By Emiliano Rabinovich, Senior Portfolio Supervisor, CFA, State Road World Advisors

By Emiliano Rabinovich, Senior Portfolio Supervisor, CFA, State Road World Advisors

All over the world, Environmental, Social and Governance (ESG) investing has seen speedy progress over latest years. Within the US, nevertheless, demand from institutional traders for ESG or climate-integrated funding methods has lagged that of its European and Asian counterparts – however it’s rising rapidly. US ESG fund flows reached $10.Four billion for within the second quarter of 2020, which on a year-to-date foundation practically matched the full-year 2019 sustainable fund web flows of $21.Four billion.1

The US Division of Labor’s lately proposed rule, entitled Monetary Elements in Deciding on Plan Investments, sought to make clear obligations associated to the consideration of ESG components by fiduciaries answerable for retirement plans. As traders proceed to guage these obligations, this text gives a framework for assessing ESG efficiency because it tracks the returns of 4 outstanding US ESG index methods versus the benchmark – utilizing the intense market volatility brought on by the COVID-19 pandemic as a singular take a look at of the methods’ efficiency.

Efficiency of 4 Fairness ESG Indices

ESG can play a key function in figuring out potential enterprise and monetary dangers, which in flip, can influence an organization’s share value. There’s additionally robust empirical proof that ESG issues have contributed to long-term sustainable returns.2

