By Thomas Urano, Principal &

By Thomas Urano, Principal & Managing Director

The cash market group is battling a 0% yield surroundings and a mountain of money threatening to drive cash market charges into unfavourable territory. What are the options for short-term traders?

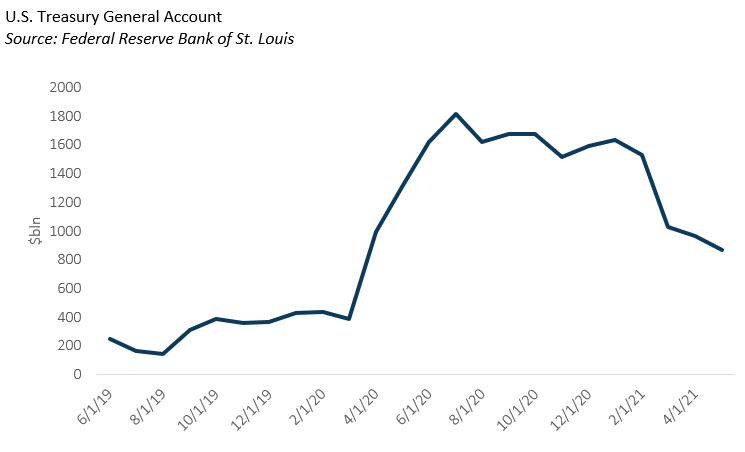

A yr in the past, the U.S. Treasury funded itself with a conflict chest of money able to spend on fiscal stimulus. Some might argue the Treasury considerably overfunded itself because the Fed’s normal account, or “checking” account, topped $1.eight trillion by summer time 2020. Over the past three months, the Treasury has spent down a big portion of this, placing over $600 billion again into the non-public sector.

[wce_code id=192]

The wave of money flooding into financial institution deposits and cash market funds is threatening to check the road within the sand between zero and unfavourable yields. The Treasury has minimize T-bill issuance this yr, inflicting a discount of $424 billion in internet T-bill provide accessible to the market. The diminished provide of Treasury payments is making it tough for cash market funds to seek out appropriate funding choices for the influx of money. At close to 0% yields, it turns into expensive to take care of the infrastructure of a cash market fund automobile and incentivizes fund operators to go prices alongside as unfavourable yields or provoke a comfortable shut of funds to new traders.

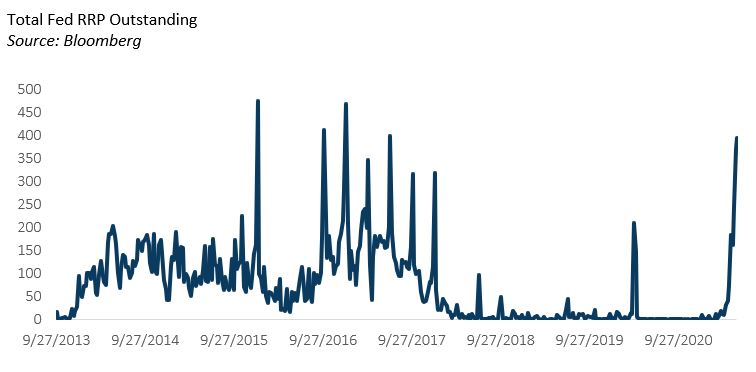

Enter the Fed. By way of its Reverse Repo Facility (RRP) the Fed is taking in money and paying out curiosity, basically serving because the final cease funding choice for money. In an effort to forestall in a single day charges from venturing into unfavourable territory, the Federal Reserve has expanded its Reverse Repo Facility to nearly $400 billion, up from zero in January.

Whether or not you take a look at T-bill yields, financial institution deposits, or RRP utilization, all indicators level to extra money desperately in the hunt for a house. Elevating rates of interest is the straightforward reply. Growing RRP charges would drag T-bill yields off the ground and alleviate some strain on different cash market charges.

What are the options for short-term traders? Enhanced Money or Extremely Quick Methods make investments simply past the investable universe accessible to cash market funds and within short-term mounted earnings methods (1-Three yr). An analysis of the funding grade company bonds which have 1) 3-12 months to maturity, 2) are U.S.-dollar denominated, and three) have greater than $300 million in excellent challenge, exhibits that a possibility for money traders nonetheless exists. The dimensions of this market is over $450 billion, the yield to worst is 0.38%, and with solely a slight extension of rate of interest sensitivity (0.5 yr efficient length).

Absent additional readability on Fed coverage, money traders with flexibility could be nicely served to think about such options to protect the yield on their short-term investments.

Disclosures: That is for informational functions solely and isn’t supposed as funding recommendation or a suggestion or solicitation with respect to the acquisition or sale of any safety, technique or funding product. Though the statements of reality, data, charts, evaluation and information on this report have been obtained from, and are primarily based upon, sources Sage believes to be dependable, we don’t assure their accuracy, and the underlying data, information, figures and publicly accessible data has not been verified or audited for accuracy or completeness by Sage. Moreover, we don’t characterize that the data, information, evaluation and charts are correct or full, and as such shouldn’t be relied upon as such. All outcomes included on this report represent Sage’s opinions as of the date of this report and are topic to alter with out discover because of numerous elements, resembling market situations. Buyers ought to make their very own selections on funding methods primarily based on their particular funding goals and monetary circumstances. All investments include danger and will lose worth. Previous efficiency isn’t a assure of future outcomes.

Sage Advisory Providers, Ltd. Co. is a registered funding adviser that gives funding administration providers for a wide range of establishments and excessive internet price people. For added data on Sage and its funding administration providers, please view our website online at www.sageadvisory.com, or consult with our Kind ADV, which is on the market upon request by calling 512.327.5530.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.