U.S. shares continued to realize on Thursday, with the expansion type taking cost, because the labor market confirmed enchancment.

Up to date authorities knowledge revealed 444,000 People utilized for first-time unemployment advantages for the week ended Might 15, in comparison with 478,000 within the week prior, the Wall Road Journal stories. It was the bottom degree because the Covid-19 pandemic hit in mid-March 2020.

The markets try to recuperate features after a tumultuous week, following issues over heightened inflationary pressures and a fast financial restoration that might push central banks to cut back accommodative financial coverage measures.

“I feel persons are nonetheless involved by the unstable strikes that we’re having in our market,” Jonathan Corpina, senior managing associate at Meridian Fairness Companions, instructed the WSJ. “In actuality, persons are nonetheless apprehensive about what the economic system will seem like one month from now, two months from now, six months from now.”

The Federal Reserve’s newest minutes revealed coverage makers in an April assembly confirmed a willingness to start plans for curbing the Fed’s large bond-buying program at a future assembly, which briefly swayed markets on Wednesday.

“The market is simply very, very jumpy about inflation and the Fed,” Seema Shah, chief strategist at Principal International Advisors, instructed the WSJ. “It’s quite a lot of knee-jerk reactions after which the market settles down a bit.”

Within the meantime, tech and development segments led the cost after struggling the brunt of the current market pullback.

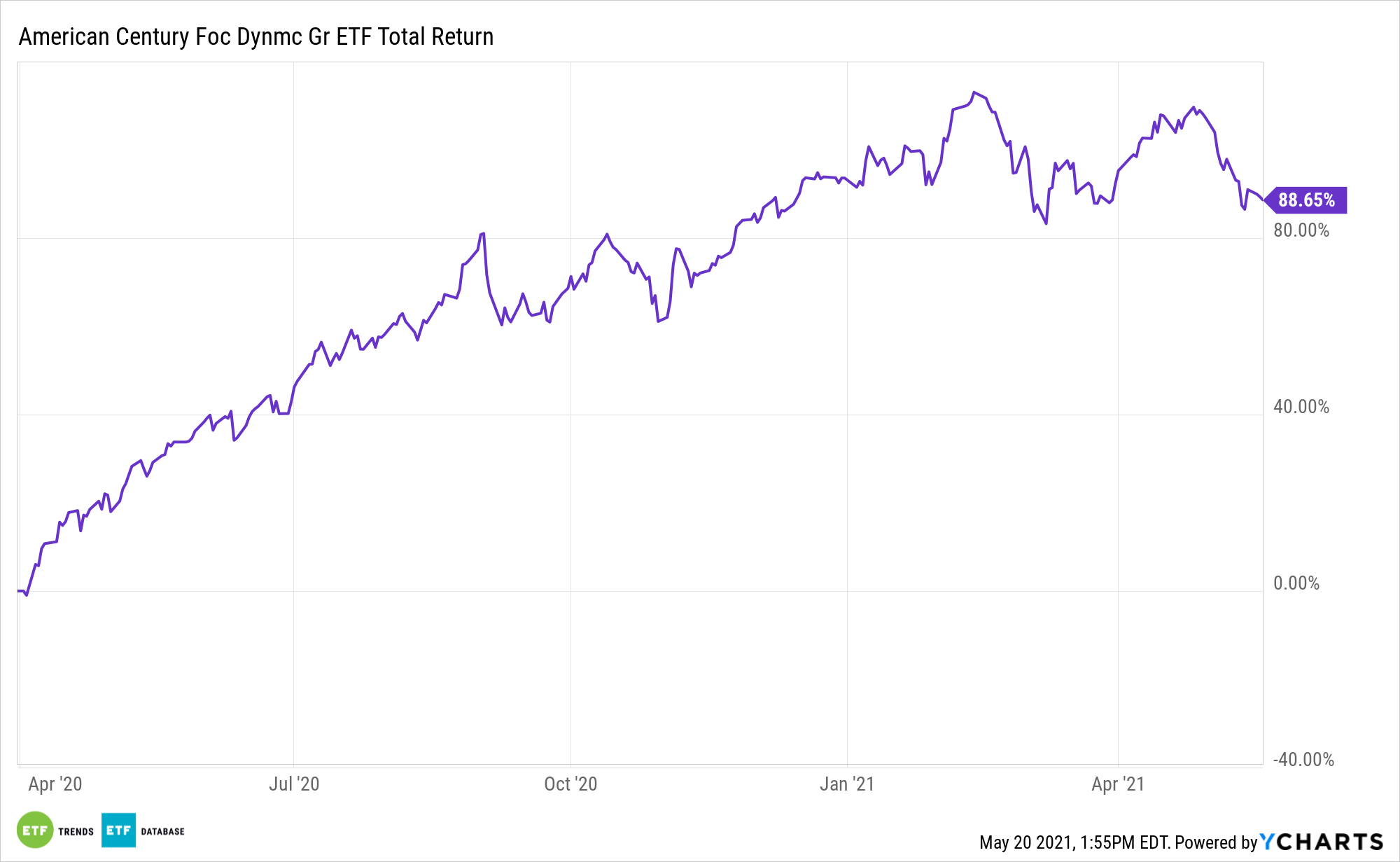

As the expansion type rebounds from the pummeling it acquired from the inflation-induced promoting stress, traders can look to methods just like the Targeted Dynamic Development ETF (FDG), which is designed to spend money on early-stage, high-growth corporations. FDG is a high-conviction technique designed to spend money on early-stage, fast development corporations with a aggressive benefit, together with excessive profitability, development, and scalability.

Moreover, traders can look into the American Century STOXX U.S. High quality Development ETF (NYSEArca: QGRO). QGRO’s inventory choice course of is damaged down into high-growth shares primarily based on gross sales, earnings, money circulation, and working revenue, together with stable-growth shares primarily based on development, profitability, and valuation metrics.

For extra information, data, and technique, go to the Core Methods Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.