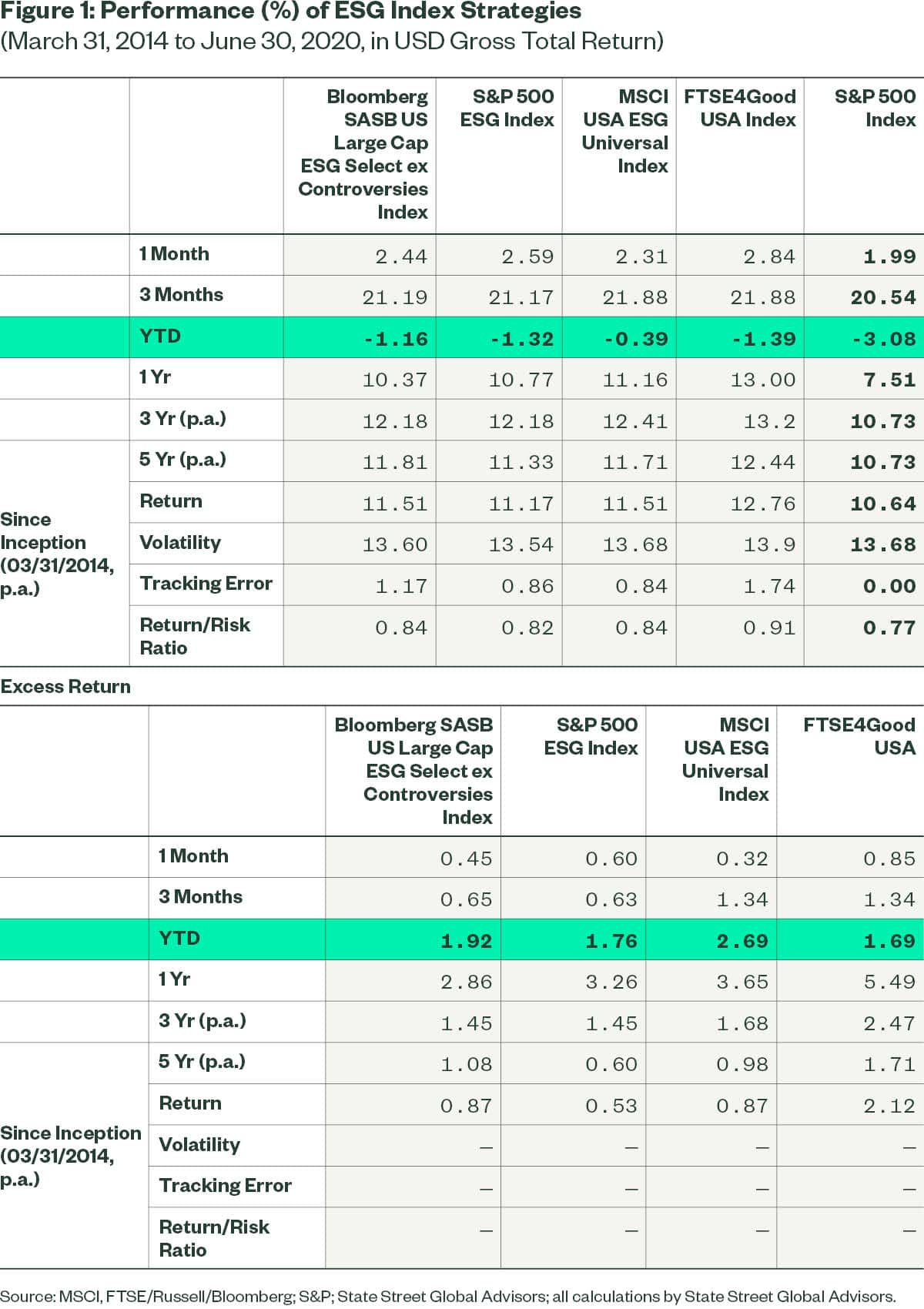

Over the primary half of 2020, ESG built-in index methods have been a supply of added worth vis-à-vis the broad market, as measured by the S&P 500 Index. We decided this by analyzing the efficiency of 4 US fairness ESG indices, created by 4 completely different index suppliers (so as to take away any building bias). As summarized in Determine 1, the 4 ESG index methods offered constant outperformance relative to the market cap index, year-to-date, for 1 12 months, Three years, 5 years and since inception of the Bloomberg SASB US Giant Cap Choose index (in March 2014).3

