By Kevin Flanagan, Head of Mounted Earnings Techniq

By Kevin Flanagan, Head of Mounted Earnings Technique

A Federal Reserve (Fed) assembly on St. Patrick’s Day—for a bond man like me, there’s nothing prefer it. In honor of those two occasions coinciding this 12 months, and given what has just lately been transpiring within the U.S. Treasury market (UST), an Irish saying involves thoughts: In case you purchase what you don’t want, you might need to promote what you do.

This 12 months’s rise within the UST 10-year yield has created hypothesis that the timing of the Fed’s first charge hike may get pushed up, whereas additionally heightening dialogue about when any stability sheet tapering speak would possibly happen. Based mostly on current feedback from Powell & Co., and naturally right now’s FOMC assembly, the Fed seems to be in no hurry for a liftoff, i.e., elevating the Fed Funds goal vary over the following 12 months or two.

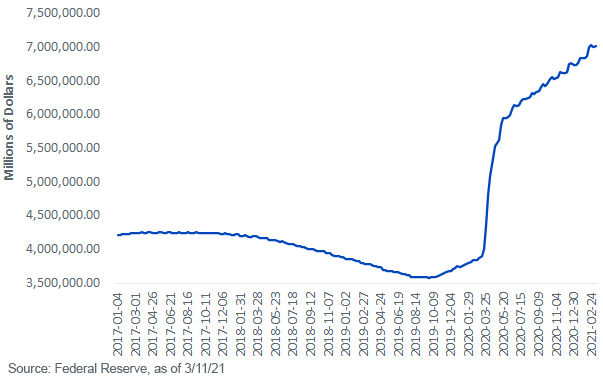

Fed Holdings of Treasuries, Company Debt & MBS

Towards this backdrop, it seems the extra possible Fed coverage headlines for this 12 months will focus on its stability sheet. However earlier than any doable taper speak, the UST market has been ready to see if the coverage makers will make any shifts within the composition of their purchases. On this entrance, Chair Powell has been making an attempt to string the needle between what is taken into account ‘regular’ charge actions given the improved financial outlook and one thing that “was notable and caught my eye.”

At this level, the Fed appears to be downplaying the notion of a disorderly transfer increased within the UST 10-Yr yield and as a substitute focusing extra on protecting financial coverage proper the place it’s, particularly, extremely accommodative. Thus, the maturity composition of the Fed’s Treasury purchases, for now, has not been altered.

When it comes to the Fed’s stability sheet, the coverage makers’ holdings of Treasuries, mortgage-backed securities (MBS) and companies have now topped $7 trillion. The accompanying graph reveals a little bit of a sawtooth sample since spring of final 12 months, however the unmistakable development is one in every of increased totals. In reality, since March 2020, the Fed’s System Open Market Account (SOMA) has risen by over $3.1 trillion, with just a little below $300 billion occurring year-to-date.

Conclusion

What usually will get ignored by traders is that although the Fed is shopping for Treasuries at a somewhat aggressive clip, charges can nonetheless rise, particularly within the intermediate to longer length areas. This doable improvement is essential to bear in mind when positioning your fastened earnings portfolio.

Except in any other case acknowledged, information supply is Federal Reserve, as of three/11/21.

Initially revealed by WisdomTree, 3/17/19

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which incorporates funding targets, dangers, fees, bills, and different info; learn and think about rigorously earlier than investing.

There are dangers concerned with investing, together with doable lack of principal. Overseas investing entails foreign money, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller corporations could expertise higher worth volatility. Investments in rising markets, foreign money, fastened earnings and various investments embody further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency just isn’t indicative of future outcomes. This materials incorporates the opinions of the creator, that are topic to alter, and may to not be thought of or interpreted as a suggestion to take part in any explicit buying and selling technique, or deemed to be a proposal or sale of any funding product and it shouldn’t be relied on as such. There isn’t any assure that any methods mentioned will work below all market circumstances. This materials represents an evaluation of the market setting at a particular time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety specifically. The consumer of this info assumes the whole threat of any use fabricated from the data supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Buyers in search of tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially signify the views of WisdomTree or any of its associates.

The MSCI info could solely be used in your inside use, will not be reproduced or re-disseminated in any type and will not be used as a foundation for or element of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a suggestion to make (or chorus from making) any form of funding resolution and will not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the consumer of this info assumes the whole threat of any use fabricated from this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Celebration have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss earnings) or every other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can’t make investments immediately in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.