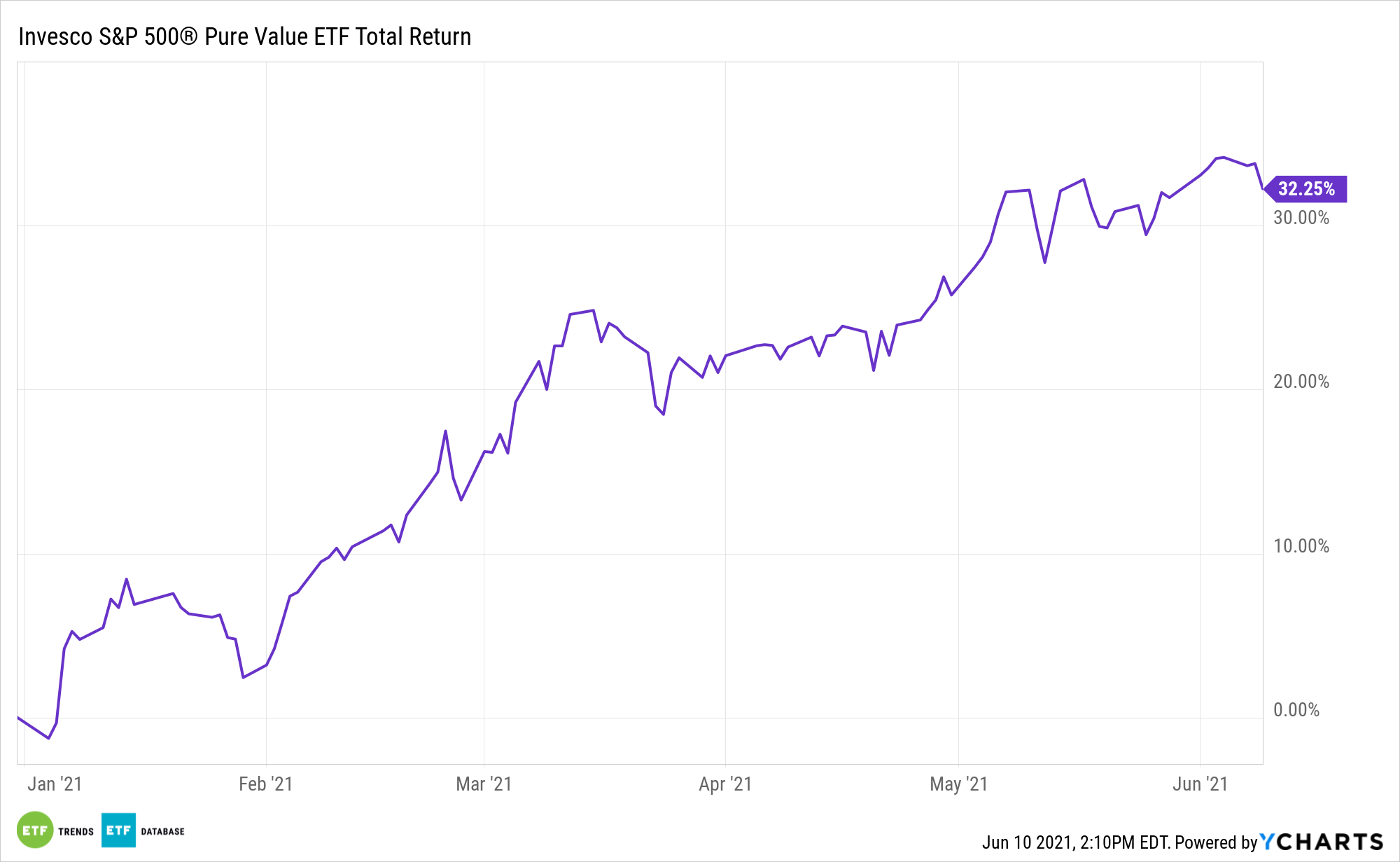

By now, many traders know that worth has been the king of funding components this 12 months. Up 32.25% year-to-date, the Invesco S&P 500® Pure Worth ETF (RPV) proves as a lot.

Some traders at the moment mulling worth publicity could also be involved about two issues. First, how rather more upside is accessible after an alternate traded funds jumps over 30% in lower than half a 12 months? Second, how for much longer will the worth renaissance final? Concerning the latter, worth shares began perking up about 9 months in the past, and issue management is usually fluid.

Historical past signifies worth rallies usually last more than 9 months.

“Since 1995, there have been six cycles when worth outperformed progress. The shortest lasted solely six months (between February and August 2009),” mentioned S&P Dow Jones Indices Managing Director Craig Lazzara in a current be aware. “On the alternative facet of the ledger, worth outperformed for greater than 4 years between 2003 and 2007. So the nine-month period of the present rally is meaningless in itself.”

Extra Ideas on the Longevity of Worth

Over the previous 12 months, RPV is increased by 48.77%, as in comparison with 31.44% for the S&P 500. As Lazzara notes, worth positive aspects can go previous the early innings.

“It’s conceptually doable that, though worth outperformed for greater than 4 years, a lot of the outperformance occurred within the early months, with solely a small dollop for latecomers. It seems that this was not the case; early traders didn’t reap a disproportionate share of worth’s positive aspects,” he mentioned in reference to the 2003-2007 worth surge.

A giant motive why RPV’s run should still be in its formative levels is the fund’s practically 44% weight to monetary companies shares. Treasury yields may rise anew, boosting the sector alongside the way in which. Plus, the group remains to be ready on official phrase from the Federal Reserve on boosting buybacks and dividends. Both method, the financial system is bettering and that ought to ease considerations about dangerous loans whereas stoking demand for brand spanking new loans.

In terms of worth, “the present nine-month cycle shouldn’t be remarkably lengthy by historic requirements, and if it retains going, historical past offers us motive to imagine that outperformance within the subsequent interval may be nearly as good because it was initially,” concludes Lazzara.

For extra information, data, and technique, go to the ETF Training Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.