By Sara Rodriguez, Sage ESG Analysis Analyst

About Micron Expertise

Micron Expertise, Inc. is an American semiconductor firm that produces quite a lot of reminiscence and storage merchandise. Micron is the fifth largest semiconductor firm on the earth by income ($21.four billion in 2020) and operates in 17 nations. The processors and microchips that Micron produces are utilized in computer systems, client electronics, cars, and telecommunications. Micron’s operations encompass each the analysis and design (R&D) and the manufacturing of semiconductors, which is notable as some firms within the business have chosen to specialise in both R&D or manufacturing, because of the extraordinarily excessive price of every course of. Micron builds its reminiscence chips at fabrication vegetation, or “fabs” in Singapore, Taiwan, Japan, and the US.

Semiconductors are essentially built-in into on a regular basis life – they’ve been in comparison with each bathroom paper and oil. Our reliance on these chips has been compounded by our expertise with the Covid-19 pandemic, as demand for electronics has elevated. Quarantine prompted an enormous shift from places of work to working from house, and semiconductors helped to energy the laptops and webcams we used to work; nonetheless, momentary manufacturing unit closures and disruptions in day-to-day operations have put stress on provide. The rebound of the worldwide financial system has additionally brought about disruption in provide chains, exacerbating the present scarcity. Reliance on chips is sort of ubiquitous, and Goldman Sachs has calculated that 169 American industries are at present affected by the chip scarcity, most notably the auto business.

Semiconductors are on the coronary heart of the intersection of tech and sustainability. Semiconductors will energy the way forward for synthetic intelligence, autonomous automobiles, the Web of Issues, and the persevering with pattern of distant work. Firms throughout industries will use these applied sciences to realize quite a lot of environmental, financial, and social objectives. The semiconductor business depends on deep international provide chains and entry to abroad markets, presenting a lot of sustainability dangers and alternatives. Presently, the business faces regulatory uncertainty, making good ESG administration paramount to its future.

Environmental

Semiconductors will present the muse on which new sustainable applied sciences will run. To actually transfer the needle towards a extra sustainable future, it’s important that semiconductors be produced in a means that won’t jeopardize the efficacy of the end-use product; nonetheless, the manufacturing of semiconductors is intensive and requires quite a few inputs, together with uncooked supplies, chemical substances, vitality, and water. Every of those presents each dangers and alternatives associated to company social accountability.

The manufacturing of semiconductors is an energy-intensive course of that may create vital carbon emissions and contain excessive vitality prices. Manufacturing of semiconductors causes emissions from direct operations, such because the greenhouse gases (GHG) used within the manufacturing course of (Scope 1 emissions), and from bought electrical energy used to energy a semiconductor fab (Scope 2 emissions). Micron’s Scope 1 emissions contain fluorinated gases, which act as coolants in the course of the manufacturing course of however are thought of essentially the most potent and longest-lasting kind of GHG emitted by human actions. Micron has fashioned specialised groups to concentrate on these gases with the aim to transition to gases that doubtlessly contribute much less to international warming, and the corporate additionally has a longer-term aim of reaching a net-zero manufacturing course of.

Most of Micron’s emissions are Scope 2 emissions, which consequence from bought electrical energy that Micron makes use of to energy its fabs and workplace buildings. To handle these emissions, Micron is working to comply with LEED standards within the development of recent buildings and has set a aim of transitioning to 100% renewable vitality in the US by 2025. Whereas admirable, most of Micron’s operations happen abroad, and international markets don’t at all times supply the identical alternatives for renewable vitality sourcing. Moreover, reminiscence and storage have an effect on the sustainability of quite a lot of finish merchandise, from laptop vitality to automobile security. Whereas Micron doesn’t report its Scope Three emissions on its company sustainability report (CSR), it does web site that 64% of the corporate’s income comes from low-carbon (vitality environment friendly) merchandise. Micron has dedicated to spending roughly $1 billion over the following 5 to seven years to develop applied sciences to additional drive down the consumption of assets and technology of byproducts in manufacturing.

