Due to rising oil costs and a deal with renewable s

Due to rising oil costs and a deal with renewable sources, the power sector has been on an uptrend after a pandemic-ridden 12 months. ETF buyers trying past broad-based commodity performs can provide the iShares MSCI World Vitality Producers ETF (FILL) a glance.

FILL seeks to trace the funding outcomes of the MSCI ACWI Choose Vitality Producers Investable Market Index (IMI). The fund usually will make investments not less than 90% of its property within the part securities of the underlying index and in investments which have financial traits which might be considerably equivalent to the part securities of the underlying index.

The index measures the mixed efficiency of fairness securities of firms in each developed and rising markets which might be primarily engaged within the enterprise of power exploration and manufacturing. At a 0.39% expense ratio, FILL is under its class common.

Total, FILL offers buyers publicity to:

- Publicity to firms that have interaction within the exploration and manufacturing of oil and fuel, or within the manufacturing and mining of coal and different fuels.

- Focused entry to international power producer shares.

- Use to diversify your portfolio and to precise a world sector view.

- Sturdy efficiency, with the fund up about 61% over the past 12 months.

A Diversified Sector Play

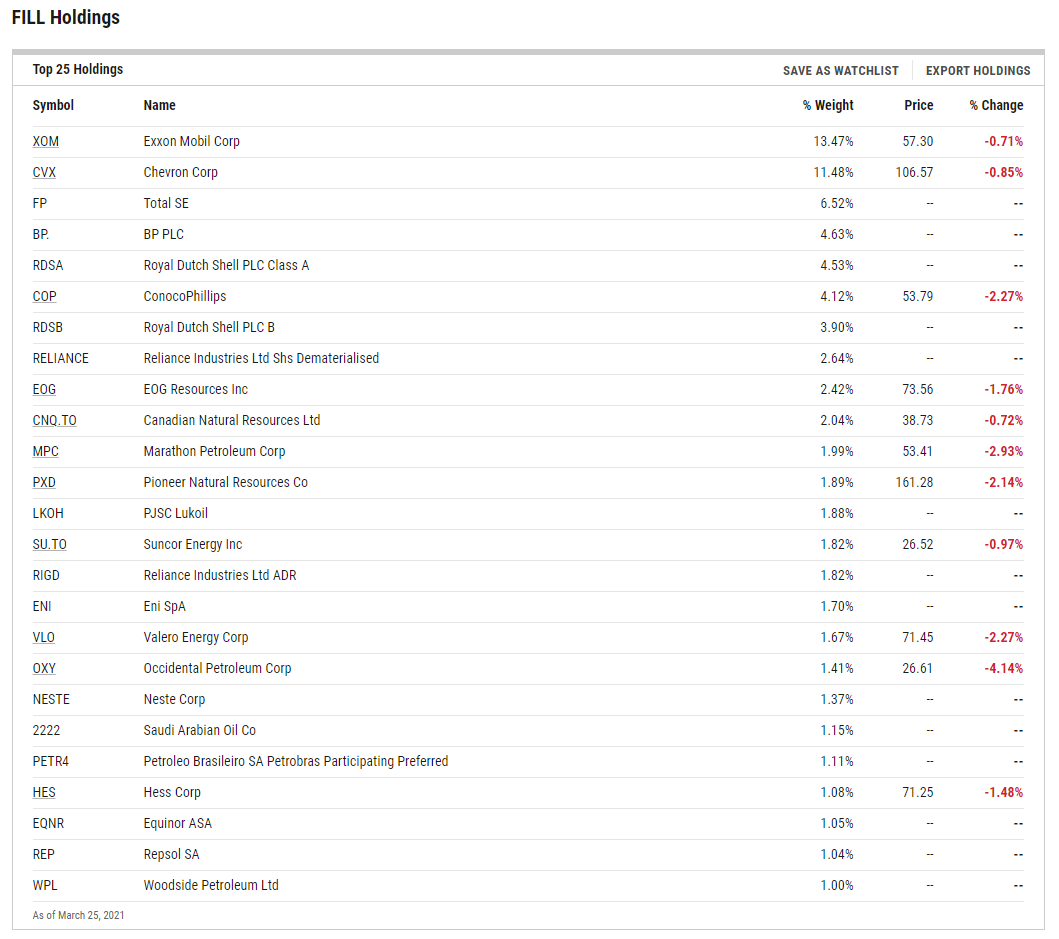

Wanting underneath the hood of FILL, acquainted names embody Exxon Mobil Corp and Chevron. These two make up nearly all of the fund’s asset allocation at about 25%, whereas the remaining comprise equities from different international locations.

ETF buyers get a diversified play in each different international locations and the power sector itself.

“This ETF gives publicity to the worldwide power sector by means of a various portfolio of home and worldwide equities, with publicity spreading throughout each developed and rising markets,” an ETF Database evaluation mentioned. “Not surprisingly, FILL has a heavy tilt in the direction of mega cap shares, as this ETF consists of quite a few the world’s largest oil firms.”

“Moreover, the worldwide label on this ETF could also be a bit deceptive seeing as how rising market firms account for less than a minimal fraction of whole property,” the evaluation mentioned additional. “Roughly half of the underlying portfolio is invested in U.S. power shares, which makes this fund much less of a real broad-based play on the worldwide power sector than some may anticipate. However, FILL options by far essentially the most various portfolio of holdings amongst broad power ETFs.”

For extra information and data, go to the Fairness ETF Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.