equal items (TEUs), with whole cargo dealt with valued at $259 billion.

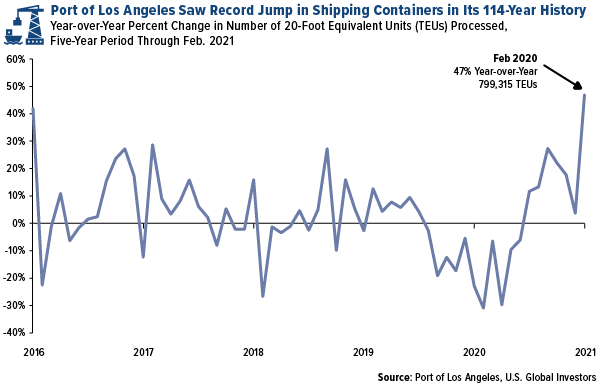

Final month, the Port of L.A. noticed an unbelievable 47% enhance in container visitors in comparison with February 2020, representing the strongest February in its 114-year historical past. The port processed practically 800,000 TEUs in the course of the month, marking the seventh straight month of year-over-year development.

click on to enlarge

Granted, final February was close to the start of the lockdown in China, America’s greatest buying and selling associate. Development was subsequently all however assured a 12 months later.

However I imagine one thing a lot bigger is occurring right here. L.A.’s phenomenal surge isn’t a one-off occasion. We’re seeing a large, synchronized explosion in world commerce as economies reopen and financial stimulus measures ignite consumption.

Listed here are only a couple extra examples of what I’m speaking about: On the East Coast, the Port of New York and New Jersey noticed not solely double-digit container visitors development in January in comparison with final 12 months but in addition its highest January on file for quantity. In China, quantity at main Chinese language ports have been up 14.5% within the first half of March versus the identical interval final 12 months.

Freight Charges Anticipated to Stay Elevated, Boosting Delivery Inventory Funding Case

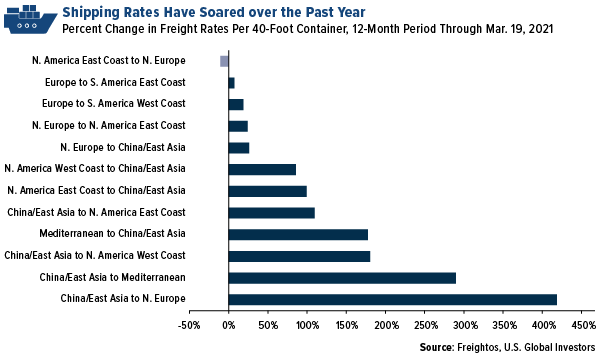

This heightened commerce exercise is resulting in a lot of supply-demand imbalances which might be in the end pushing up freight charges, benefiting container ship operators.

Congestion at ports is on the rise, resulting in longer wait instances. In keeping with S&P International Platts, turnaround instances on the Port of Singapore have elevated from round two days to as many as 5 and even seven days. Some retailers are reportedly paying extra to have items flown by air cargo to the U.S. to bypass lengthy port delays. Demand for brand new delivery containers has outpaced new orders, resulting in a worldwide scarcity.

Once more, that is all placing large upward strain on charges. For the 12-month interval by means of March 19, world container charges jumped practically 195%, from a median of $1,377 per 40-foot container to $4,045.

Among the many routes with the most important year-over-year will increase was China/East Asia to North Europe. The fee to ship a single container from Shanghai to Rotterdam rose an astonishing 418%, in line with Freightos information. (I anticipate these charges to go up much more because of the latest logjam within the necessary Suez Canal brought on by a lone container ship run aground.)

click on to enlarge

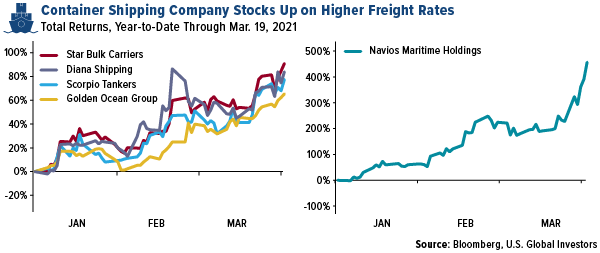

What’s been an enormous headache for importers and exporters has been a boon for traders of delivery shares.

Dry bulk shares have been the perfect performers, up 50.4% year-to-date by means of March 19, among the many sectors tracked by maritime analysis and consulting agency Drewry.

In keeping with Drewry analyst Ishan Dafaria, the second week of February was the perfect week of the 21st century for the spinoff dry freight market, with buying and selling quantity exceeding $1 billion.

The present rally, which started in December 2020, “has defied the same old pattern of a seasonally weak first quarter,” Dafaria writes.

Among the many greatest NYSE or Nasdaq-listed cargo shares have been Golden Ocean (up 65.4%), Scorpio Tankers (77.5%), Diana Delivery (84.0%) and Star Bulk Carriers (91.1%). Microcap Navios Maritime Holdings, with a market valuation of solely $140 million, was the highest performer, up a jaw-dropping 456.9% year-to-date, on information of its merger with Navios Maritime Containers.

click on to enlarge

However Is the Rally Sustainable?

That relies on who you ask in fact, however many analysts proper now see freight prices remaining elevated for a 12 months or extra as client demand and capability keep tight.

That features McKinsey & Firm’s Ludwig Hausmann, who advised Bloomberg lately that he sees costs staying excessive “for the subsequent one or two years” on account of a lull in worth wars and the truth that many shippers have already locked in long-term contracts.

Analysts at UBS and Morgan Stanley are likewise bullish on the trade, with UBS’s Tom Wadewitz saying he sees a “excellent storm” for freight demand proper now because of tight capability, stock rebuilding and ongoing fiscal stimulus. His financial crew believes spending on items is “nicely supported” by means of the second quarter of 2022.

Morgan Stanley’s Ravi Shanker, in the meantime, says that financial reopenings are supportive not simply of companies spending however items spending as nicely.

As we come out of the pandemic, many property are on the rise, together with commodities, vitality, house valuations and extra. With a lot financial exercise coming again on-line, it solely is smart to me that container ship operators will see a few of the greatest positive factors because of this.

Initially printed by US Funds, 3/25/21

Some hyperlinks above could also be directed to third-party web sites. U.S. International Buyers doesn’t endorse all data equipped by these web sites and isn’t liable for their content material. All opinions expressed and information supplied are topic to alter with out discover. A few of these opinions might not be applicable to each investor.

Holdings could change every day. Holdings are reported as of the newest quarter-end. Not one of the securities talked about within the article have been held by any accounts managed by U.S. International Buyers as of 12/31/2020.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.