Innovation is vital to driving sustainability in semiconductor manufacturing. Smaller chips supply larger effectivity and efficiency, decrease manufacturing prices, and a cheaper price. This idea is named Moore’s regulation—named after Gordon Moore, the founding father of Micron’s business peer Intel—and states that the variety of transistors in a semiconductor doubles each two years. Larger efficiency implies that with every successive technology of product, the semiconductor business produces microchips with fewer assets and fewer emissions per unit of manufacturing. This will make an enormous distinction in solely a brief period of time, and Micron has been capable of scale back its mixed Scope 1 and a couple of GHG emissions per unit of manufacturing by 36% since 2018. Micron’s long-term GHG emissions objectives embody a 75% discount in emissions per unit of manufacturing by 2030 and a 40% discount in absolute emissions, each in comparison with a 2018 baseline. Micron has been rising manufacturing lately, and due to this fact has not but seen a lower in absolute emissions; nonetheless, we imagine the corporate is heading in the right direction and even forward of some business friends in its aim towards extra carbon-friendly operations.

Like all industries, the semiconductor business faces dangers related to local weather change. Whereas flooding, warmth waves, and drought have the potential to enormously have an effect on operations, Micron has discovered that essentially the most vital local weather change transition danger is regulation associated to carbon pricing. As the corporate has comparatively massive Scope 1 and a couple of emissions, carbon pricing mechanisms have the potential to have a unfavourable monetary influence on the corporate by rising direct prices in Micron’s operations. That is particularly pertinent in Singapore the place the Nationwide Surroundings Company has adopted the Carbon Pricing Act to tax greenhouse fuel emissions; whereas this has the potential to price Micron $3.Three million USD yearly over the following few years, we view it as a mandatory incentive to scale back emissions.

One other necessary enter within the manufacturing course of is water, which is essential to manufacturing. Semiconductor fabs depend on ‘ultrapure’ water to make sure high quality and sterilize the manufacturing unit ground, and as applied sciences develop extra complicated, water demand has grown. Growing international water stress is more likely to pose operational dangers to the business, and corporations ought to incorporate water stress circumstances in selections about fab places. Utilizing the World Assets Institute’s Aqueduct device, Micron has recognized fabs which might be situated in areas of excessive water stress, and at present, only one% of operations happen in these areas; nonetheless, a lot of Micron’s services nonetheless face potential water stress. In truth, the manufacturing of chips and show panels in Taiwan was affected by drought this previous spring, inflicting chipmakers like Micron to need to truck in water to stop fab shutdowns. Micron can handle water consumption by rising water effectivity and lowering water demand. Presently, Micron makes use of a mixture of recycled water from its personal operations and native water, however having to compete with native communities for water presents danger. Micron is working towards a aim of reusing, recycling, or restoring 100% of water utilized in its operations with an interim aim of 75% by 2030.

After the manufacturing course of is full, semiconductor fabs are left with quite a lot of waste supplies. To reduce this waste, Micron focuses on lowering hazardous chemical utilization by course of enhancements and encourages the phase-out of those chemical substances. A lot of the waste Micron produces is hazardous, which presents even larger environmental danger. The corporate aspires to recycle or recuperate 100% of its hazardous waste with an interim aim of reaching 95% by 2030. As of 2020, Micron reuses, recycles, or recovers 84% of its complete waste. Along with waste created in manufacturing, end-product digital waste is a crucial sustainability problem. When these merchandise find yourself in landfills, they’ve the potential to hurt the communities round them, and the uncooked supplies, water, and vitality which might be put into making them are misplaced. Whereas that is extra pertinent to the businesses which might be utilizing Micron’s merchandise, we hope the corporate will think about this problem of their future sustainability studies.

Lastly, whereas the corporate’s focus is on environmental administration in Micron’s personal operations, the corporate does have requirements in place to watch suppliers and work to enhance vitality effectivity, scale back GHGs, and reduce waste, wastewater, and air emissions utilizing the Accountable Enterprise Alliance (RBA) audit course of. In 2020, Micron discovered that 7% of the suppliers it assessed have been discovered to have environmental-related points that required enchancment, and related motion was taken.

Social

From a posh and intensive international provide chain to requiring a extremely expert workforce, working within the semiconductor business presents a mess of social dangers. These points have the potential to have an effect on an organization’s monetary efficiency, and powerful administration is critical.

