Cimpolite oil futures are gaining on Tuesday as crude pegged an 11-month excessive as tighter provi

Cimpolite oil futures are gaining on Tuesday as crude pegged an 11-month excessive as tighter provide and projections for a decline in U.S. inventories offset fears over surging coronavirus circumstances.

Crude oil climbed to above $53 a barrel on Tuesday, for a acquire of 1.63%, because the commodity approached the early March highs of close to $57. In the meantime, Brent crude was 80 cents, or 1.4%, increased at $56.44 a barrel and earlier hit $56.75, its highest stage since final February.

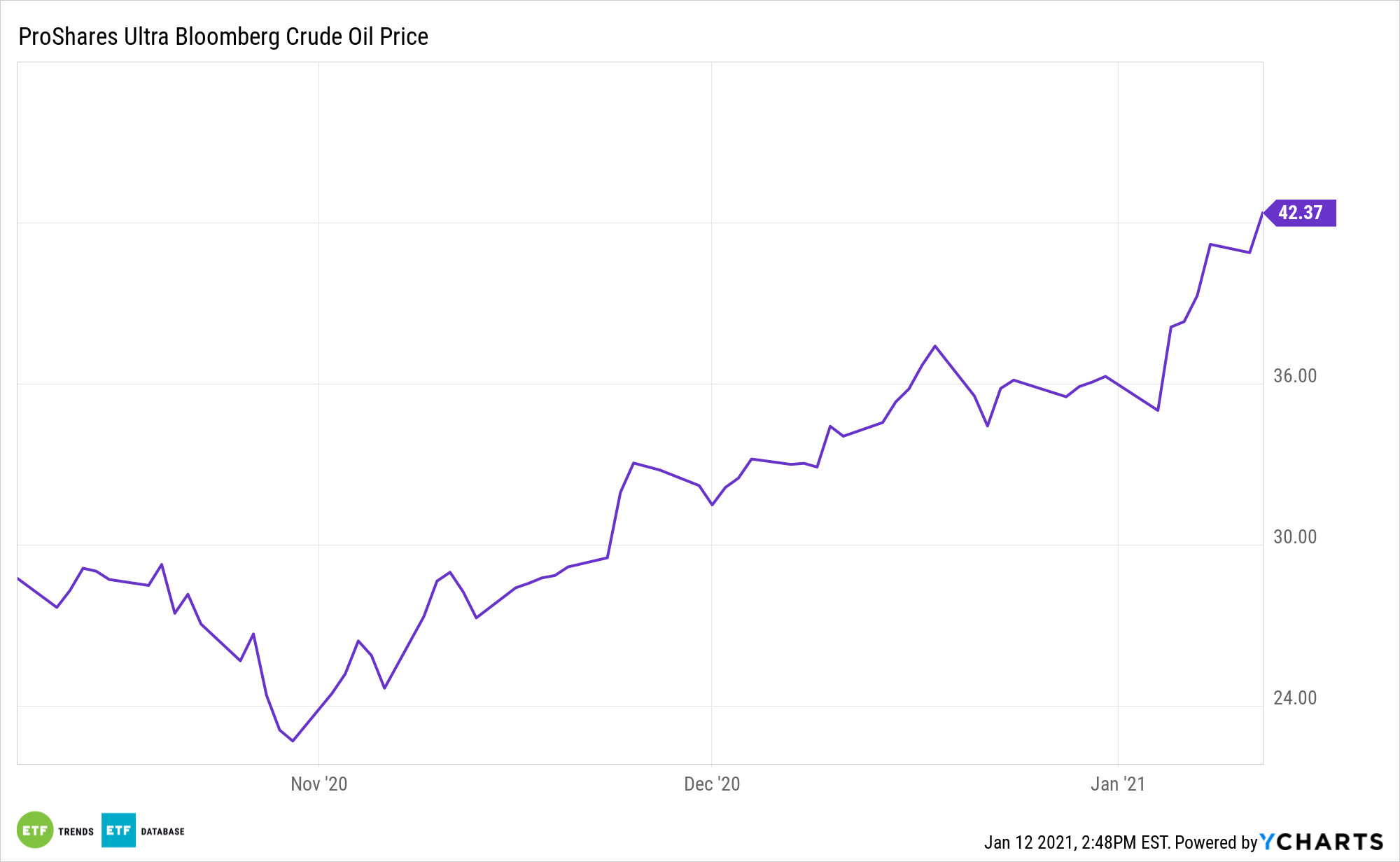

Crude ETFs gained amid the information, with the United States Oil Fund (USO) including 1.73% and the ProShares Extremely Bloomberg Crude Oil (UCO) gaining greater than 3.38%.

Saudi Arabia is about to slash output by an additional 1 million barrels per day (bpd) in February and March to curb inventories. The newest U.S. provide stories are predicted to disclose that crude shares dropped for greater than a month in a row.

“Saudi Arabia particularly is guaranteeing via its further voluntary manufacturing cuts that the market is undersupplied if something,” stated Eugen Weinberg of Commerzbank.

With report cuts now occurring in crude, now some analysts see additional good points as doubtless, and are warning buyers to keep away from brief vital threat.

“We advise buyers with a excessive threat tolerance to be lengthy Brent or to promote its draw back worth dangers,” stated Giovanni Staunovo of UBS in a report on Tuesday.

Analyzing Future Oil Costs

Technical analysts are additionally suggesting a bullish improve.

“The worth of oil could exhibit a bullish development all through the primary quarter of 2021 as each the 50-Day SMA ($44.77) and 200-Day SMA( $37.43) begin to monitor a constructive slope, whereas the Relative Energy Index (RSI) registers one other excessive studying in January to imitate the acute habits final seen in 2019,” writes David Track, a strategist from dailyfx.com.

The analyst did warn {that a} promote may consequence nonetheless, if sure technical situations are met.

“With that stated, the technical outlook for crude stays constructive as the worth of oil trades above pre-pandemic, however the RSI could point out a textbook promote sign over the approaching days if the oscillator slips under 70,” Track added.

Crude additionally rallied on the expectation of a fall in U.S. crude stockpiles. Analysts anticipate that black gold inventories may drop by 2.7 million barrels for a fifth straight week of declines.

For buyers in search of crude ETFs to play the run-up in oil, which has been pretty regular since November, the United States 12 Month Oil Fund (USL) and the iPath Pure Beta Crude Oil ETN (OIL) are two funds to contemplate.

For extra market traits, go to ETF Tendencies.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.