By Adam Grossman, CFA, Riverfront Funding Group

SUMMARY

- Regardless of excessive present valuations we imagine neither the Nasdaq nor the Dow is in a bubble; each are positioned to develop into their valuations based mostly on robust anticipated earnings.

- We imagine each index kinds (Progress for Nasdaq and Worth for Dow) will do higher than mounted revenue over the subsequent few years.

- Evaluating the 2 indices, given our view of a robust financial restoration mixed with an accommodative fed, we favor the cheaper Dow firms over the costlier Nasdaq.

We now favor Blue Chip shares over Progress shares

Our view of the macro economic system and the market favors Blue Chip shares, like those who make-up the Dow Jones Industrial Common, over Progress shares that dominate the Nasdaq-100. A constant message from RiverFront has been the migration from Progress-oriented themes to Worth-oriented themes, and this evaluation hopefully explains a few of the underpinnings. (See our 12.14.2020 Weekly View: The Progress vs Worth Debate)

[wce_code id=192]

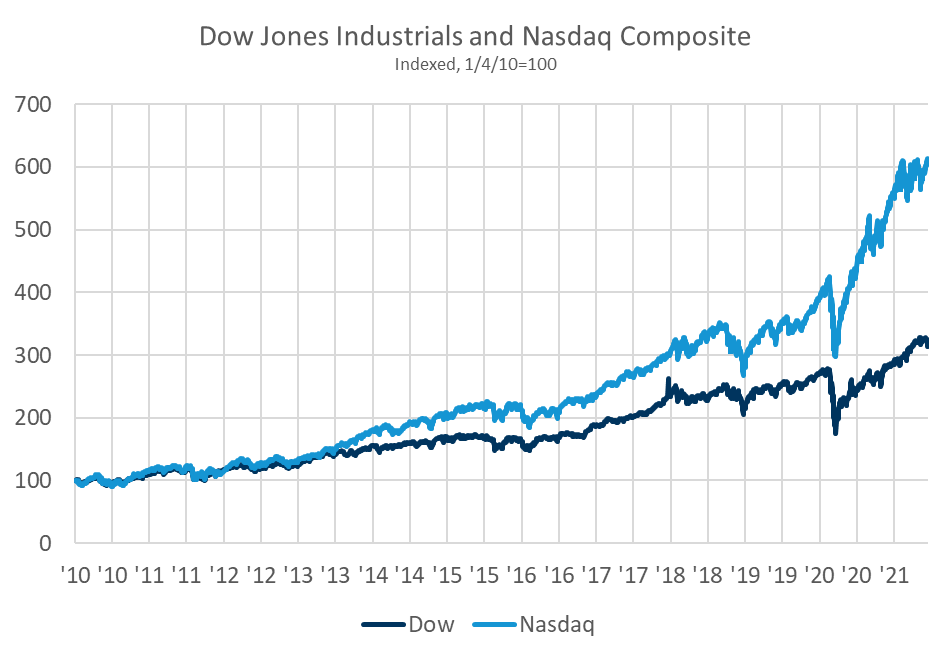

Previous efficiency isn’t any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency. Index definitions can be found within the disclosures.

We’re reminded of the battle between Ford and Ferrari to win the Le Mans automobile race within the 1960s. In our thoughts the Dow (extra conventional and value-oriented) reminds us of Ford, and the extra growth-oriented Nasdaq of Ferrari. We briefly clarify how every index is put collectively, their historic efficiency and the drivers of that efficiency. Regardless of excessive present valuations, neither the Nasdaq nor the Dow is in a bubble, in our view, as a result of we imagine the large rebound in earnings after COVID-19 will permit them to ‘develop into their valuations’. Nevertheless, we predict the expectations of continued quick progress within the Nasdaq could also be too excessive, whereas we predict the Dow will positively shock traders, simply as Ford did when it gained the race in 1966.

Composition and historic efficiency of every index:

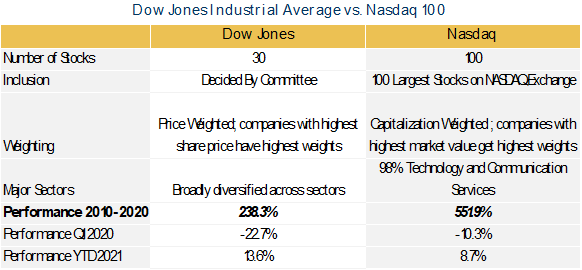

Desk 1: Two very totally different indexes

Previous efficiency isn’t any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency. Index definitions can be found within the disclosures.

Desk 1 reveals the numerous variations between the composition of the 2 indexes and the substantial outperformance of the Nasdaq over the previous ten years. This decade was characterised by low financial progress and low rates of interest. These circumstances positioned a premium on firms who might generate robust progress in such an setting, favoring Know-how versus the extra cyclical sectors within the Dow. This may be seen clearly within the working efficiency of every index throughout the interval. In Desk 2 we present gross sales progress (what firms make), in addition to progress in earnings (what firms hold).

