After the U.S. Division of Labor set its sights on environmental, social, and governance, or ESG, i

After the U.S. Division of Labor set its sights on environmental, social, and governance, or ESG, investments in America’s non-public sector retirement plans, monetary business consultants have tried to focus on the significance of ESG elements as a supply of worth for traders firstly.

“The selection to both intentionally ignore the materiality of ESG elements and disrespect them as a supply of efficiency, or to anticipate to have the power to show their monetary efficacy past any doubt, is inconsistent with the pure pursuit of excellence in investing. Asset managers, as fiduciaries, should proceed to have a broad lens when making funding choices. Judgments on ESG elements are rooted within the hunt for worth, not values, with the perfect curiosity of the investor paramount,” Rick Lacaille, World Chief Funding Officer, State Avenue World Advisors, London, mentioned in a Wall Avenue Journal article.

“Let {the marketplace} decide the worth of analysis and outcomes arising in asset administration. The diploma of scrutiny from traders and their brokers and the excessive degree of transparency afforded to traders will proceed to drive a wholesome and aggressive market,” he added.

Lacaille identified that there’s enough proof from quite a few and diversified research linking ESG elements like provide chain resilience or safety of firm information with long term company and funding efficiency to conclude that these are worthy of consideration.

As a manner to assist traders faucet into these alternatives, State Avenue World Advisors provides a set of socially accountable and ESG-related ETFs. For instance, the lately launched SPDR S&P 500 ESG ETF (EFIV) enhances each SPDR’s ESG and S&P 500 ETF choices, serving to traders incorporate ESG whereas reaching a threat and return profile similar to the S&P 500. The ETF tracks the S&P 500 ESG Index, which is designed to measure the efficiency of securities assembly sure sustainability standards (i.e. standards associated to environmental, social, and governance elements) whereas sustaining an identical general business group weight because the S&P 500 Index.

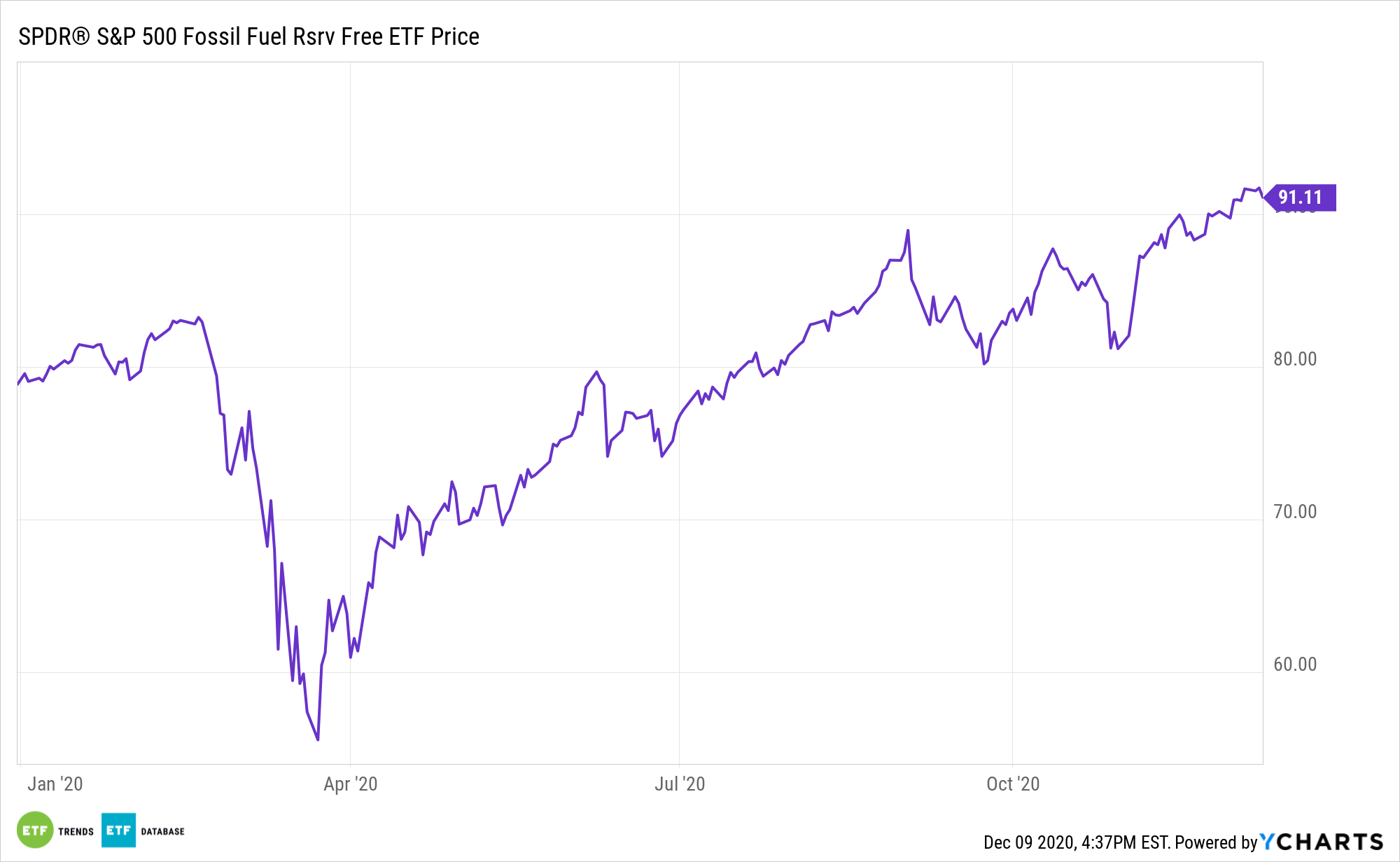

State Avenue World Advisors’ SPDR S&P 500 Fossil Gas Free ETF (SPYX) tries to permit local weather change-conscious traders to align the core of their funding technique with their values by eliminating firms that personal fossil gas reserves from the S&P 500.

