By Frank Holmes, CEO, U.S. World Buyers Wish to hear one th

By Frank Holmes, CEO, U.S. World Buyers

Wish to hear one thing actually scary? Inflation, the scourge of the trendy financial system, could also be operating a lot sooner than we’re led to consider.

I’ll use client spending on Halloween for instance of what I imply.

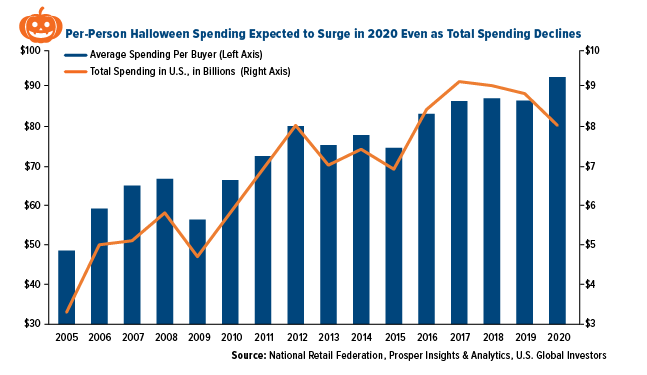

Whole Halloween spending has fallen for the previous three years and was projected to fall but once more this season, to $Eight billion from $8.Eight billion final yr, in keeping with current knowledge from the Nationwide Retail Federation (NRF).

No shock there. With many individuals nonetheless avoiding massive gatherings as a result of pandemic, and well being officers calling trick-or-treating a “high-risk exercise,” much less goes to be spent on sweet, costumes, get together decorations and different Halloween-related gadgets.

Certainly, spending on costumes was forecast to plunge a not insignificant $600 million in comparison with final yr, from $3.2 billion to $2.6 billion.

Given this, you may suppose that on a per-person foundation, Halloween spending would even be down. And but that’s not the case, in keeping with the NRF’s survey. Common spending per client was anticipated to enhance virtually 7 %, from $86.28 to $92.12.

So what’s occurring right here?

There could also be quite a lot of attainable explanations for this phenomenon, however I consider probably the most convincing can also be the best: Inflation.

And as I’ve mentioned earlier than, the actual inflation could also be a lot increased than the official client worth index (CPI) issued month-to-month by the Bureau of Labor Statistics (BLS).

Final month, the BLS reported that client costs have been up just one.four % in September in comparison with the identical time final yr. If we take away unstable meals and power costs, they have been up barely extra, at 1.7 %.

How can this be, when customers are spending 7 % extra on sweet and costumes this yr, regardless of whole Halloween spending declining?

The reality is that the CPI has undergone a number of modifications in methodology through the years. At one time, it was a real price of products index (COGI). Immediately, nonetheless, it’s extra of a value of dwelling index (COLI). So if you see that inflation is up 1.four % year-over-year, you may be positive it’s truly increased—doubtlessly a lot increased.

How a lot increased? Economist John Williams, who runs the favored web site ShadowStats.com, makes use of the 1980 methodology for measuring inflation. Based on this gauge, client costs are up nearer to 9 % than 1 %.

The implication, in fact, is that inflation could possibly be consuming your lunch sooner than you notice. And that’s actually scary, whether or not you’re nonetheless in your wealth constructing years or retirement.

Positioning Your Portfolio for Treasury Secretary Elizabeth Warren

There’s motive to consider that the speed of inflation may get a lift subsequent yr, significantly if we see further multi-trillion-dollar stimulus packages. I’ll talk about the election extra in-depth beneath, however I’ll say upfront that it’s being reported that Massachusetts senator Elizabeth Warren is searching for an appointment as Treasury secretary ought to Joe Biden win tomorrow.

I’ve written earlier than about fashionable financial principle (MMT), the controversial financial thought that claims governments with full management over their very own currencies can spend as freely because it desires. To a proponent of MMT, a $52 trillion price ticket means nothing. Simply print more cash. This is identical Elizabeth Warren who, whereas nonetheless a presidential candidate, mentioned her Medicare-for-all well being care plan would price a staggering $52 trillion.

At present the system is simply that—a principle—however with the opportunity of a Treasury Secretary Warren, MMT could grow to be a actuality prior to we anticipated.

That mentioned, prepare for unrestricted cash printing—and, consequently, hyperinflation.

Just lately I shared with you Goldman Sachs’ forecast of upper inflation subsequent yr. The funding financial institution recommends commodities, uncooked supplies and different arduous property, which might profit in a high-inflation setting.

Many big-name cash managers are urging buyers get publicity to gold. Talking on the Robin Hood Buyers Convention final week, billionaire household workplace supervisor Stanley Druckenmiller mentioned he believed a “blue wave” would harm equities long-term and that bond yields and gold costs would rise.

Additionally final week, I had the pleasure of co-hosting a webcast with my pal Kevin O’Leary, “Mr. Great.” Kevin mentioned he was sustaining a 5 % weighting in gold, break up between bodily bullion and shares of SPDR Gold Shares (GLD). Gold, he mentioned, is “all about hedging in opposition to inflation.”

Missed the webcast? E mail me at [email protected] to get a replica of the replay!