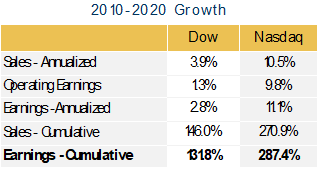

Desk 2: Large distinction in progress during the last 10 years

Previous efficiency isn’t any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency. Index definitions can be found within the disclosures.

The Nasdaq’s 10% annual gross sales progress compounded over the interval to a rise of 170%, whereas the Dow was barely in a position to enhance income by 50%. Moreover, the Nasdaq’s extra favorable value construction led to a good larger distinction in earnings progress. This was enhanced by their robust steadiness sheets which allowed them to difficulty debt to purchase again shares.

A bubble?

A query on our shoppers’ thoughts proper now’s: “Are US shares in a bubble”? This can be a cheap query for the reason that S&P 500 is near all-time highs, and the market has largely shrugged off each a world pandemic and accompanied by a decline in 2020 earnings. At first look one would possibly marvel if shares are buying and selling on hope and conjecture quite than concrete fundamentals. We predict not. This week we take a look at two indexes to achieve perception into present valuations and prospects for 2 very various kinds of shares, represented by the Dow Jones Industrials Index and the Nasdaq-100.

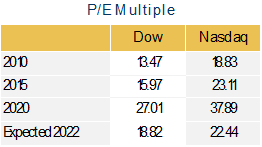

Desk 3: We anticipate P/E multiples return to regular by 2022

Previous efficiency isn’t any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency. Index definitions can be found within the disclosures.

Investor considerations a few inventory bubble appear to focus on valuations – particularly the worth of those indexes relative to their earnings, their price-to-earnings ratio (P/E ratio). As we will see in Desk 3 (see proper) the Dow’s P/E ratio has grown from 13.5x in 2010 to 27.0x in 2020, whereas the Nasdaq’s has grown from 18.8x to 37.9x over the identical timeframe. Traders have rewarded Know-how firms with considerably increased P/E multiples, which implicitly means traders anticipate Nasdaq firms to proceed their fast progress each in absolute phrases, and relative to the businesses within the Dow.

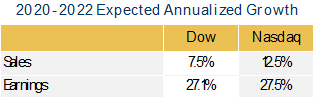

Desk 4: Dow firms anticipated to get well extra strongly

In our view, the rationale the present valuations of each indexes are so excessive is that they’re based mostly on depressed 2020 earnings numbers. Bloomberg analysts are very assured earnings will get well strongly in 2021 and 2022 (see desk Four left) and we predict they’re proper. Desk Four reveals analysts’ consensus anticipated progress charges in each gross sales and earnings between 2020 and 2022. You will notice how robust the restoration is anticipated to be, particularly for the Dow. Reaching these numbers would get P/E multiples again all the way down to an inexpensive degree, therefore the idea that shares are positioned to “develop into their multiples”.

Previous efficiency isn’t any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency. Index definitions can be found within the disclosures.

Wanting ahead: Shares versus Bonds

Low rates of interest accompanied by stronger financial progress is a robust mixture. It permits customers to proceed to make massive purchases (properties, vehicles, and so on.), and it permits firms to proceed to borrow cash cheaply and use that as gasoline for progress. This can be a huge driver of RiverFront’s choice for shares over bonds since we imagine returns from bonds are largely pushed by beginning yields. At present rates of interest, we imagine the bar is low for shares to outperform.

…and Dow versus Nasdaq

To reply the query of which index will do higher, we should make just a few assumptions about how the longer term would possibly play out. One of many issues to notice from the 2-year ahead estimates is the sharper rebound within the Dow’s income and earnings progress. That is no coincidence; the working construction of commercial firms relies on bigger financial progress to gasoline profitability. This “working leverage” to the upper financial progress we anticipate is what we predict can propel Dow-like firms to develop earnings extra quickly over the subsequent 5 years than the earlier 10. If the earnings progress seems sustainable, we might envision share costs of Dow-like firms rising sooner than earnings.

For Nasdaq firms, we see some challenges:

Whereas we predict progress in gross sales and earnings will result in continued profitability and constructive market returns, we imagine that progress will in the end sluggish throughout the Nasdaq writ massive, greater than multiples at the moment mirror. Moreover, we imagine rates of interest will logically enhance after a interval of progress, and it will remove the benefit that Progress firms have had issuing debt to purchase again shares. Lastly, though software program and a few {hardware} segments have unlocked new sources of progress, like cloud computing over the previous few years, we see the potential for larger regulation and political scrutiny.

Whereas most of this dialogue has been evaluating the 2 indexes, we imagine that inside in every index there are exceptions to our normal steering, and we predict it’s potential to do higher than both index by selecting to personal a few of the huge names and never others. Within the Nasdaq, we favor software program firms and corporations which might be shopper going through, because of their capability to assist customers and companies get well from the pandemic. In distinction, we imagine that communication companies segments (streaming / web) will wrestle to take care of their progress because of a mixture of slowing progress in streaming/connectivity and potential federal regulation.

