Blease crude costs are within the midst of a three-week slide and West Texas Intermediate is stumbling amidst issues that the Delta variant of the coronavirus will stymie the reopening commerce and as members of the Group of Petroleum Exporting International locations (OPEC) and the so-called “plus” nations agreed to ramp up output.

Predictably, that volatility and subsequent worth retrenchment has weighed on beforehand scorching oil equities. The S&P 500 Vitality Index tumbled almost 8% final week.

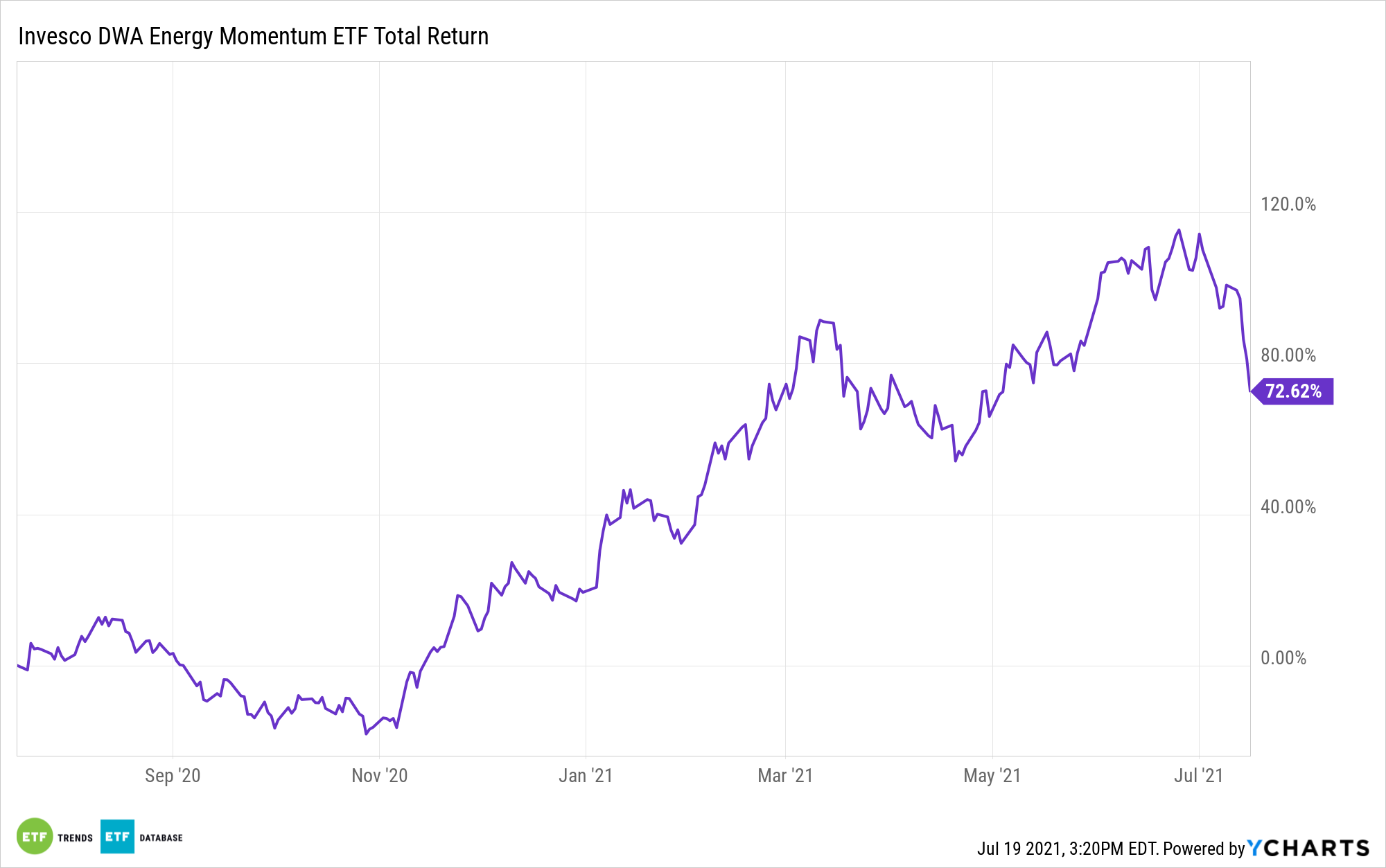

These are the breaks with vitality shares, however in a case of a unfavorable probably turning right into a constructive down the highway, the current weak point within the vitality sector is making multiples on some members of the Invesco DWA Vitality Momentum ETF (PXI).

Previous to the current pullback a slew of vitality shares “had been pretty valued however solely as a result of the market was concurrently 1) overweighting excessive near-term costs and a pair of) unfairly discounting the long-term worth technology. The OPEC deal has eradicated the primary of those points however not the latter, therefore sure shares at the moment are trying low-cost,” mentioned David Meats, Morningstar vitality fairness analysis director.

PXI’s Rebound Potential

The $183.5 million PXI follows the Dorsey Wright Vitality Technical Leaders Index. That benchmark is rooted in Dorsey Wright’s famed, proprietary relative power methodology, probably making the fund a super option to take part in an vitality rebound.

As Morningstar notes, there’s at the least one good thing about the aforementioned vitality stumble.

“However with the pullback within the sector, the roster of 4-star vitality shares has grown barely. As of the shut of buying and selling on July 14, 18 of the 58 vitality shares fell into that undervalued class,” in response to the analysis agency.

Among the many quartet of recent entrants to that undervalued checklist is PXI part Pioneer Pure Sources (NYSE: PXD), which slid virtually 11% final week. The corporate produces oil and pure gasoline within the Permian Basin in West Texas, one of many largest home shale performs, that means the inventory is levered to a attainable rebound in West Texas Intermediate costs. If costs stay excessive, home exploration and manufacturing corporations will possible increase output.

The inventory accounts for two.54% of PXI’s roster.

For extra information, data, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.