Investing in healthcare shares is compelling for a lot of traders due to the defensive qualities of blue chip prescription drugs firms and the expansion prospects of biotechnology names.

Nonetheless, as sustainable investing turns into an more and more distinguished a part of the funding lexicon, some could ponder the advantage, or lack thereof, of embracing firms pushing merchandise with exorbitant prices. Take the instance of Biogen’s (NASDAQ: BIIB) lately accredited Alzheimer’s drug Aduhelm. That remedy carries an annual price ticket of $56,000. To ensure that Medicare to choose up that tab for hundreds of thousands of sufferers, the federal government may spend extra on that remedy than it does on the Environmental Safety Company (EPA) or NASA, in response to the New York Occasions.

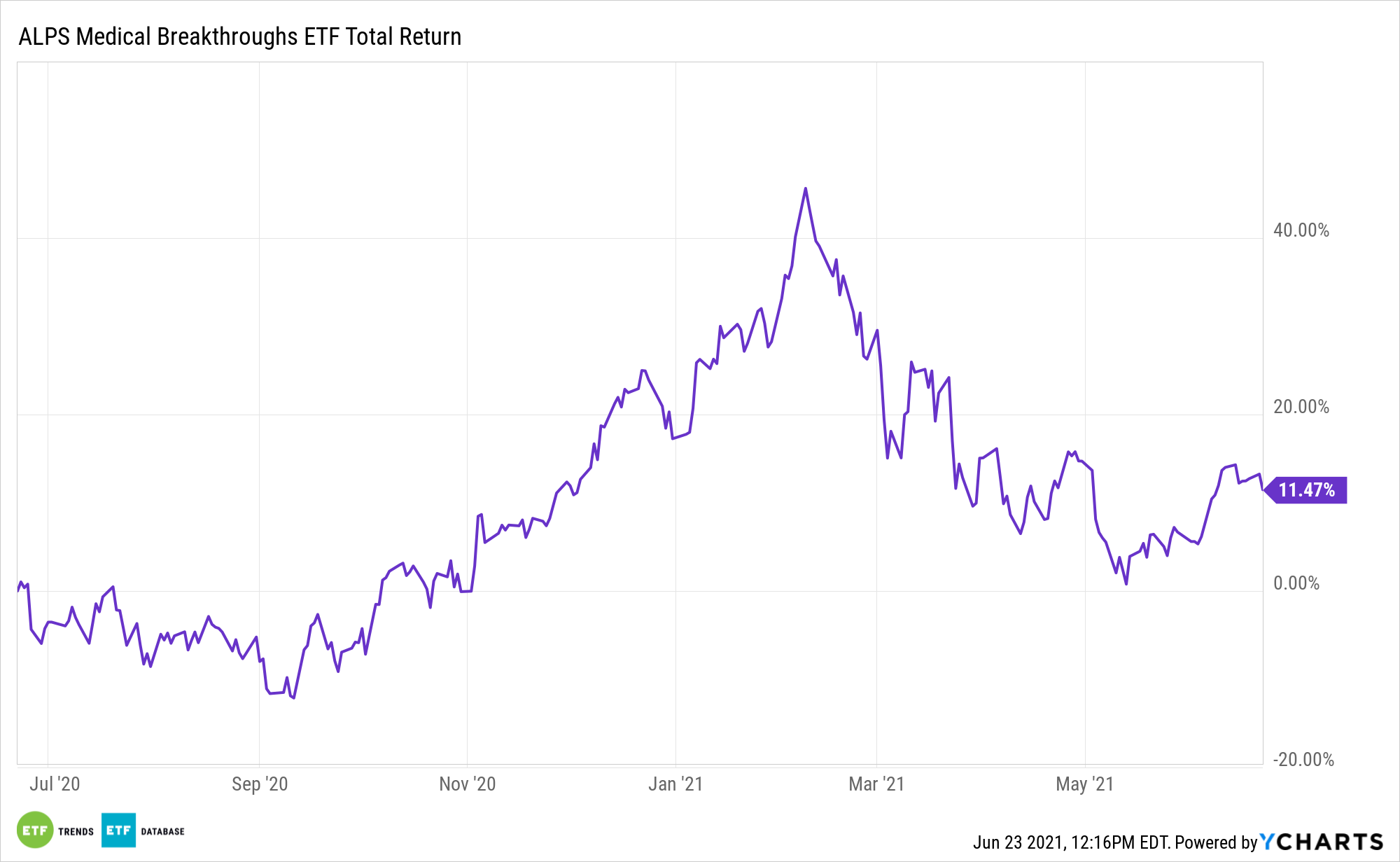

It is no surprise drug pricing reform is again in deal with Capitol Hill. Nonetheless, traders could not want to worry concerning the debate’s affect on ETFs just like the ALPS Medical Breakthroughs ETF (SBIO).

One in every of SBIO’s necessities for admission is that firms have a minimum of one drug or remedy in Part II or Part III U.S. Meals and Drug Administration scientific trials. In different phrases, it is truthful to say many SBIO elements are prioritizing analysis and growth. Over time, that may not solely profit investor outcomes, however these of sufferers, as effectively.

Translation: some SBIO elements are the very firms that can make progress on life-threatening diseases and desires presently described by medical neighborhood as “unmet.” Politicians are unlikely to face in the best way of these developments.

“Current years have seen the introduction of many groundbreaking new therapies for illnesses like hepatitis C, cancers, and genetic illnesses, together with gene therapies,” in response to a latest notice from Senate Finance Committee Chairman Ron Wyden (D-OR). “The analysis that led to those medical advances can largely be traced again to small biotechnology firms that tackle a disproportionate share of the chance of R&D.”

The point out of smaller biotech firms is related to SBIO traders as a result of the ALPS fund solely contains companies with market values of $200 million to $5 billion on the time of rebalancing. For now a minimum of, it seems Wyden’s committee needs to permit innovators to proceed innovating.

“To guard their means to innovate, insurance policies developed within the Finance Committee might be tailor-made to the dimensions of those firms, in addition to different components that have an effect on their entry to capital,” stated the senator.

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.