In conclusion, three attention-grabbing takeaways come out of our evaluation:

- Our view of the macro economic system and the market favors the Dow over the Nasdaq. A constant message from RiverFront has been the migration from Progress themes to Worth-oriented themes, and this evaluation hopefully explains a few of the underpinnings.

- Safety choice will proceed to be a extra necessary device in our arsenal. Inside the Nasdaq, there are firms that may and will be unable to fulfill or exceed the excessive expectations set for them. Equally, within the Dow, there are companies which is able to wrestle to generate earnings out of financial progress. We anticipate to get extra granular in our picks of sectors and inventory themes, and to give attention to firms at cheap valuations that may develop earnings.

- Threat administration of views and positioning is significant for this outlook. Our view relies on our present understanding of COVID-19 restoration, Fed Coverage, Tax Coverage, world financial relations, and world financial progress. As all the time when making long term forecasts, we acknowledge that a lot of our present assumptions is not going to prove precisely as now we have laid out. For this reason at RiverFront a key a part of our course of is adapting to new data in any of those areas and adjusting our plans accordingly. We prefer to consult with this philosophy as ‘course of over prediction’.

Vital Disclosure Info

The feedback above refer usually to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to alter. Previous efficiency just isn’t indicative of future outcomes and diversification doesn’t guarantee a revenue or shield in opposition to loss. All investments carry some degree of danger, together with lack of principal. An funding can’t be made straight in an index.

Chartered Monetary Analyst is an expert designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of monetary analysts. Candidates are required to go three ranges of exams overlaying areas reminiscent of accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can grow to be a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Info or information proven or used on this materials was obtained from sources believed to be dependable, however accuracy just isn’t assured.

This report doesn’t present recipients with data or recommendation that’s ample on which to base an funding choice. This report doesn’t take note of the particular funding aims, monetary state of affairs or want of any explicit consumer and might not be appropriate for every type of traders. Recipients ought to take into account the contents of this report as a single think about investing choice. Further elementary and different analyses can be required to make an funding choice about any particular person safety recognized on this report.

In a rising rate of interest setting, the worth of fixed-income securities usually declines.

When referring to being “obese” or “underweight” relative to a market or asset class, RiverFront is referring to our present portfolios’ weightings in comparison with the composite benchmarks for every portfolio. Asset class weighting dialogue refers to our Benefit portfolios. For extra data on our different portfolios, please go to www.riverfrontig.com or contact your Monetary Advisor.

Investing in overseas firms poses further dangers since political and financial occasions distinctive to a rustic or area might have an effect on these markets and their issuers. Along with such normal worldwide dangers, the portfolio may additionally be uncovered to forex fluctuation dangers and rising markets dangers as described additional beneath.

Adjustments within the worth of foreign currency in comparison with the U.S. greenback might have an effect on (positively or negatively) the worth of the portfolio’s investments. Such forex actions might happen individually from, and/or in response to, occasions that don’t in any other case have an effect on the worth of the safety within the issuer’s dwelling nation. Additionally, the worth of the portfolio could also be influenced by forex trade management laws. The currencies of rising market international locations might expertise vital declines in opposition to the U.S. greenback, and devaluation might happen subsequent to investments in these currencies by the portfolio.

Overseas investments, particularly investments in rising markets, may be riskier and extra unstable than investments within the U.S. and are thought-about speculative and topic to heightened dangers along with the overall dangers of investing in non-U.S. securities. Additionally, inflation and fast fluctuations in inflation charges have had, and will proceed to have, unfavorable results on the economies and securities markets of sure rising market international locations.

Shares signify partial possession of an organization. If the company does properly, its worth will increase, and traders share within the appreciation. Nevertheless, if it goes bankrupt, or performs poorly, traders can lose their whole preliminary funding (i.e., the inventory worth can go to zero). Bonds signify a mortgage made by an investor to an organization or authorities. As such, the investor will get a assured rate of interest for a particular time frame and expects to get their unique funding again on the finish of that point interval, together with the curiosity earned. Funding danger is compensation of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Traders ought to concentrate on these variations previous to investing.

Know-how and internet-related shares, particularly of smaller, less-seasoned firms, are usually extra unstable than the general market.

Index Definitions:

Dow Jones Industrial Common Index — measures the inventory efficiency of thirty main blue-chip U.S. firms.

NASDAQ 100 Index consists of 100 of the biggest home and worldwide non-financial securities listed on the Nasdaq Inventory Market based mostly on market capitalization.

Normal & Poor’s (S&P) 500 Index measures the efficiency of 500 massive cap shares, which collectively signify about 80% of the entire US equities market.

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Change Fee. Registration as an funding adviser doesn’t suggest any degree of ability or experience. Any dialogue of particular securities is supplied for informational functions solely and shouldn’t be deemed as funding recommendation or a suggestion to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Integrated (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its staff by way of RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and due to this fact an oblique proprietor of RiverFront. BFC is the mother or father firm of Robert W. Baird & Co. Integrated, a registered dealer/vendor and funding adviser.

To overview different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Kind ADV, Half 2A. Copyright ©2021 RiverFront Funding Group. All Rights Reserved. ID 1693846

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.