Workforce well being and security is a serious space of concern for the semiconductor business, as chemical utilization in manufacturing can have long-term impacts on worker well being, and complicated equipment presents the danger for damage. It’s essential for firms like Micron to take measures to guard worker well being and security and in flip, defend themselves from lawsuits and reputational harm associated to hazardous substances and security violations. Micron’s CSR lays out a transparent imaginative and prescient—the corporate strives for an incident-free office at each manufacturing web site, inclusive of each staff and contractors. Micron’s manufacturing places are licensed to Worldwide Requirements of Group (ISO) 45001 security and administration techniques, a extensively accepted certification for factories. The corporate views itself as an business chief in its dealing with of hazardous chemical substances and goals to get rid of as many high-hazard substances from the office as potential. In 2020, Micron confronted no financial losses from authorized proceedings relating to worker well being and security violations and the corporate has had no associated controversies lately.

Past bodily security, firms have an obligation to make sure the safety of human rights for his or her staff. That is very true for firms that function in international contexts, as nations range of their employee safety legal guidelines. Micron works to uphold a excessive degree of labor ethics in its personal operations guided by the corporate’s Code of Enterprise Conduct and Ethics; nonetheless, extra challenges come up in the case of the operations of Micron’s suppliers, contractors, and different companions. A lot of Micron’s suppliers are situated in Asia, which is related to the next danger for human rights violations towards international and migrant staff.

Micron mitigates these dangers by its membership with the Accountable Enterprise Alliance (RBA), an business coalition fashioned to standardize company social accountability in international provide chains and promote accountable working circumstances, moral enterprise practices, and environmental stewardship. Provider verification with the RBA requires an preliminary self-assessment questionnaire and an in-person audit performed by a 3rd get together. As soon as the provider is deemed to have applicable security and human rights requirements in place, Micron will proceed audits each two years. Suppliers discovered to have points at any time are given a brief window to resolve them earlier than they’re faraway from the provision chain. Micron extends the oversight of human rights to anybody who works on a Micron web site in any capability, together with any individuals employed briefly by suppliers. The corporate assessed 1,400 suppliers in 2020, up from 900 in 2019, and none have been discovered to satisfy the standards for termination because of noncompliance with social points. Micron is one in every of solely a handful of firms within the RBA to have a blemish-free audit historical past, and that’s mirrored in an absence of previous firm scandals or lawsuits.

One other pertinent human rights-related provide chain problem Micron faces is the sourcing of battle minerals. Like many expertise firms, Micron depends on using tin, tungsten, tantalum, and gold (3TG) within the manufacturing of its merchandise. These minerals are related to human rights violations within the Democratic Republic of the Congo (DRC) and surrounding areas. Part 1502 of the Dodd-Frank Act requires publicly traded U.S. firms to trace, monitor, and report on provide chain minerals that will originate in or close to the DRC yearly. Micron’s Accountable Minerals Coverage requires suppliers to supply conflict-free minerals from smelters or refiners which might be validated by regulatory our bodies, together with the Accountable Minerals Initiative (RMI) and the Accountable Minerals Assurance Protocol (RMAP).

Micron is a founding member of the RMI, which has helped the corporate to develop a typical method for addressing battle mineral provide chains and protocols. This course of contains third-party auditing, due diligence instruments, and a public database documenting smelters and refiners. The corporate publicly studies the outcomes of its due diligence on battle minerals yearly. Nevertheless, 3TG minerals aren’t the one parts of Micron merchandise which have the potential to be sourced from suppliers who contribute to human rights violations. Copper, cobalt, and lithium are all parts that additionally carry provide chain danger but aren’t regulated by Part 1502 of the Dodd-Frank Act. The RMI’s cobalt reporting program is anticipated to be applied in 2022; nonetheless, Micron doesn’t produce batteries and doesn’t use vital quantities of cobalt. We hope to see Micron proceed to increase its accountable minerals program.

Along with human rights points, Micron’s administration of human capital is a crucial social problem that may have an effect on the underside line. Working within the semiconductor business requires a extremely expert workforce, and Micron faces fierce competitors in recruiting not solely from business friends, but in addition from different industries. The analysis and improvement of semiconductors requires extremely educated staff and is extremely costly, taking on 15% to 20% of the typical business participant’s annual gross sales income — solely pharmaceutical firms spend extra. The lack to retain key educated staff might have a cloth adversarial impact on Micron’s enterprise. One notable business story is that of Morris Chang, who labored at Texas Devices (TI) within the 1960s and 1970s and went on to start out the world’s largest semiconductor foundry, Taiwan Semiconductor Manufacturing Firm (TSMC) after being snubbed for an govt place. TSMC is now a direct competitor of TI.

