Weak greenback or sturdy greenback, all of it provides to the volatility of gold, and this week specifically may show to be a bumpy trip with an outpouring of financial information forward.

To begin the week’s buying and selling session, the greenback determined to take a again seat whereas gold inched greater.

“After a sluggish begin to the day, to not neglect downbeat weekly opening, gold regains upside momentum because the US Greenback Index (DXY) fails to increase the day past’s rebound from a two-week low, down 0.07% intraday round 92.64 on the newest,” a FX Avenue report stated. “Along with the buck weak point, cautious optimism within the markets and mildly bid S&P 500 Futures, to not neglect a three-day downtrend of the US 10-year Treasury yields, additionally favor gold consumers of late.”

COVID-19 continues to be a key mover for the markets, so buyers are watching the variety of instances for indicators of dwindling. The FX Avenue article talked about that Southeast Asia is beginning to see the variety of instances ease.

Up forward, there’s the nonfarm payrolls information, which is able to give an concept on how the roles market is coping with the Delta variant of COVID-19. A drop in payrolls may sign a extra cautious jobs market that might stagnate the restoration and push gold costs greater.

The Federal Reserve will definitely be watching this information carefully because it ponders its stimulus tapering. Recent off his Jackson Gap speech, Federal Reserve chairman Jerome Powell warned that an “ill-timed coverage transfer” may damage the restoration.

“With (Federal Reserve) Chair Powell taking a much less cavalier perspective to taper than a few of his FOMC colleagues, we search for the USD to commerce with a softer tone into the upcoming payrolls report which we count on will disappoint consensus,” analysts at TD Securities stated. ”That stated, dips within the greenback must be shallow and well-marked; within the DXY, we predict the post-June Fed ‘vary’ lows close to 91.50/00 must be stable assist.”

Like Gold, however Not Volatility?

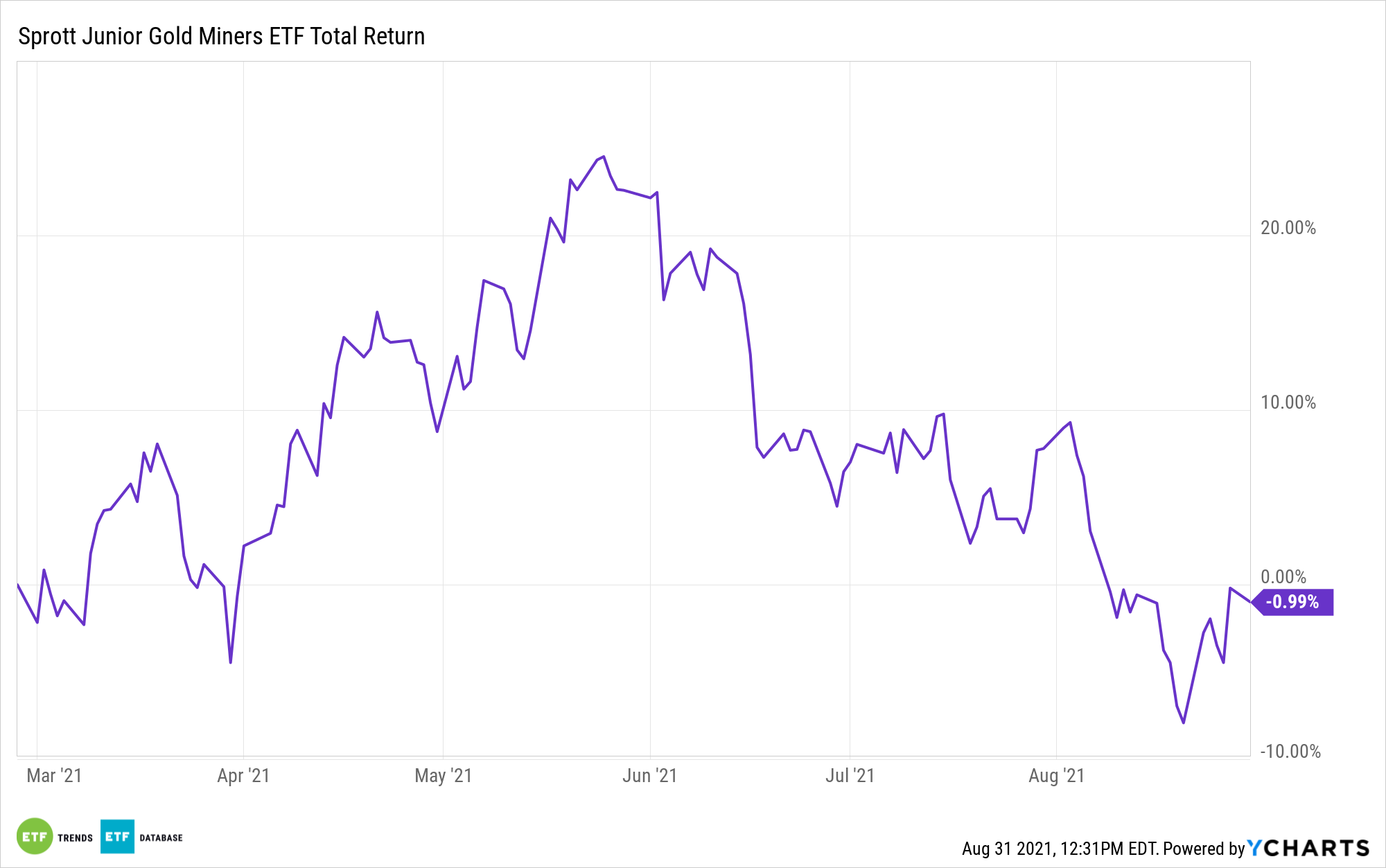

With volatility seemingly forward, would-be gold buyers may take a distinct route. A method is with miners through ETFs just like the Sprott Junior Gold Miners ETF (SGDJ) — SGDJ tracks small-cap gold mining corporations, specializing in small corporations with sturdy income development and value momentum, two components which have traditionally predicted long-term inventory efficiency.

The portfolio, which holds roughly 30 to 40 shares at any given time, tracks the Solactive Junior Gold Miners Customized Elements Index. It’s rebalanced semi-annually, guaranteeing that it reacts to grab alternatives in a well timed vogue and retains its holdings optimized.

For extra information, info, and technique, go to the Gold & Silver Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com