A little over 100 years in the past, the US emerged

A little over 100 years in the past, the US emerged from the double whammy of a world conflict and lethal pandemic. Wanting to get again to “regular” life, Individuals went on a decade-long spending splurge, shopping for vehicles and radios and shares, most for the primary time ever.

Though everyone knows the way it ended, the Roaring Twenties was largely a product of pent-up demand.

This summer time, I consider we might see the beginning of the same demand-driven financial increase as thousands and thousands of Individuals, newly vaccinated and $1,400 richer, make up for misplaced time by reserving flights and holidays, occurring cruises, taking the household to Disney World and extra.

As I shared with you earlier this month, near $18 trillion sit in Individuals’ financial savings accounts proper now—a file quantity. A lot of this money is simply ready to be unleased into the U.S. financial system.

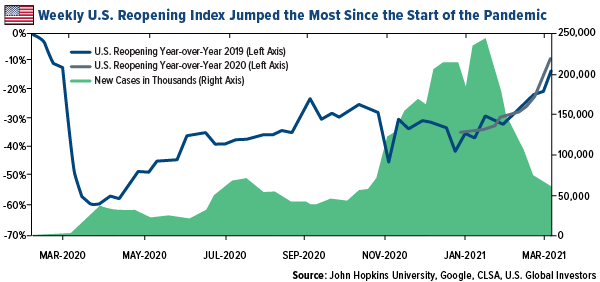

Issues are already on track. In keeping with CLSA’s proprietary reopening index, the U.S. noticed the most important weekly acquire because the begin of the pandemic, up 8%, because the variety of new day by day infections dropped additional. Right here in Texas, all COVID-19 restrictions had been lifted 100% final on Wednesday, simply in time for Spring Break.

click on to enlarge

Airways Betting on a Sturdy Rebound in Summer season Bookings

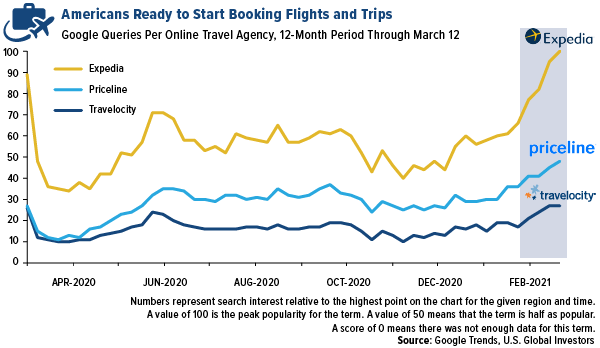

Final week marked the one-year anniversary of the beginning of the pandemic, and if Google Tendencies information is any indication, Individuals are able to journey once more. The variety of Google queries for on-line journey businesses Expedia, Priceline and Travelocity hit pandemic highs final week as airways introduced new offers and routes.

click on to enlarge

Low-cost carriers Allegiant and Southwest just lately expanded their networks to incorporate 36 new continuous routes within the former’s case, 17 within the latter’s. In keeping with Bloomberg, that is the second-largest community enlargement in Allegiant’s historical past and the biggest for Southwest since 2013.

Throughout the Atlantic, Lufthansa can be including to its slate of summer time locations in anticipation of a powerful rebound in bookings. Europe’s largest service will add round 20 new routes from Frankfurt and 13 from Munich to trip spots such because the Caribbean, Canary Islands and Greece.

In the meantime, bank card information from the tip of February exhibits an uptick in airline reserving amongst older Individuals—these most probably to have been absolutely vaccinated. At a Raymond James convention, the CEOs of Delta and Spirit advised traders that bookings took a constructive flip in mid-February.

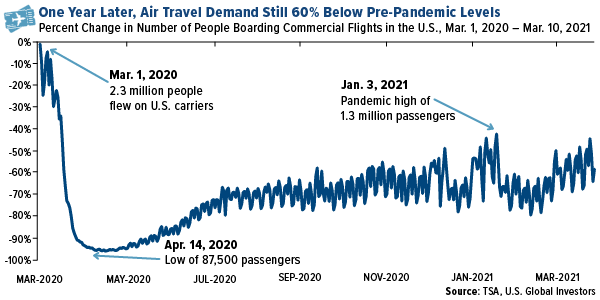

Passenger quantity within the U.S. continues to be down about 60% in comparison with pre-pandemic ranges, however I count on this to enhance the nearer we get to trip season and as extra folks get their pictures. Cowen aviation analyst Helane Becker, who helped us launch our airways ETFs in 2015, advised Yahoo Finance that she believed the variety of day by day passengers would cross above 1 million by March 20. As of March 14, the quantity exceeded 1 million folks for the fourth day straight.

click on to enlarge

American Airways is so optimistic of a restoration in summer time leisure journey that it simply elevated the scale of its debt financing, from $7.5 billion to $10 billion. The debt, in keeping with MarketWatch, is underpinned by the service’s $20 billion AAdvantage loyalty program.

One other signal that airways are sensing a shift in Individuals’ urge for food for air journey? Funds service Frontier filed to IPO final Monday, saying that it was “effectively positioned to make the most of the anticipated demand restoration as vaccine distribution continues.” Rival service Solar Nation additionally supplied new particulars for its personal upcoming IPO on Monday, telling traders it seeks to boost some $200 million to assist repay pandemic disaster loans from the federal authorities.

