ETF traders in search of a pure play on the communi

ETF traders in search of a pure play on the communications sector can look to funds just like the Invesco S&P 500 Equal Weight Communication Providers ETF (EWCO).

EWCO, which is up about 20% year-to-date, seeks to trace the funding outcomes of the S&P 500® Equal Weight Communication Providers Plus Index. The fund usually will make investments at the least 90% of its complete property within the securities that comprise the underlying index.

The underlying index consists of all the elements of the S&P 500® Communication Providers Plus Index, an index that comprises the frequent shares of all corporations included within the S&P 500® Index which are labeled as members of the communication companies sector, as outlined in keeping with the World Trade Classification Normal (GICS). The fund makes use of a mixture of allocation kinds, however primarily operates inside massive cap worth, mix, and progress, with some mid cap worth and mix kinds added in.

Diversification and Larger Returns

An Invesco “Technique Insights” report not too long ago highlighted the advantages of utilizing an equal-weighted funding method. A few these embrace diversification potential and traditionally increased returns when evaluating the S&P 500 Index and S&P 500 Equal Weight Index (EWI).

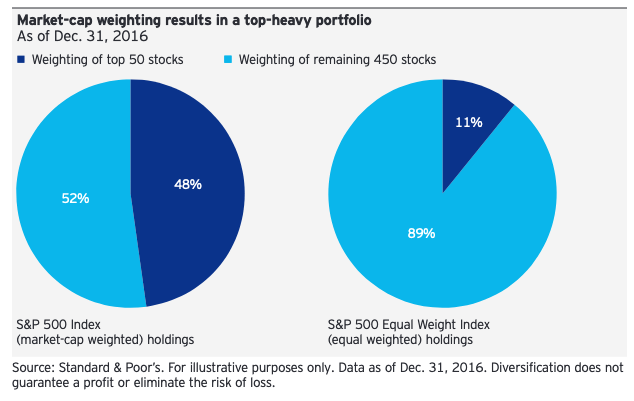

“Resulting from market-cap weighting, efficiency of the S&P 500 Index could be dominated by a small variety of shares,” the report mentioned. “The 50 largest securities within the index symbolize almost 50% of its weight, leaving the subsequent 450 shares to account for the remaining 50%. The highest 50 shares within the S&P EWI, on the different hand, comprise simply 11% of that index.”

“Equal weighting means each inventory has the identical potential affect on the returns of the S&P EWI, whereas within the S&P 500 Index, a inventory with a weight of two% has 10 occasions the affect of 1 with a weight of simply 0.2%,” the report famous.

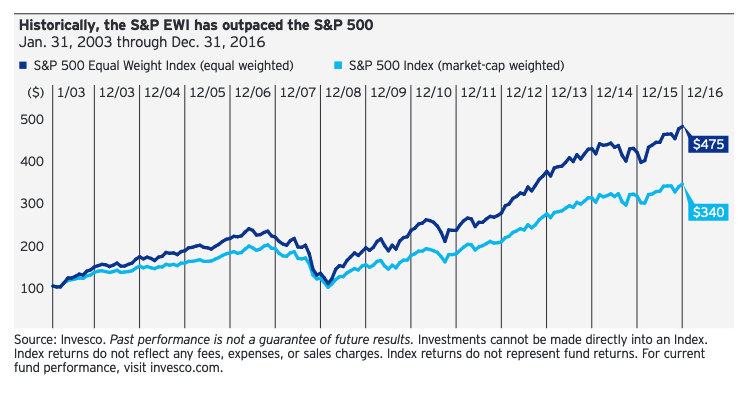

In fact, traders need to know simply how properly the technique as held up over time. To this point, historical past is on its facet.

“The S&P EWI has additionally outpaced the S&P 500, traditionally. Investments of $100 on Jan. 31, 2003 would have grown to $475 by Dec. 31, 2016 for the S&P EWI, however solely $340 for the S&P 500,” the report mentioned additional. “Larger publicity to smaller capitalization shares with increased progress charges might assist to clarify this distinction.”

“Firms price a whole bunch of billions of {dollars}, like the biggest shares within the S&P 500, might discover continued above-average progress troublesome since ‘timber don’t develop to the sky,'” the report added.

For extra information and knowledge, go to the Modern ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.