U.S. development shares and associated alternate traded funds took the lead on Monday as traders reassessed the inflation and financial outlooks.

Inflation fears have eased in latest days, however traders stay on edge, in search of indicators that Federal Reserve officers would roll again easy-money insurance policies which have supported the rally in U.S. equities.

“It virtually feels just like the market goes to be at a standstill till we get a greater readability on inflation and the expansion outlook,” Seema Shah, chief strategist at Principal International Advisors, informed the Wall Road Journal. “The market hasn’t obtained any main driver to push it considerably greater.”

Inflation has been on the forefront of traders’ minds, particularly as President Joe Biden prepares for trillions of {dollars} of latest authorities spending on infrastructure. Nonetheless, Fed officers have argued that the latest inflationary pressures are as a result of short-term elements like shortages of labor and supplies associated to the reopening of the U.S. financial system after the Covid-19 pandemic.

“The market is in search of path,” Robert Pavlik, senior portfolio supervisor at Dakota Wealth, informed Reuters. “It’s digesting Friday’s payrolls report and ready for this week’s CPI knowledge to come back out and see what the Fed has to say.”

“It’s primarily buying and selling close to all-time highs and in search of what’s subsequent,” Pavlik added.

As the expansion type rebounds from the pummeling it acquired from the inflation-induced promoting strain, traders can look to methods just like the American Century Centered Dynamic Development ETF (FDG), which is designed to put money into early-stage, high-growth corporations. FDG is a high-conviction technique designed to put money into early-stage, speedy development corporations with a aggressive benefit, together with excessive profitability, development, and scalability.

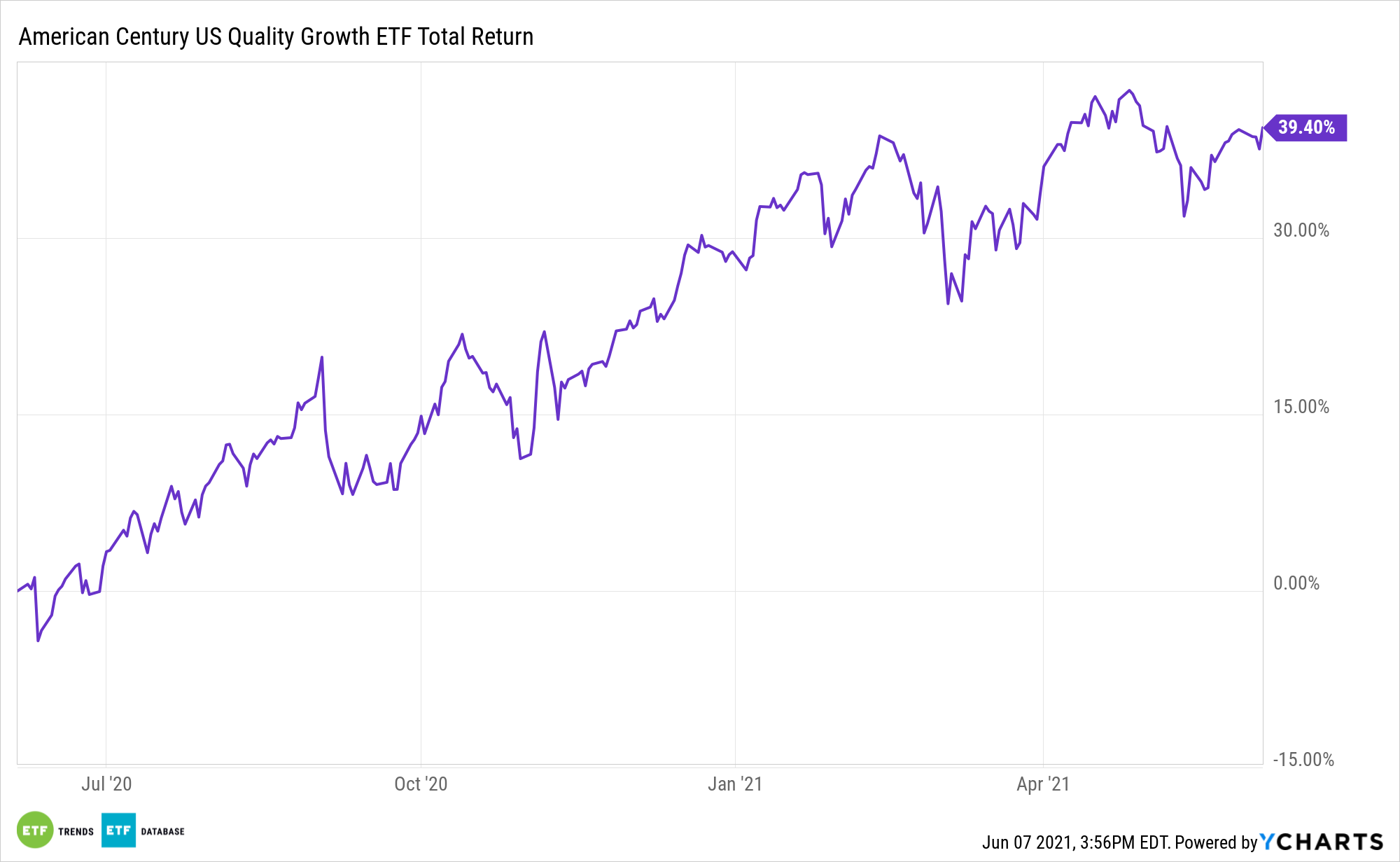

Moreover, traders can look to the American Century STOXX U.S. High quality Development ETF (NYSEArca: QGRO). QGRO’s inventory choice course of is damaged down into high-growth shares based mostly on gross sales, earnings, money movement, and working earnings, together with stable-growth shares based mostly on development, profitability, and valuation metrics.

For extra information, data, and technique, go to the Core Methods Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.