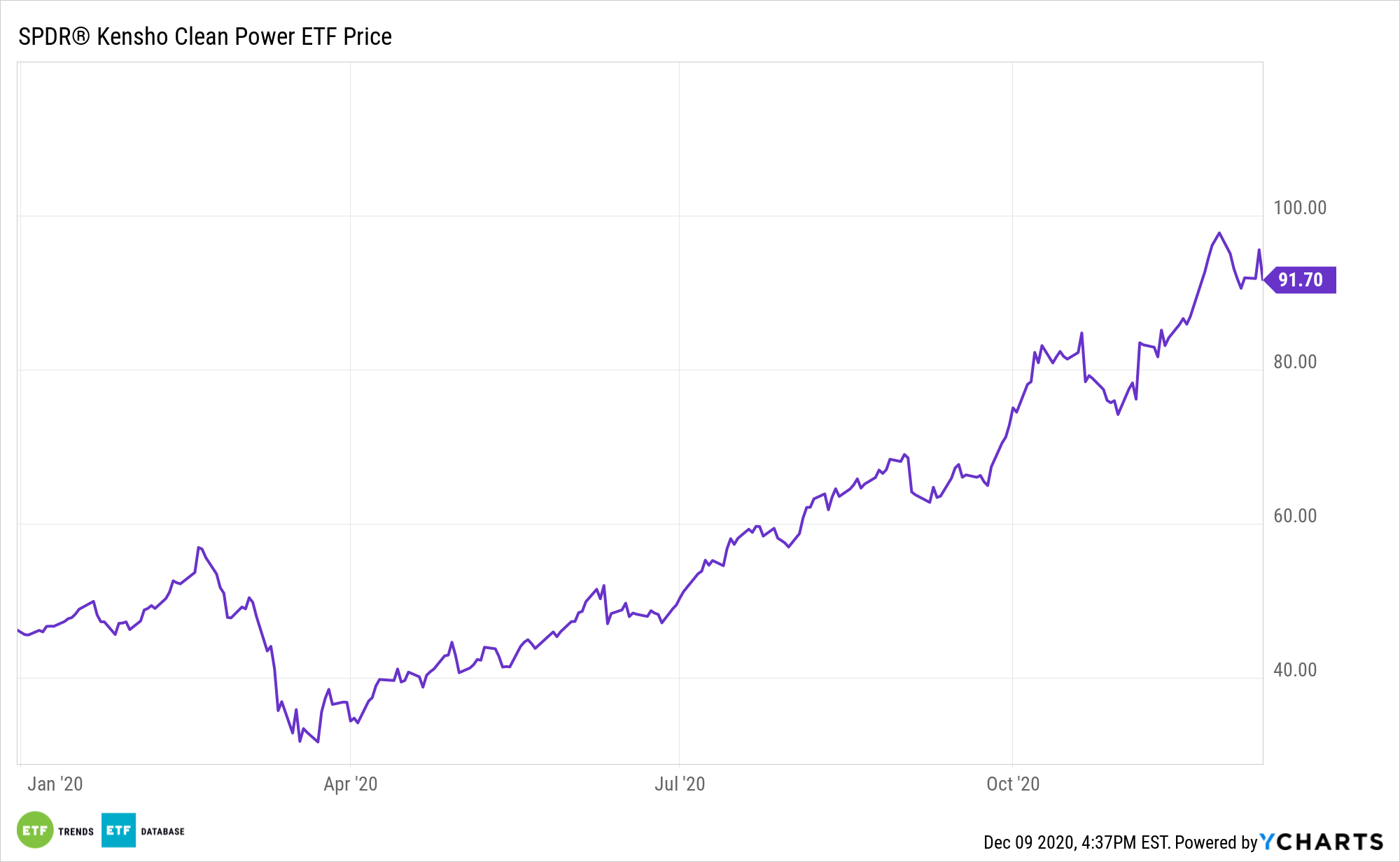

The SPDR Kensho Clear Energy ETF (CNRG) seeks to offer publicity to the clear energy business when it comes to each technology and underlying expertise. Various vitality sources are an more and more essential a part of the facility technology dialog.

Lastly, the SPDR MSCI ACWI Low Carbon Goal ETF (NYSEArca: LOWC) targets the MSCI ACWI Low Carbon Goal Index, which tries to handle carbon publicity by overweighting firms with low carbon emissions relative to gross sales and per greenback of market capitalization, as in comparison with the broader market. LOWC was created for the U.N. Joint Workers Pension Fund.

For extra information, data, and technique, go to the ESG Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.