The S&P 500 Vitality index has rallied 45% prior to now few months. 5 of the best-performing ET

The S&P 500 Vitality index has rallied 45% prior to now few months. 5 of the best-performing ETFs from Invesco have been within the power sector.

Invesco S&P SmallCap Vitality ETF (PSCE): PSCE seeks to trace the funding outcomes (earlier than charges and bills) of the S&P SmallCap 600® Capped Vitality Index. The fund typically will make investments a minimum of 90% of its complete belongings within the securities of small-capitalization U.S. power firms that comprise the underlying index. These firms are principally engaged within the enterprise of manufacturing, distributing or servicing power associated merchandise, together with oil and fuel exploration and manufacturing, refining, oil companies, and pipelines.

Invesco WilderHill Clear Vitality ETF (PBW): seeks to trace the funding outcomes (earlier than charges and bills) of the WilderHill Clear Vitality Index. The underlying index consists of shares of publicly traded firms in the US which are engaged within the enterprise of the development of cleaner power and conservation. Shares are included within the underlying index based mostly on the index supplier’s analysis that such firms will considerably profit from a societal transition towards the usage of cleaner power and conservation.

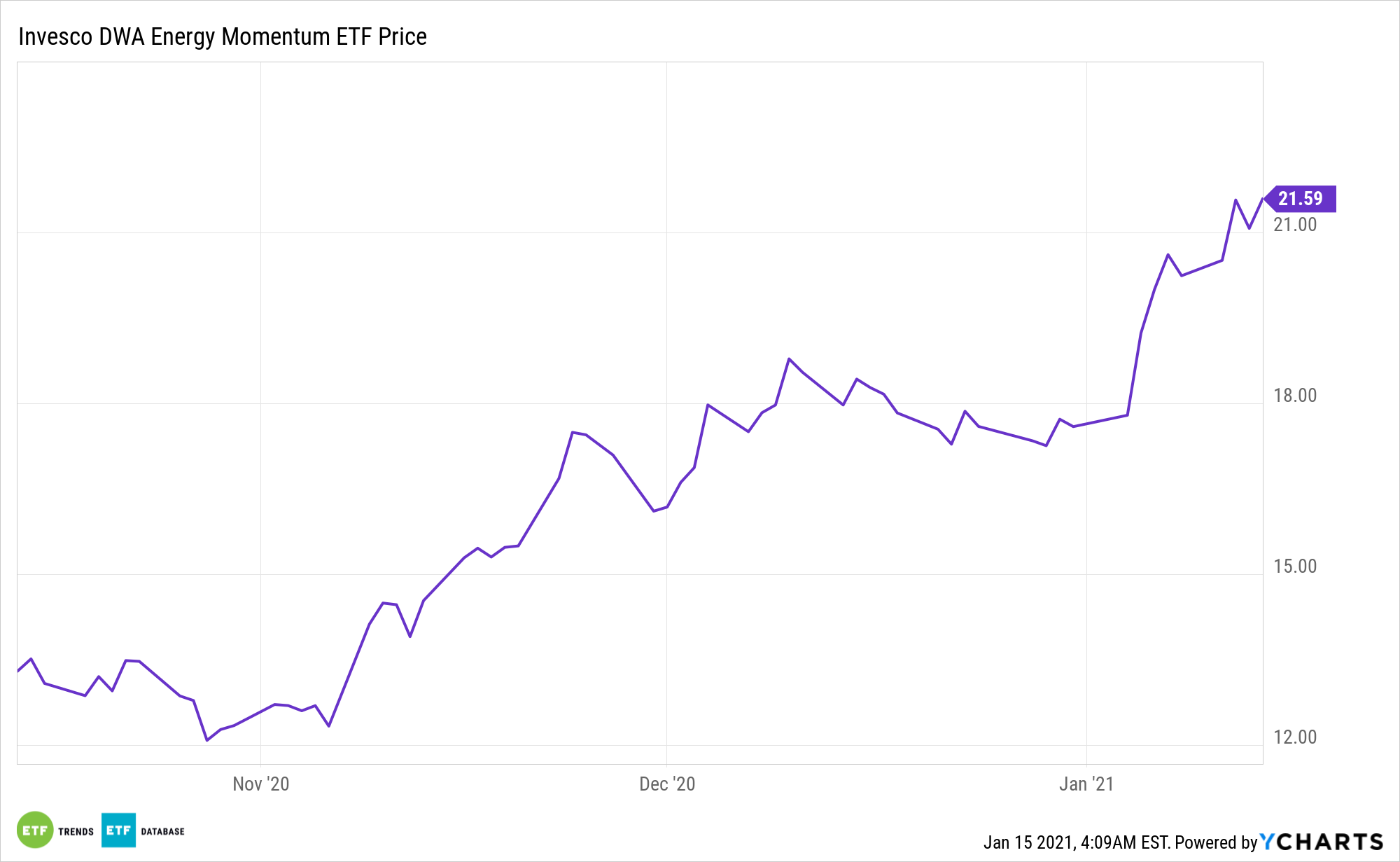

Invesco DWA Vitality Momentum ETF (PXI). The fund seeks to trace the funding outcomes (earlier than charges and bills) of the Dorsey Wright® Vitality Technical Leaders Index. The fund typically will make investments a minimum of 90% of its complete belongings within the securities that comprise the underlying index. The underlying index consists of a minimum of 30 securities of firms within the power sector which have highly effective relative power or “momentum” traits.

Invesco Dynamic Vitality Exploration & Manufacturing ETF (PXE): seeks to trace the funding outcomes of the Dynamic Vitality Exploration & Manufacturing IntellidexSM Index. The fund invests a minimum of 90% of its complete belongings within the securities that comprise the underlying intellidex. The intellidex was composed of frequent shares of U.S. firms concerned within the exploration and manufacturing of pure assets used to supply power. These firms are engaged principally in exploration, extraction and manufacturing of crude oil and pure fuel from land-based or offshore wells.

Invesco Dynamic Oil & Gasoline Companies ETF (PXJ): seeks to trace the funding outcomes (earlier than charges and bills) of the Dynamic Oil Companies IntellidexSM Index. The fund typically will make investments a minimum of 90% of its complete belongings within the securities that comprise the underlying index. The underlying index was composed of frequent shares of U.S. firms that help within the manufacturing, processing and distribution of oil and fuel.

For extra information and data, go to the Revolutionary ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.