Our work means that U.S. financial prospects proceed to brighten. Greater long-term

Our work means that U.S. financial prospects proceed to brighten. Greater long-term rates of interest presently mirror market expectations for quicker financial progress and considerably larger inflation. We anticipate the pattern in the direction of larger rates of interest to proceed in matches and begins. As the next graph illustrates, long-term rates of interest are inclined to rise considerably greater than short-term rates of interest in the course of the preliminary levels of an financial restoration, which is called yield curve steepening and is a really optimistic sign. That is very true relative to the yield curve inversion we witnessed nearly two years in the past when long-term rates of interest dipped under short-term charges. Nonetheless, with every successive enterprise cycle during the last 40 years, the height in long-term rates of interest has been under the height of the earlier cycle. We consider that this pattern is because of basic elements, comparable to an getting older inhabitants, that stay in impact. This phenomenon ought to restrict how excessive long-term rates of interest will ultimately go.

[wce_code id=192]

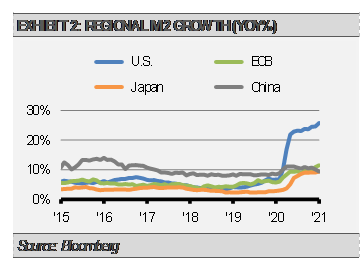

Likewise, liquidity progress, particularly within the U.S., signifies a optimistic backdrop for financial progress. For an economic system to develop, there have to be sufficient liquidity progress within the economic system to facilitate lending and transactions. Because the graph under illustrates, liquidity progress within the U.S. as measured by M2, which incorporates money, checking deposits, and short-term time deposits comparable to CDs, has grown rather more shortly over the previous yr than in different main economies.

Moreover, enhancements in U.S. main financial indicators counsel extra progress forward. Certainly one of our stronger main financial indicators is the mix of vehicle manufacturing and residential funding as a share of financial exercise. As the next graph illustrates, this indicator has not solely turned solidly optimistic however nonetheless has a protracted option to go to match earlier cycles. Importantly, that is all earlier than any extra stimulus is factored into the equation.

We now have elevated our forecast for U.S. GDP progress and anticipate larger rates of interest because of these elements. Although we anticipate bouts of market volatility, the underlying traits ought to stay optimistic. Subsequently, we’ve positioned our Methods for continued larger long-term rates of interest with the expectation that cyclical fairness sectors will outperform the broad market and any fairness market declines are seemingly shopping for alternatives.

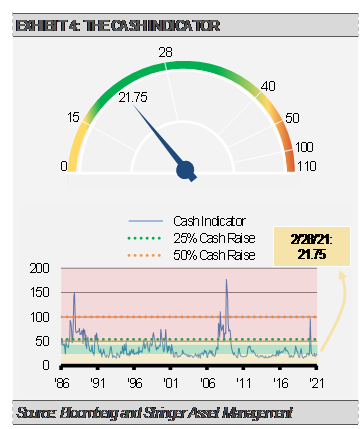

The Solid Indicator

The Money Indicator (CI) has been helpful for serving to us choose potential volatility. The CI degree stays constructive and displays that markets are working in regular ranges of volatility and correlation.

DISCLOSURES

Any forecasts, figures, opinions or funding strategies and methods defined are Stringer Asset Administration, LLC’s as of the date of publication. They’re thought of to be correct on the time of writing, however no guarantee of accuracy is given and no legal responsibility in respect to error or omission is accepted. They’re topic to vary with out reference or notification. The views contained herein are to not be taken as recommendation or a suggestion to purchase or promote any funding and the fabric shouldn’t be relied upon as containing adequate info to assist an funding determination. It ought to be famous that the worth of investments and the revenue from them might fluctuate in accordance with market situations and taxation agreements and buyers might not get again the total quantity invested.

Previous efficiency and yield will not be a dependable information to future efficiency. Present efficiency could also be larger or decrease than the efficiency quoted.

The securities recognized and described might not signify the entire securities bought, bought or beneficial for consumer accounts. The reader shouldn’t assume that an funding within the securities recognized was or shall be worthwhile.

Knowledge is supplied by numerous sources and ready by Stringer Asset Administration, LLC and has not been verified or audited by an impartial accountant.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.