Some of the air got here out of the clear vitality

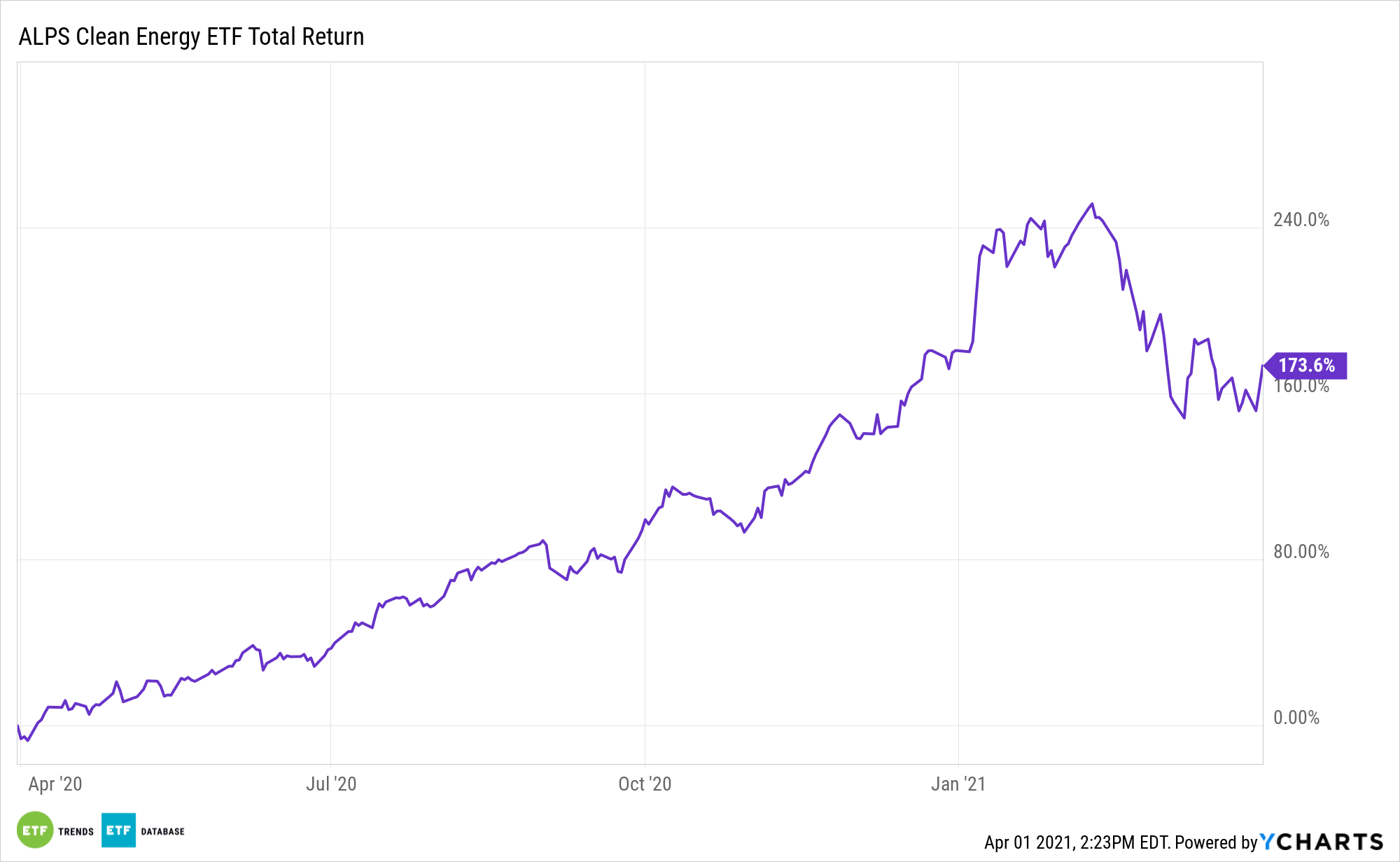

Some of the air got here out of the clear vitality commerce within the first quarter, however with the Biden Administration ready to spend large on this problem, renewable vitality funds just like the ALPS Clear Power ETF (ACES) may get one other increase.

ACES follows the CIBC Atlas Clear Power Index. That benchmark is comprised of U.S.- and Canada-based corporations that primarily function within the clear vitality sector. Constituents are corporations targeted on renewables and different clear applied sciences that allow the evolution of a extra sustainable vitality sector.

Some researchers are forecasting an enormous amount of money heading to renewable vitality shares within the coming years – a situation that ought to profit ACES.

“UBS has estimated that round $140 trillion of funding will probably be spent on decarbonizing the world’s vitality provide by 2050 and named a lot of shares set to learn,” stories Vicky McKeever for CNBC. “2050 is the 12 months many international locations have set as a deadline to grow to be carbon impartial, with a purpose to meet targets set out within the Paris Local weather Settlement.”

ACES Might Shine Over the Lengthy-Time period

A catalyst for ACES this 12 months is elevated ESG consciousness in company America, which has solely contributed to wash vitality’s general progress. Wanting forward, regulators may additionally lay out pointers to assist traders higher put money into the inexperienced trade.

“Clear vitality at present makes up 15% of the full consumed globally, however UBS mentioned this wanted to prime 55% for the world to attain net-zero emissions,” based on CNBC. “In a word revealed (final) Thursday, the analysts mentioned that whereas the expected vitality transition could be a ‘once-in-a-generation’ funding alternative, there have been ‘numerous’ methods to play the theme.

ACES takes a unique method than what’s seen in different conventional clear vitality ETFs. Most of the legacy funds on this area concentrate on one various vitality idea, comparable to photo voltaic or wind energy. For its half, ACES seems to be to all kinds of present and rising clear vitality applied sciences.

Different various vitality ETFs embrace the First Belief International Wind Power ETF (FAN) and the SPDR Kensho Clear Energy ETF (CNRG).

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.