Encouraging financial knowledge and information of one other authorities spending plan, have bolstered ETFs with higher weight in economically delicate sectors.

The U.S. financial growth accelerated within the first quarter after huge authorities help to households and companies. A labor market report revealed 553,000 individuals filed for unemployment advantages two weeks in the past, in comparison with 566,000 within the prior interval, Reuters studies.

Nancy Vanden Houten, the chief economist at Oxford Economics, pointed to 2 components supporting the economic system now, together with the reopening of the economic system and aggressive stimulus efforts from each the federal authorities and Federal Reserve, the Wall Road Journal studies.

“We’re on a extremely good path right here,” Vanden Houten advised the WSJ, including {that a} full restoration remains to be a good distance off, a sentiment additionally echoed by the Federal Reserve.

The markets have additionally been weighing bets on additional stimulus. President Biden outlined proposals Wednesday for a brand new American Households Plan, which might improve spending on youngster care, schooling, and paid go away.

Federal Reserve Chairman Jerome Powell additionally said that the central financial institution would preserve its assist of the economic system and was hopeful as indicators confirmed development has revived and the labor market is strengthening.

“On this setting, it is rather troublesome to be bearish,” Gregory Perdon, co-chief funding officer at non-public financial institution Arbuthnot Latham, advised the WSJ.

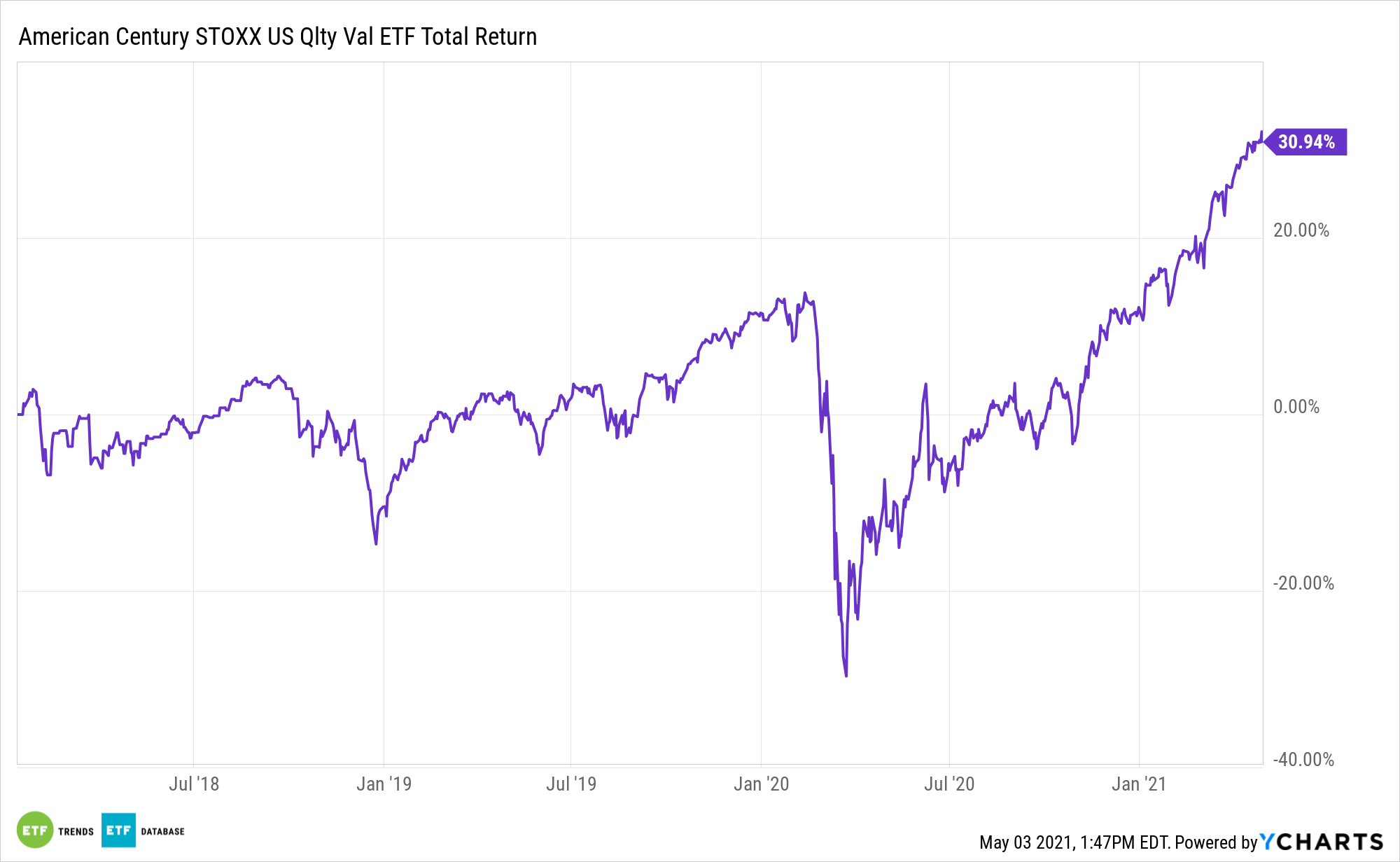

As a strategy to play a broad financial restoration, buyers have appeared to ETFs that observe the worth model, which incorporates extra economically delicate sectors. For instance, the American Century STOXX U.S. High quality Worth ETF (NYSEArca: VALQ) incorporates a sensible beta technique paying homage to actively managed investments. It tries to mirror the efficiency of the iSTOXX American Century USA High quality Worth Index, which is made up of 900 largest publicly traded U.S. fairness securities screened and weighted by basic measures of high quality, worth, and earnings.

For extra information, info, and technique, go to the Core Methods Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.