We've simply completed a tumultuous 2020, so 2021 ought to be a breeze, proper? As we attempt to re

We’ve simply completed a tumultuous 2020, so 2021 ought to be a breeze, proper? As we attempt to return to regular after a risky yr, buyers should take into account new challenges, notably within the fastened earnings markets.

Within the upcoming webcast, Flip the Web page – Asset Allocation in 2021, Dan Phillips, Director Asset Allocation Technique, Northern Belief Asset Administration; and Michael Natale, Head of Middleman Distribution, Northern Belief Asset Administration, will define the trail to potential restoration and spotlight asset allocation in 2021.

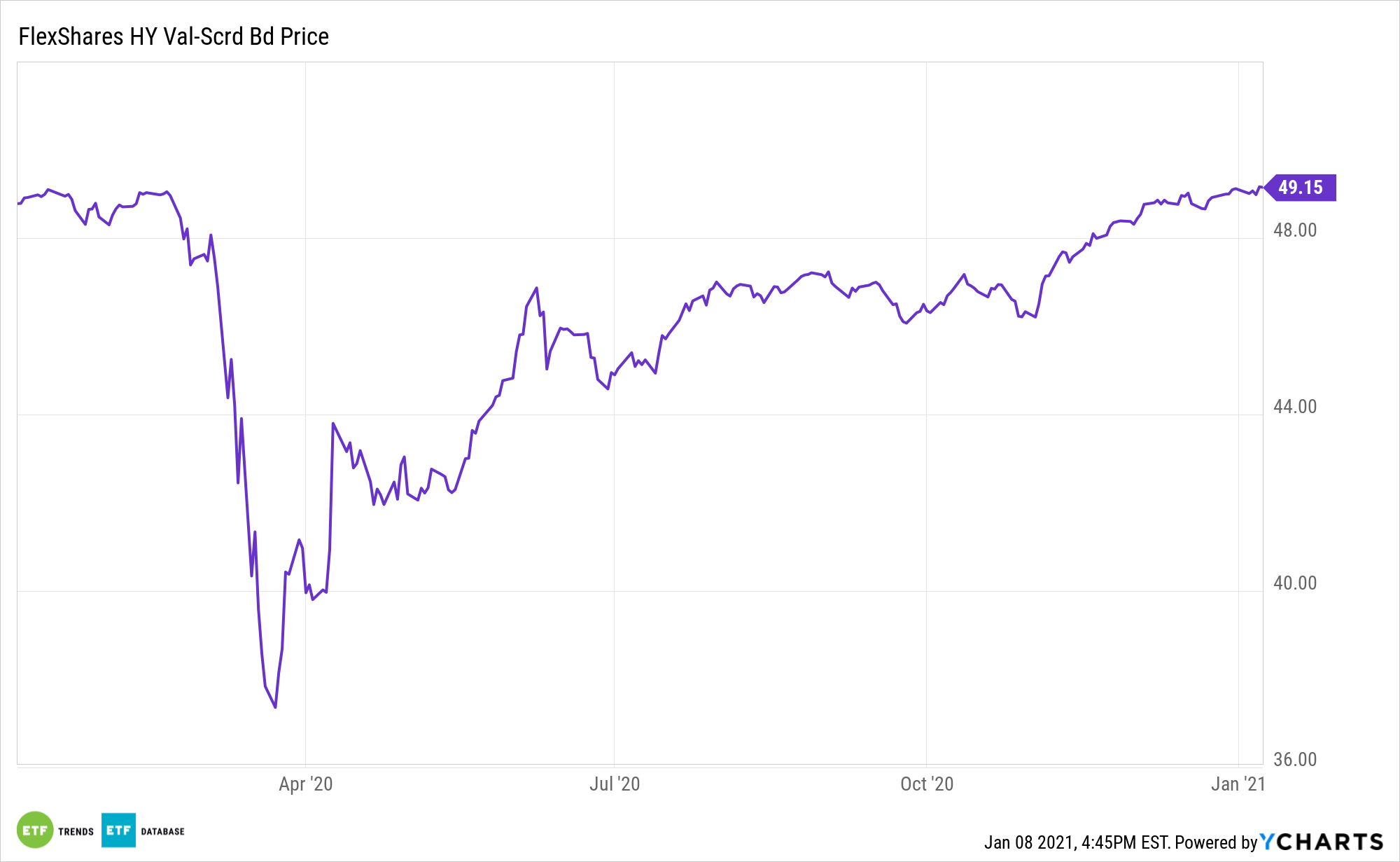

For instance, fixed-income buyers could also be contemplating methods to reinforce their yield alternative by means of bond ETFs, just like the FlexShares Excessive Yield Worth-Scored Bond Index Fund (NYSE: HYGV).

HYGV makes use of a singular display screen for high-yield company debt. The FlexShares Excessive Yield Worth-Scored Bond Index Fund tries to mirror the efficiency of the Northern Belief Excessive Yield Worth-Scored US Company Bond Index, which hones in on worth with a proprietary credit score scoring mannequin that maximizes issue inputs for worth whereas on the identical time, successfully screens for high quality and liquidity threat. The bond issuers are then basically evaluated towards present market circumstances, with low-quality issuers precluded from the index.

Particularly, the ETF focuses on worth by pursuing the upper threat/return potential discovered by concentrating on a focused credit score beta; using Northern Belief Credit score Scoring methodology to get rid of backside 10% of issuers; performing a liquidity evaluation primarily based on issuer’s debt excellent, age, and remaining time to maturity to take away the underside 5% illiquid securities; and intends to match the period of a market cap-weighted index (ICE BofAML US Excessive Yield Index), whereas sustaining sector neutrality.

“We imagine that the index’s composite worth, high quality and liquidity rating rating creates the potential for higher diversification and earnings era, and should improve risk-adjusted returns. Initially, high-yield ETFs have been panned by legacy high-yield energetic managers. They predicted dire market behaviors and atypical efficiency outcomes as a result of ETFs’ all-day buying and selling liquidity and full value transparency. Our analysis means that these predictions haven’t held up with the passage of time,” writes FlexShares.

“Our multi-factor method represents the sort of innovation that, in our view, is required to assist buyers pursue larger ranges of potential earnings in our present low market rate of interest setting.”

Monetary advisors who’re curious about studying extra about high-yield methods can register for the Monday, January 11 webcast right here.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.