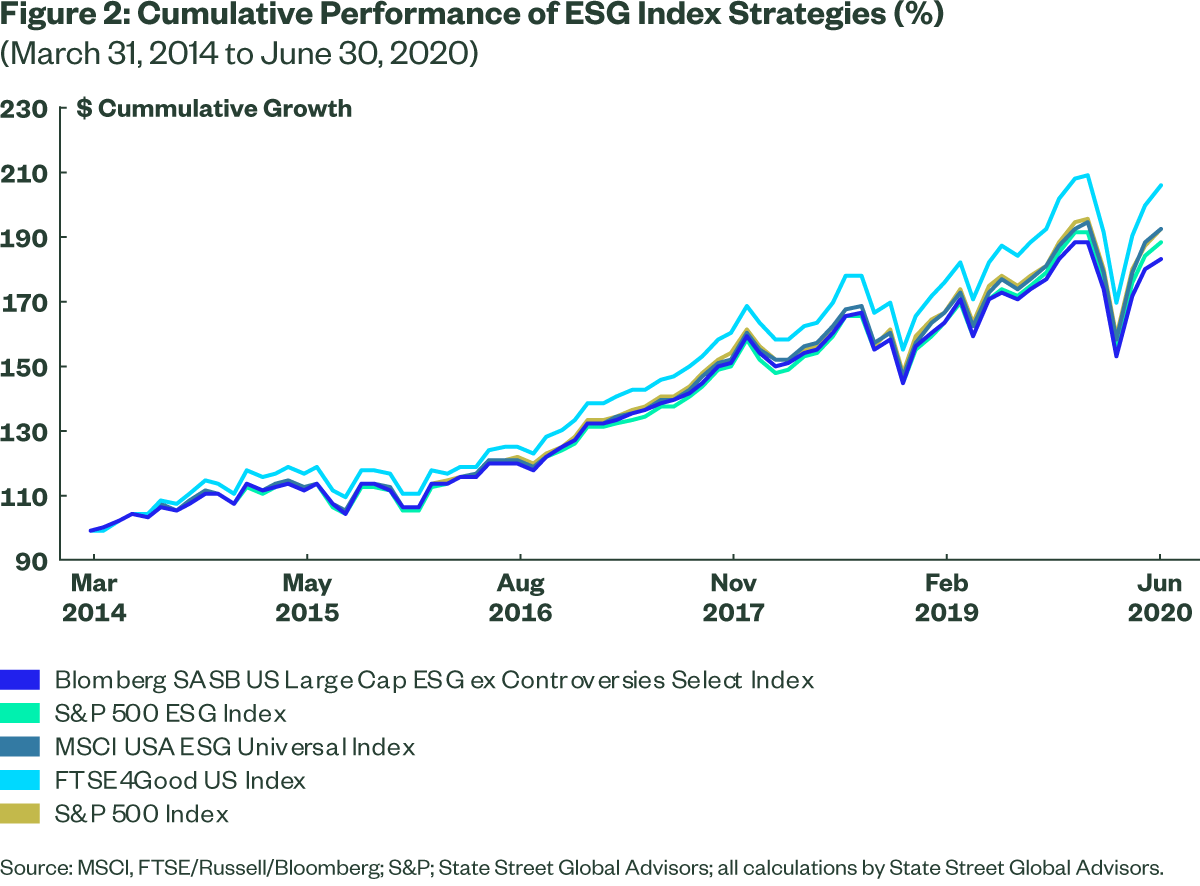

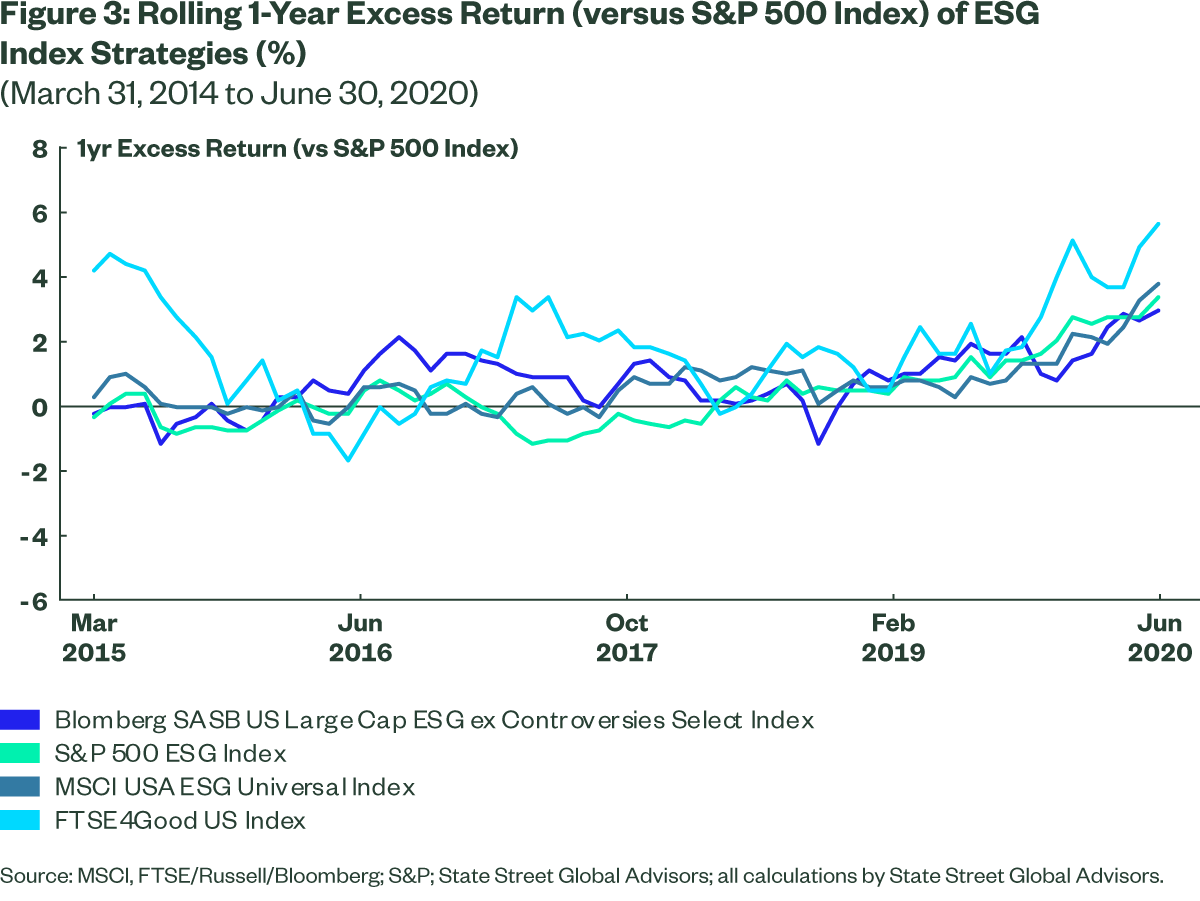

Whereas many ESG indices symbolize a departure from the normal market-capitalization weighting scheme, they’re usually designed to replicate broad threat and return traits whereas concentrating on an improved ESG profile. This “index-awareness” is demonstrated within the efficiency journeys displayed in Determine 2, and Determine Three gives the rolling 1-year extra return of those methods versus the S&P 500. Regardless of some divergent return patterns close to the start of 2020, all 4 ESG indices demonstrated incremental will increase in extra return over the primary half of 2020.