Innovation is fostered by numerous views, and an inclusive firm tradition drives the retention of extremely expert staff. Micron publishes an annual Variety and Inclusion (D&I) report, and the 2020 report presents an in-depth have a look at the corporate’s insurance policies and demographic knowledge. In response to the social unrest within the U.S. in 2020, Micron has laid out six DEI commitments for 2021, together with rising illustration, driving equitable pay, strengthening inclusion, advocating for the underrepresented, committing a proportion of money investments to be managed by minority-owned corporations, and rising range amongst its suppliers.

It’s no secret that the expertise business has traditionally been a spot of underrepresentation for girls and stays predominately male. Globally, girls nonetheless make up solely about one-third of Micron’s workforce, however the firm has insurance policies in place to allow progress in gender range and is seeing progress in feminine management. The board of administrators is now 37.5% feminine, up from solely 14% in 2018. Moreover, senior management was 14.2% feminine in 2020. Micron commonly evaluations for inequities in pay on a worldwide degree, together with base pay and inventory awards. Whereas traditionally this evaluation has targeted on gender, Micron has expanded it to concentrate on all underrepresented teams, together with minorities, individuals with disabilities, and veterans.

There are challenges that come up when trying to foster range and inclusion as a worldwide firm. Lots of the range and inclusion insurance policies all through the tech business and past are very U.S.-centric; nonetheless, as talked about, 71% of Micron’s workforce is situated in Asia. Micron mentions this deficiency in its range report. Because the U.S. just isn’t the one a part of the world that offers with the problems of range and inclusion, it’s important that Micron and different firms work to make their insurance policies transcend the challenges of geopolitics. We spoke to Micron on this topic and have been assured that the difficulty can be relayed to the DEI crew. The corporate has made some current progress on this space, together with increasing its DEI crew in Asia, opening new worker useful resource group chapters around the globe, and establishing a Provider Variety program.

Regardless of its progress, Micron administrators not too long ago confronted a lawsuit introduced forth by one in every of its shareholders alleging that they breached their duties by publicly touting a dedication to range whereas failing to meaningfully improve it. The lawsuit claimed that the compensation of administrators, reminiscent of Micron’s CEO, was extreme partially as a result of it was tied to their dedication to range applications and initiatives, however that no significant change has occurred in Micron’s workforce range. The submitting of this case alerts that shareholders are placing firms beneath larger scrutiny in the case of ESG insurance policies, and board and workforce range points could proceed to be a supply of potential litigation.

Governance

Efficient administration of an organization’s mental property is an important element of excellent governance within the semiconductor business. The aggressive fringe of each semiconductor design and manufacturing is dependent upon the efficient administration of mental property. In accordance with the corporate’s 2020 10-Ok, Micron is the proprietor of 14,200 lively U.S. patents and 6,500 lively international patents. Micron has proactive IT measures in place to watch and establish suspicious exercise, and these efforts proved to be instrumental in a case relating to the suspected theft and misuse of Micron’s mental property. In 2018, the U.S. Justice Division indicted two firms primarily based in China and Taiwan for conspiring to steal commerce secrets and techniques from Micron. These makes an attempt to steal Micron’s confidential data exhibit the rising significance of the corporate’s mental property to the expertise business.

Whereas mental property safety is a crucial driver of innovation, it has the potential to limit competitors and promote anti-competitive habits. These dangers might engender regulatory scrutiny and authorized motion. Micron is the one U.S.-based producer of dynamic random-access reminiscence (DRAM) chips, and Korean firms Samsung and SK Hynix are its solely rivals in that house. In 2018, a lawsuit was filed towards the trio in U.S. District Courtroom in California, accusing the businesses of artificially limiting the provision of DRAM reminiscence chips to create a scarcity and lift costs. Related lawsuits have subsequently been filed in the identical court docket in addition to in Canadian courts, and an investigation has been opened in China. These lawsuits have the potential to trigger monetary loss for Micron by settlements, fines, and potential regulation. Whereas these occasions are solely a chunk of the complicated puzzle that makes up governance, we discover them to be essentially the most financially materials and related subjects for Micron’s business for the needs of this report.

