The Biden Administration, contemporary off the $1.9

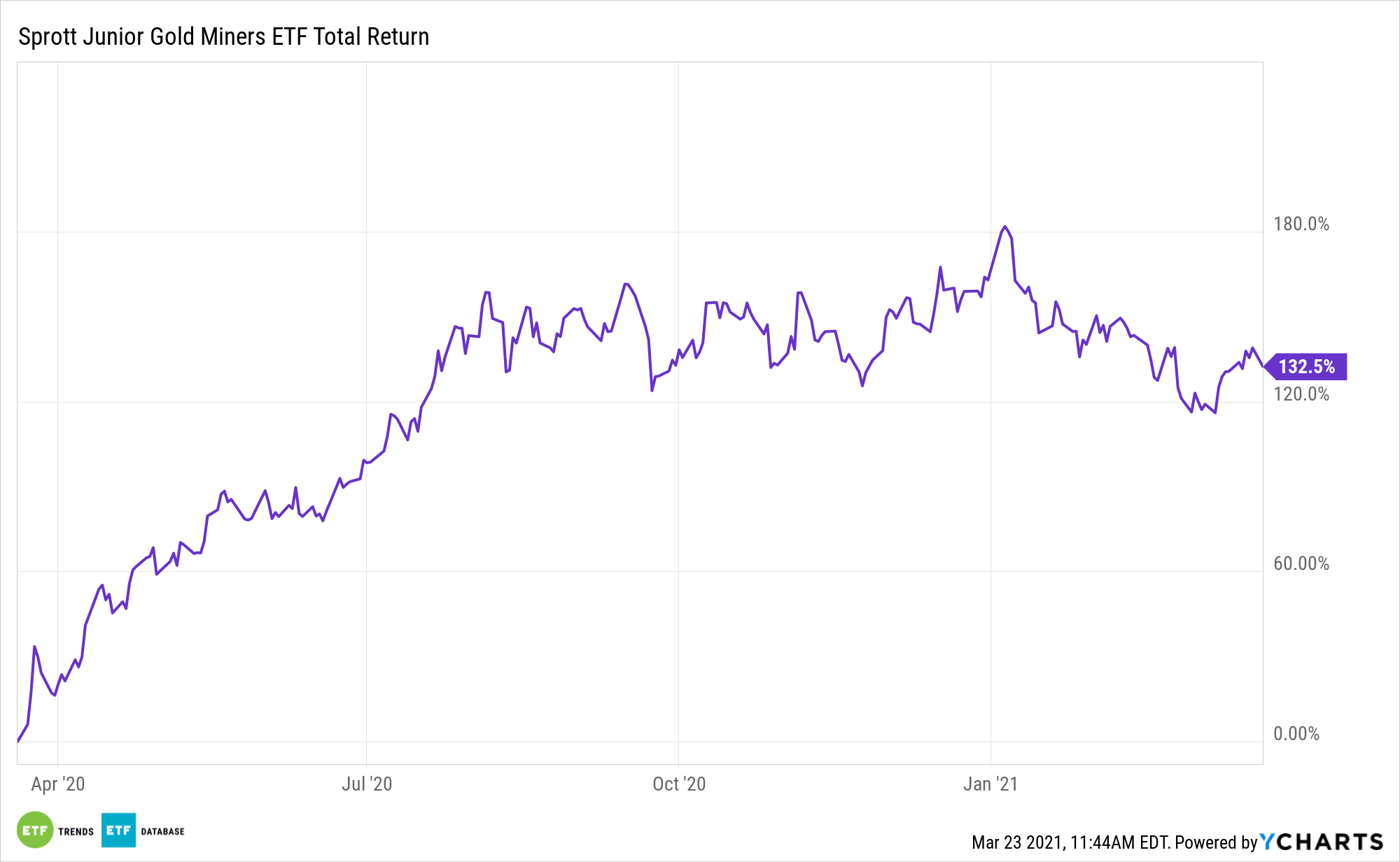

The Biden Administration, contemporary off the $1.9 trillion stimulus invoice, is already eyeing one other $three trillion bundle. All that authorities spending might stoke inflation, placing mining belongings such because the Sprott Junior Gold Miners ETF (NYSEArca: SGDJ) in focus.

SGDJ tracks small cap gold miners, however weighs its elements primarily based on income development and value momentum. The ETF focuses on value momentum, which helps determine main junior gold miners pushed by components like new discovery, mine improvement, or joint ventures.

“The factor-based Index methodology seeks to emphasise firms with the strongest relative income development and value momentum, two components that traditionally have been robust predictors of long-term inventory efficiency for junior gold miners,” based on Sprott.

“The latest $1.9 trillion stimulus invoice will add to the wave of unprecedented cash printing that now we have seen in the US,” based on In search of Alpha. “This might very simply result in inflation as soon as the economic system reopens and other people start spending their cash.”

Gold and Inflation

The small cap SGDJ makes use of a momentum-based technique that “emphasizes small- to mid-sized gold producers with the best income development and exploration firms with the strongest inventory value momentum,” based on the issuer.

“President Biden is at present planning one other large infrastructure invoice with a price ticket of between $2 trillion and $four trillion. Whereas Bloomberg studies that at the least a few of this spending will likely be financed by tax hikes, the reality stays that at the least a few of this spending will nearly definitely develop the nationwide debt and lead to a major quantity of newly-printed cash sloshing via the economic system,” provides In search of Alpha.

The present inflation outlook bodes nicely for SGDJ upside.

“One of many largest the reason why each investor ought to maintain a place in gold is due to the safety that it gives towards inflation. Economists typically outline inflation as a basic rise in costs in an economic system but it surely’s triggered when the cash provide grows sooner than the manufacturing of products and companies within the economic system,” concludes In search of Alpha.

For extra information, data, and technique, go to the Gold & Silver Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.