Despite a 3rd wave of coronavirus instances in Euro

Despite a 3rd wave of coronavirus instances in Europe, the Direxion Each day FTSE Europe Bull 3X ETF (EURL) remains to be chugging alongside. As Europe appears to comprise the virus, merchants can get bullish on an financial restoration.

“Now we have to interrupt this third wave,” stated German Chancellor Angela Merkel in a CNBC report. “We’re obliged by legislation to comprise the unfold, and in the meanwhile, that’s not occurring.”

EURL seeks day by day funding outcomes which are equal to 300% of the day by day efficiency of the FTSE Developed Europe All Cap Index. The index itself is a market capitalization weighted index that’s designed to measure the fairness market efficiency of large-, mid- and small-cap firms in developed markets in Europe.

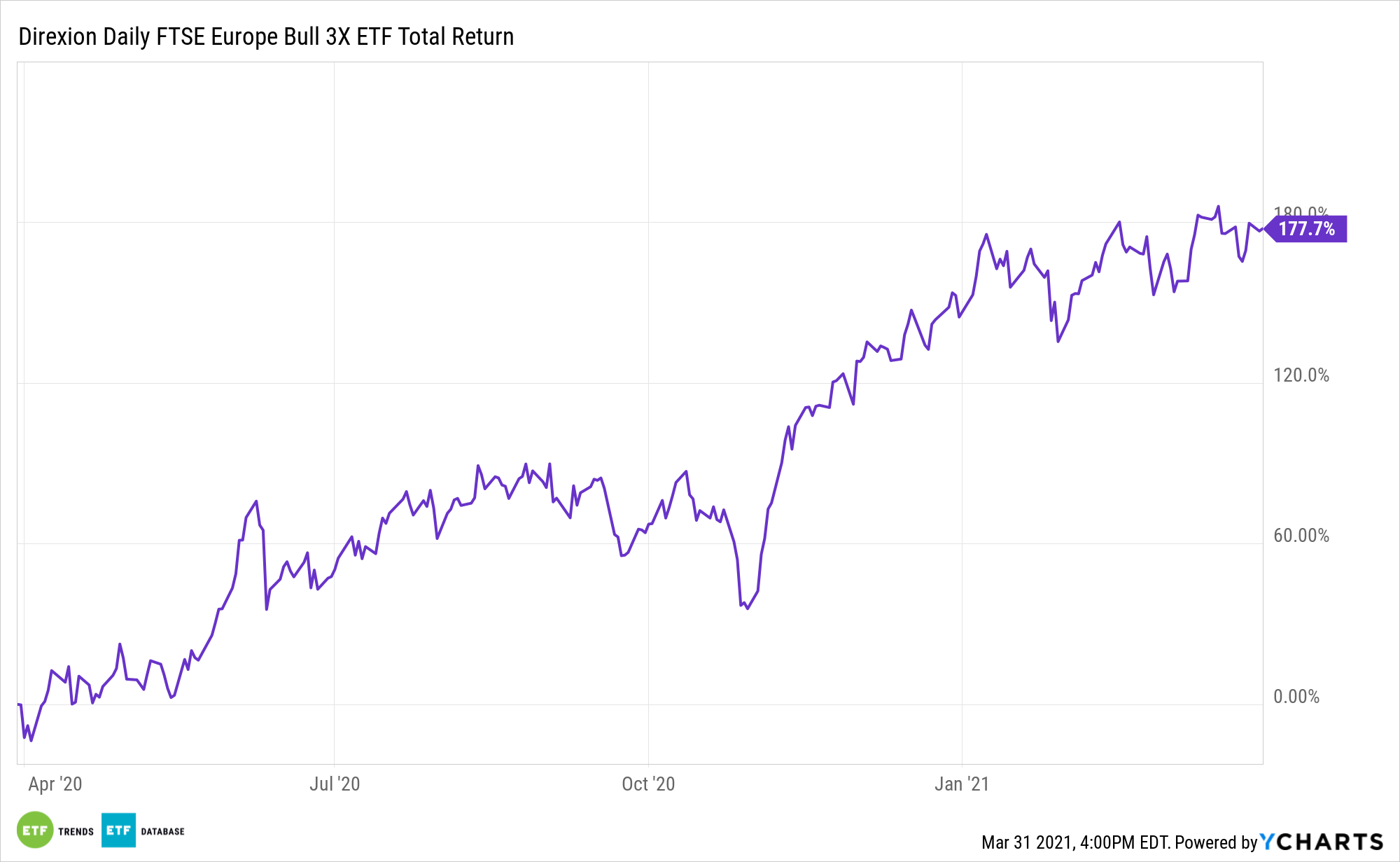

Regardless of the third wave of instances, EURL is shifting onward and upward, at the very least throughout the final 12 months. The fund is up about 180%.

Momentum might be at an inflection level with EURL because the relative energy index (RSI) teeters between overbought and oversold ranges. Proper now, the 50-day shifting common remains to be above the 200-day shifting common, displaying upward momentum since late final 12 months.

What is the Euro Saying?

The euro is flashing indicators of how effectively the markets are reacting to the most recent information popping out of Europe. Throughout Monday’s buying and selling session, the euro retreated because the prospect of extra Covid-19 measures hurts the financial system within the short-term.

“The euro languished beneath $1.18 on Monday because the prospect of harder coronavirus curbs in France and Germany weighed on the short-term outlook for the European financial system,” a Reuters article reported. “The widespread foreign money is headed for its largest month-to-month drop since mid-2019 as Europe’s faltering vaccination programme runs right into a wave of latest infections at the same time as positioning information confirmed buyers stay closely lengthy euros.”

“A lot focus will stay on the virus scenario in Europe and whether or not lockdowns can gradual rising case numbers and likewise whether or not the gradual tempo of vaccinations can lastly attain exit pace,” ING economists stated in a day by day word.

Within the meantime, the MSCI Euro index is up about 5% up to now in 2021. That very same index is up about 52% throughout the previous 12 months, displaying the resilience of the euro as the primary quarter winds down.

For extra information and data, go to the Leveraged & Inverse Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.