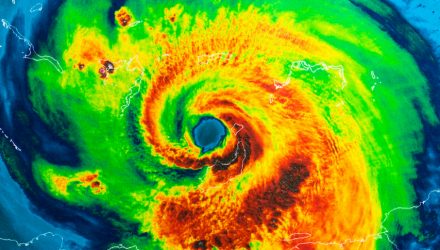

Cimpolite oil futures and crude ETFs have been unstable following the fallout from Hurricane Ida and investor issues about an OPEC+ assembly that would doubtlessly end in further output as soon as once more.

Oil futures dropped by as a lot as 1.6% Monday, as analysts and employees assessed harm from Ida. Gasoline futures rocketed over 4% earlier within the session earlier than retracing a few of these good points. Whereas Gulf of Mexico producers had closed out about 1.7 million barrels a day of crude output forward of the storm, refineries in Louisiana could also be extra sluggish to return to full manufacturing.

Analysts appear to imagine that the impression from the hurricane may very well be smaller than initially predicted.

“The market is concerning the impression on crude manufacturing as minimal at this level from Ida in contrast to refining,” mentioned Bart Melek, head of world commodity technique at TD Securities. “This implies much less demand for feed as refiners have a diminished capability, which may see crude shortage worries go away.”

Platts Analytics had mentioned that roughly 4.Four million b/d of refinery capability had been in Ida’s path, which correlated with the hurricane making landfall in Louisiana. These services accounted for roughly 1.4–1.6 million b/d of gasoline output, 1.1–1.three million b/d of distillate manufacturing, and 300,000–400,000 b/d of kerojet provide, which suggests there’ll probably be one other spike on the pump quickly.

“Hurricane Ida is predicted to come back ashore alongside the identical path as different storms, which did intensive harm to USGC refining and petrochemical services. Many vegetation have been hardened towards hurricanes, however disruptions in operations are nonetheless very probably as a result of flooding, energy outages and personnel dislocations,” Platts Analytics mentioned.

Ida was anticipated to “quickly intensify because it strikes over the Southeastern and Central Gulf of Mexico tonight” on Aug. 28, the Nationwide Hurricane Middle had said.

Ida isn’t the primary upset to the oil and gasoline markets, as crude oil and gasoline costs have witnessed important volatility this month, buying and selling from close to $73 per barrel in WTI crude oil, right down to the $61 degree, earlier than urgent greater as soon as once more as a result of issues over the pandemic.

Traders contemplated oil consumption wants given the continued pandemic resurgence in elements of Asia, the U.S., and Europe. In the meantime, the Group of Petroleum Exporting Nations and its companions are projected to proceed with their plans to spice up output this week.

Power merchants shall be monitoring the OPEC and non-OPEC Ministerial Assembly, the place specialists predict the group will ahead with plans to revive manufacturing, with some nervousness over demand from China eased. Final month, oil costs fell exhausting after OPEC+ determined to regularly terminate the rest of manufacturing limits that commenced final 12 months.

In a single day, Hurricane Ida smashed New Orleans and the Louisiana coast, slamming the world with torrential rain and cruel gusts of wind, leaving a lot of the area bereft of electrical energy and making ready for floods. The storm pressured a wall of water inland when it burst ashore Sunday as a Class Four hurricane and reversed the course of a part of the Mississippi River.

Throughout a flyover by the U.S. Coast Guard on Sunday afternoon, nevertheless, the Shell-operated Mars revealed that Olympus and Ursa crude and pure gasoline platforms remained on location.

“We anticipate a extra speedy return of oil manufacturing than refining manufacturing within the area,” Goldman Sachs Group Inc. analysts wrote in a be aware Monday. It’s too early to find out how lengthy refineries within the area will stay shut, they mentioned.

With the panic that accompanies such a large tropical storm, gasoline costs within the southeast U.S. may surge within the coming weeks if refineries endure intensive harm or stay shuttered for a chronic interval, including to the present value inflation hitting People.

“For a Class 4, you may be 4 to 6 weeks or extra of downtime for the refineries,” mentioned Andy Lipow, president of Lipow Oil Associates LLC in Houston.

Ida, which got here ashore about 60 miles (97 kilometers) south of New Orleans, drove up ocean ranges as a lot as 16 ft (4.9 meters). The hurricane’s 150-mile-per-hour winds tie information beforehand set in Louisiana by Laura in 2020 and a 19th century storm.

Richard Joswick, head of world oil analytics at S&P International Platts, defined on CNBC that, “Plenty of services are out of energy and roughly 2 million barrels a day of capability are offline proper now. However fortunately the storm missed lots of the extra susceptible areas. It may have been worse. It may have been as much as Four million barrels a day which can be out.”

Joswick added, nevertheless that, “Its an enormous quantity. That quantity is equipped usually not simply to the gulf coast space, but additionally goes up a pipeline, the Colonial Pipeline system, as much as the U.S. East Coast, and likewise Mexico actually depends on the U.S. gasoline and exports. So actually all three areas are slightly bit susceptible to this lack of capability.”

Thankfully, Joswick believes that on the refinery degree there’s in all probability ample protection for the subsequent couple of weeks. The difficulty that would come up, nevertheless, is that if there’s panic on the pumps, which may end in chaos and gasoline shortages, driving gasoline costs even greater.

For vitality traders, this might imply a continued transfer greater within the vitality complexes, together with crude futures and ETFs.

This may very well be excellent news for ETF merchants who favor crude oil. Crude ETFs just like the United States Oil Fund (USO) and the ProShares Extremely Bloomberg Crude Oil (UCO) may see doubtlessly huge good points, as quick ETFs just like the ProShares UltraShort Bloomberg Crude Oil (SCO) may endure with rising costs.

For traders searching for crude ETFs to play the run-up in oil, which has been pretty regular since November, the United States 12 Month Oil Fund (USL) and the iPath Pure Beta Crude Oil ETN (OIL) are two different funds to think about.

For extra information, data, and technique, go to ETF Developments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com