Threat & Outlook

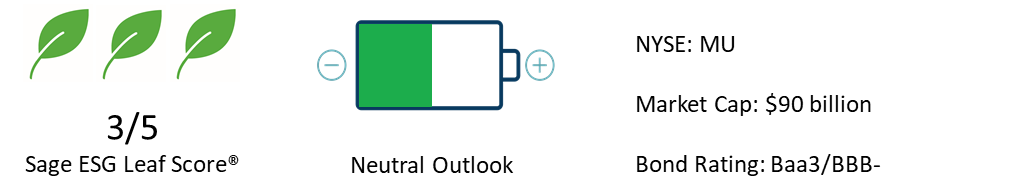

Semiconductors are the fundamental constructing blocks of recent expertise and are really a product of globalization. From the uncooked materials inputs to the manufacturing course of to the tip product, semiconductors cross borders, oceans, and fingers in each nation on the earth. Whereas some semiconductor firms have a extra concentrated provide chain because of specializing in both the R&D or the manufacturing of microchips, Micron does each. Consequently, ESG dangers have an effect on Micron from begin to end. The corporate’s manufacturing course of entails a laundry listing of environmental danger. Micron faces social points starting from defending human rights within the provide chain to range and inclusion and the nice administration of human capital. And eventually, the corporate should defend its mental property with out involving itself in anti-competitive habits — a problem for good governance. General, we imagine Micron is intentional with its dealing with of ESG dangers and infrequently goes a step past its business friends in its forward-thinking sustainability objectives; nonetheless, many are nonetheless simply that—objectives. We are going to proceed to watch Micron’s progress and thus give the corporate a Sage Leaf Rating of three/5.

Sage ESG Leaf Rating Methodology

No two firms are alike. That is exceptionally obvious from an ESG perspective, the place the problem lies not solely in assessing the variations between firms, but in addition within the variations throughout industries. Though an organization could also be a frontrunner amongst its peer group, the business during which it operates could expose it to dangers that can not be mitigated by firm administration. By combining an ESG macro business danger evaluation with a company-level sustainability analysis, the Sage Leaf Rating bridges this hole, enabling traders to rapidly assess firms throughout industries. Our Sage Leaf Rating, which relies on a 1 to five scale (with 5 leaves representing ESG leaders), makes it straightforward for traders to match an organization in, for instance, the vitality business to an organization within the expertise business, and to know that every one 5-leaf firms are leaders primarily based on their particular person firm administration and the extent of business danger that they face.

For extra data on Sage’s Leaf Rating, click on right here.

Sources

- Quick Ahead: 2021 Sustainability Report.

- Institutional Shareholder Companies (ISS) ESG Company Ranking Report for Micron Expertise, Inc.

- For All: 2020 Annual Report. Micron Variety, Equality, and Inclusion. 2020.

- Micron Expertise, Inc. Kind 10-Ok. September 2020.

- Shilov, Anton. Micron: Tawian Drought is Over, however Extra Issues Incoming. Tom’s {Hardware}. July 2021.

- Yoo-chul, Kim. Lawsuit filed towards Samsung, SK, in US. The Korea Occasions. Might 2021.

- Wince-Smith, Deborah. America’s Lack Of Chips Is Extra Than A Blip. June 2021.

- Blum, Andrew. From Vehicles to Toasters, America’s Semiconductor Scarcity Is Wreaking Havoc on Our Lives. Can We Repair It? June 2021.

- Ovide, Shira. Laptop Chips Are the New Bathroom Paper. The New York Occasions. Might 2021.

- Bloom, Sahil. The Wonderful Story of Morris Chang. The Curiosity Chronicle. January 2021.

- Godoy, Jody. Micron shareholder sues administrators over “phantom” range dedication. February 2021.

Disclosures

Sage Advisory Companies, Ltd. Co. is a registered funding adviser that gives funding administration companies for quite a lot of establishments and excessive internet value people. The information included on this report represent Sage’s opinions as of the date of this report and are topic to vary with out discover because of varied elements, reminiscent of market circumstances. This report is for informational functions solely and isn’t meant as funding recommendation or a proposal or solicitation with respect to the acquisition or sale of any safety, technique or funding product. Traders ought to make their very own selections on funding methods primarily based on their particular funding targets and monetary circumstances. All investments comprise danger and will lose worth. Previous efficiency just isn’t a assure of future outcomes. Sustainable investing limits the kinds and variety of funding alternatives obtainable, this may increasingly consequence within the Fund investing in securities or business sectors that underperform the market as an entire or underperform different methods screened for sustainable investing requirements. No a part of this Materials could also be produced in any type, or referred to in another publication, with out our specific written permission. For added data on Sage and its funding administration companies, please view our website online at www.sageadvisory.com, or consult with our Kind ADV, which is offered upon request by calling 512.327.5530.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com