Portfolio building explains a number of the efficiency variations amongst ESG index methods proven in Determine 3. For instance, the FTSE4Good index takes on extra lively threat relative to the opposite index methods, suggesting that it ought to outperform different ESG methods throughout time intervals when, collectively, ESG does properly. Notice that this stage of lively threat will not be acceptable for all traders. The Appendix summarizes the portfolio building approaches taken by the 4 ESG index methods.

Though the magnitude of the outperformance varies among the many completely different ESG index suppliers, it’s vital to notice that every has overwhelmed the benchmark over time and has achieved so persistently, no matter ESG methodology or ESG knowledge supplier. And whereas previous efficiency is just not an indicator of future outcomes, we imagine that the efficiency demonstrated by US ESG Indices since their inception is worthy of consideration.

Drivers of ESG Outperformance

So what are the drivers of the year-to-date outperformance of the 4 US ESG indices, and are they the identical throughout the completely different permutations of ESG index methods? To know efficiency drivers over the primary half of 2020, we decomposed lively returns and recognized three frequent themes.

Sectors

We carried out a sector attribution for the ESG indices relative to the S&P 500 Index, for one 12 months as of June 30, 2020. For all 4 of the indices, Data Expertise was the sector that contributed most to outperformance. Relying on the precise index building strategy, Industrials, Financials and Client Discretionary all contributed to outperformance. Apparently, the Power sector underweight that may be a frequent theme in ESG index methods was not discovered to be a big driver of added worth.

Elements

All 4 indices additionally present modest lively type issue publicity relative to the S&P 500. We see constructive publicity to momentum (given the robust efficiency these indices exhibited) and profitability (often related to high-quality shares). On the identical time, we see destructive publicity to worth and leverage (once more related to high-quality shares). Given the restricted historical past of strong ESG knowledge (versus conventional type issue premia), we didn’t anticipate to see a constant relationship between the ESG profile and anyone explicit type issue. Moderately, sources of lively threat and return could also be attributable to idiosyncratic options of a supplier’s ESG sign.

ESG Sign

We examined the ESG index publicity and attribution by way of the lens of State Road’s R-Issue™ an modern, clear ESG scoring mechanism that measures the efficiency of an organization’s enterprise operations and governance because it pertains to financially materials ESG points going through that firm’s industries. R-Issue™ facilitates an goal evaluation of the ESG tilts embedded in every of those indices. Notice, nevertheless, that whereas we imagine that firms with larger R-Issue scores are usually managing their ESG dangers higher, and that the proactive administration of ESG dangers is a marker of firm efficiency, this in fact doesn’t at all times end in higher inventory efficiency.

All indices display an improved ESG profile vis-à-vis the S&P 500 index, as measured by R-Issue™. Along with incorporating an ESG tilt, index building performs an vital function in holdings and due to this fact efficiency. For instance, the MSCI USA ESG Common Index presents a really low R-Issue™ enchancment over the S&P 500 Index, however that is probably as a result of index methodology that prioritizes diversification by way of a lot of securities with solely a minimal ESG tilt. Traders in search of indices that present larger publicity to ESG ought to be aware these key building variations.

And, whereas all indices reported a constructive chubby to R-Issue™, the best scoring ESG shares (i.e., first quintile) made by far the most important contributions to lively returns, leading to a constructive allocation impact all ESG indices. See Determine 4. This reinforces our perspective that an improved ESG profile was a possible supply of worth add over the previous 12 months.

Abstract

ESG index efficiency within the US has skilled robust, constant efficiency in recent times, together with through the COVID-19-related market volatility. Whereas the US regulatory surroundings stays unsure for now, ESG investing is reaching grassroots help from numerous private and non-private traders throughout the nation. As stewards of capital, State Road believes traders ought to think about a spread of threat and alternatives that would influence funding returns, and these embody materials ESG components alongside the normal monetary components. And whereas there’s nonetheless extra work to do in standardizing ESG metrics, methodologies, and reporting, we hope these arguments elevate the funding neighborhood’s conviction that financially materials ESG issues are key drivers of long-term sustainable efficiency.