Gold Funding at Report Highs

The yellow steel’s conventional haven standing has undoubtedly strengthened this yr. The World Gold Council’s (WGC) abstract of the third quarter exhibits that whole holdings in gold-backed ETFs hit a file excessive of three,880 tonnes, having added 272.5 tonnes within the three months ended September 30.

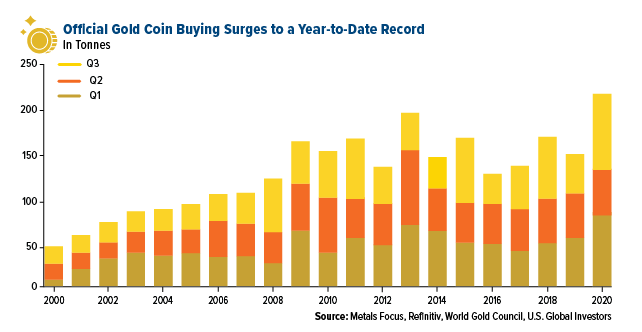

Bodily gold funding additionally hit a brand new all-time excessive. Gold bar and coin purchases elevated an unbelievable 49 % year-over-year by the top of the third quarter, reaching 222.1 tonnes. Largest quantity will increase have been seen in Western markets, China and Turkey, the WGC says.

Closing Feedback Earlier than the Election

Talking of breaking data… As of Friday, it’s being reported {that a} file 80 million Individuals participated in early voting. Right here in my dwelling state of Texas, greater than 9 million individuals have voted early—which exceeds the full variety of Texans who went to the polls in 2016.

What this means is that voters this cycle are galvanized like by no means earlier than.

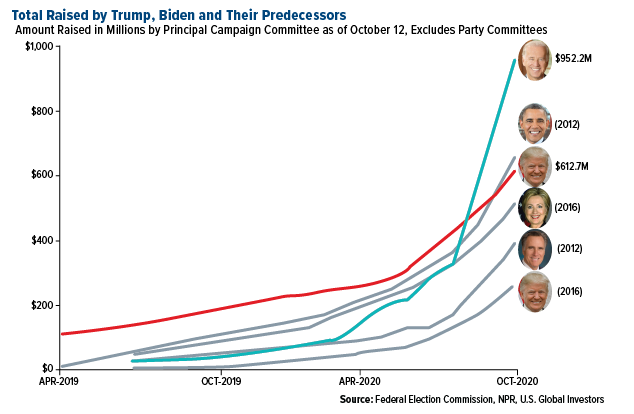

However we already knew that. For what it’s price, Biden has raised more cash than some other presidential candidate in U.S. historical past. As of October 12, his warfare chest stood at a head-spinning $952.2 million, which is one and a half instances as a lot as President Donald Trump has raised over the identical interval.

The market additionally seems to be pointing towards a Biden victory. In August, I shared with you that when the market was up from July 31 to October 31, it traditionally favored the incumbent get together. And when the market was down, it favored the challenger.

As of the shut on Friday, the S&P 500 was down 0.37 % from July 31. What’s extra, final week was the worst for shares since mid-March.

What’s working in Trump’s favor proper now? Actually stellar financial development within the third quarter. GDP expanded at a file tempo of seven.four % quarter-over-quarter and 33.1 % annualized.

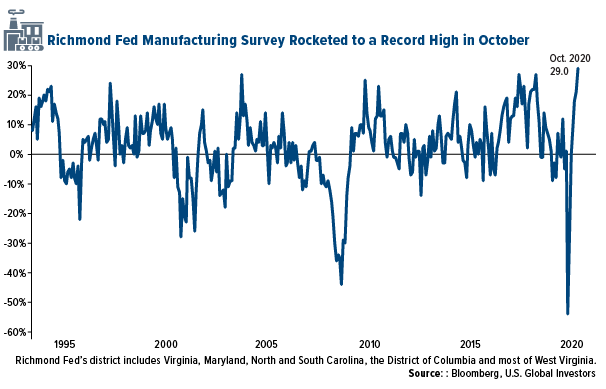

Additionally, manufacturing exercise has been extremely optimistic. The U.S. ISM Manufacturing PMI has been in expansionary mode for the previous three months, and in October it registered a 59.3, the very best studying since September 2018. Final week, the manufacturing index for the Federal Reserve Financial institution of Richmond exhibits factories rising at a file tempo. The index hit 29.Zero in October, the very best studying going again to 1992.

Nothing is ready in stone, clearly, and there’s at all times the chance that election outcomes shall be contested. Nevertheless issues end up, be ready for heightened volatility.

I’ll see you on the opposite aspect of the election!

Initially printed by U.S. World Buyers, 11/2/20

All opinions expressed and knowledge offered are topic to vary with out discover. A few of these opinions might not be acceptable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. World Buyers doesn’t endorse all info equipped by this/these web site(s) and isn’t accountable for its/their content material.

Client costs (CPI) are a measure of costs paid by customers for a market basket of client items and providers. The yearly (or month-to-month) development charges symbolize the inflation charge. The Buying Managers’ Index (PMI) is an index of the prevailing route of financial developments within the manufacturing and repair sectors.

The S&P 500 is extensively thought to be one of the best single gauge of large-cap U.S. equities and serves as the muse for a variety of funding merchandise. The index contains 500 main firms and captures roughly 80% protection of obtainable market capitalization.

Holdings could change every day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. World Buyers as of (09/30/2020): SPDR Gold Shares.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.