APPENDIX

ESG Index Portfolio Development Comparability

| Bloomberg SASB US Giant Cap ESG ex Controversies Choose Index | S&P 500 ESG Index | MSCI ESG Common Index | FTSE4Good World Index | |

| Index Supplier | Bloomberg | S&P Dow Jones Indices | MSCI | FTSE Russell |

| ESG Rating Supplier | SSGA (R-Issue™ ESG Rating) | S&P DJI ESG Rating | MSCI ESG Analysis | FTSE ESG Rankings |

| ESG Exclusion Classes | Controversial Weapons, Extreme ESG Controversies, Tobacco, Civilian Firearms, UNGC Violators, Thermal Coal | Controversial Weapons, Thermal Coal, Tobacco, UNGC Violators, Weakest ESG scores,

Reputational Danger |

Controversial Weapons, Extreme ESG Controversies, Weakest ESG scores

|

Controversial Weapons, Controversies, Tobacco, Coal, Funding Trusts

|

| Index Development Strategy

(Choice/Weighting) |

Optimization | As much as 65% (of the float adjusted market-cap universe), ranked greatest to worst on ESG rating and market cap weighted. | All shares in eligible universe, weighted by the product of the market cap weight * mixed ESG rating. | Minimal ESG score required (above 3.3) and market cap weighted

|

| Sector/Inventory Constraints | Sector/Inventory Lively: +/-1.0% | n/a | Max 5% inventory weight | n/a |

| Variety of Names* | 180 | 310 | 598 | 270 |

| Predicted Monitoring Error* | 1.42% | 1.91% | 1.35% | 2.77% |

1 Morningstar, as of 30 June 2020.

2 Serafeim, Khan et al. “Company Efficiency: First Proof of Materiality.” HBR 2017

3 The earliest frequent inception date throughout all 4 indices

4 State Road’s Duty Issue, or R-Issue™, depends on three key ideas: 1) A number of ESG knowledge sources; 2) Clear materiality framework outlined by the Sustainable Accounting Requirements Board (SASB); 3) Governance scoring influenced by State Road’s asset stewardship group.

5 You will need to spotlight that the Bloomberg SASB Giant Cap Choose ex Controversies Index makes use of R-Issue™ in its building course of, and due to this fact tends to point out larger publicity to this metric, relative to the opposite indices.

Initially printed by State Road World Advisors, 10/8/20

Disclosures

Advertising and marketing Communication

The entire or any a part of this work will not be reproduced, copied or transmitted or any of its contents disclosed to 3rd events with out SSGA’s specific written consent. The returns on a portfolio of securities which exclude firms that don’t meet the portfolio’s specified ESG standards might path the returns on a portfolio of securities which embody such firms. A portfolio’s ESG standards might consequence within the portfolio investing in trade sectors or securities which underperform the market as a complete. Accountable-Issue (R Issue) scoring is designed by State Road to replicate sure ESG traits and doesn’t symbolize funding efficiency. Outcomes generated out of the scoring mannequin relies on sustainability and company governance dimensions of a scored entity. The data offered doesn’t represent funding recommendation and it shouldn’t be relied on as such. It shouldn’t be thought-about a solicitation to purchase or a suggestion to promote a safety. It doesn’t have in mind any investor’s explicit funding targets, methods, tax standing or funding horizon. It is best to seek the advice of your tax and monetary advisor. All info is from SSGA until in any other case famous and has been obtained from sources believed to be dependable, however its accuracy is just not assured. There isn’t any illustration or guarantee as to the present accuracy, reliability or completeness of, nor legal responsibility for, selections based mostly on such info and it shouldn’t be relied on as such. The views expressed on this materials are the views of the ESG Analysis group by way of the interval ended August 31, 2020, and are topic to alter based mostly on market and different situations. This doc accommodates sure statements that could be deemed forward-looking statements. Please be aware that any such statements will not be ensures of any future efficiency and precise outcomes or developments might differ materially from these projected. Investing includes threat together with the chance of lack of principal. The data contained on this communication is just not a analysis advice or ‘funding analysis’ and is assessed as a ‘Advertising and marketing Communication’ in accordance with the Markets in Monetary Devices Directive (2014/65/EU) or relevant Swiss regulation. Which means that this advertising and marketing communication (a) has not been ready in accordance with authorized necessities designed to advertise the independence of funding analysis (b) is just not topic to any prohibition on dealing forward of the dissemination of funding analysis.

© 2020 State Road Company.

All Rights Reserved

3275487.1.1.GBL.RTL

Exp. Date: 10/31/2021

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.