$15 Billion Stimulus for Airways and Airline Contractors, $Eight Billion for Airports

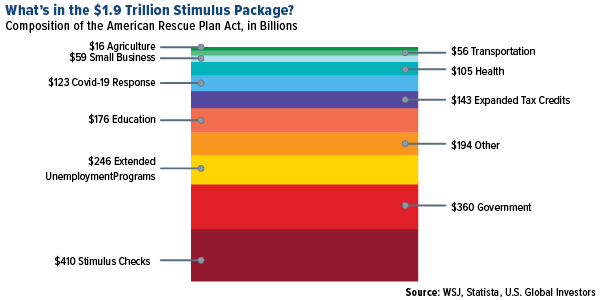

The U.S. aviation trade is ready to obtain one other spherical of contemporary stimulus now that President Joe Biden has signed the $1.9 trillion rescue package deal.

American and United instantly dropped plans to put off or furlough a mixed 27,000 staff.

Included within the invoice is roughly $15 billion for airways and airline contractors, $Eight billion for airports and concessionaires.

click on to enlarge

As anticipated, U.S. airline and airport commerce teams had been fast to reward the rescue package deal. Airways for America (A4A) wrote that it’s “important to have our staff on the job and able to help as our nation prepares to maneuver ahead from this disaster,” whereas the American Affiliation of Airport Executives (AAAE) stated that the quantity earmarked for airports “underscores the big monetary affect that the pandemic is having on airports and your complete aviation ecosystem.”

How the Semiconductor Chip Scarcity Will Contribute to Inflation

One of many anticipated penalties of financial reopening is larger inflation. Add trillions of {dollars} in new debt and money-printing, and inflation might find yourself being hotter than any of us anticipated.

Final week, the Bureau of Labor Statistics (BLS) reported that the patron worth index (CPI) rose barely to 1.7% year-over-year in February, up from 1.4% in January.

Of the gadgets tracked by the BLS, used automobile and truck costs superior essentially the most at 9.3%. This was the sixth straight month that used car costs jumped greater than 9% in comparison with final yr.

The explanation for that is easy economics: Too few automobiles accessible on the market through the pandemic and too many patrons.

In a analysis report, CLSA wrote that the chip scarcity “ought to in the end hasten electrification of the worldwide automotive trade.” With chip provide in query, automakers are shifting precedence to the merchandise highest in demand proper now, i.e., electrical automobiles (EVs). Quite a few firms, together with Ford, Basic Motors and Toyota, have prolonged plant shutdowns attributable to restricted chip availability.The value hike is more likely to proceed with the worldwide scarcity in semiconductor chips, that are used extensively in automotive manufacturing. The “smarter” our vehicles and vehicles get, the extra chips are wanted.

Consequently, costs for conventional inner combustion engine (ICE) automobiles will definitely face upward stress as fewer of them roll off manufacturing unit flooring.

The ethical to the story? In the event you’re out there for a brand new automobile or truck, you would possibly need to make a purchase order sooner quite than later.

Ethereum Mining Income Broke Above $1 Billion for the First Time

The chip scarcity has hit different industries, in fact, together with crypto mining. Demand from miners is so excessive proper now that chipmaker Nvidia introduced it will likely be releasing a brand new collection of semiconductors designed particularly for mining Ethereum.

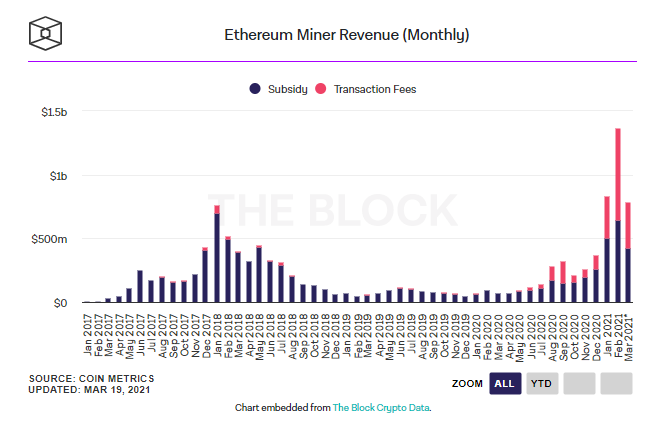

In different Ethereum-related information, Coin Metrics information exhibits that month-to-month income generated by Ethereum miners hit a file $1.37 billion in February, an unimaginable 1,300% enhance from the identical month in 2020, and a 65% enhance from the earlier month.

Miner income contains inflation rewards (block subsidy) and transaction charges. Miners are paid rewards within the blockchain’s native foreign money for producing legitimate blocks and processing transactions.

This is excellent information for HIVE Blockchain Applied sciences, the one publicly traded crypto miner that mines each Bitcoin and Ethereum utilizing 100% inexperienced power.

Missed our webcast final week on crypto and gold? You’re in luck! The replay is on the market to hearken to by clicking right here.

Initially printed by US Funds, 3/15/21

Some hyperlinks above could also be directed to third-party web sites. U.S. International Traders doesn’t endorse all data provided by these web sites and isn’t answerable for their content material. All opinions expressed and information supplied are topic to vary with out discover. A few of these opinions will not be acceptable to each investor.

The Shopper Worth Index (CPI) is without doubt one of the most well known worth measures for monitoring the value of a market basket of products and companies bought by people. The weights of elements are based mostly on client spending patterns.

Frank Holmes is the interim CEO and govt chairman of HIVE Blockchain Applied sciences. Mr. Holmes owns shares of HIVE whereas U.S. International Traders owns convertible securities.

Holdings might change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. International Traders as of (12/31/2020): American Airways Group Inc., Spirit Airways Inc., Southwest Airways Co., Delta Air Strains Inc., Allegiant Journey Co., United Airways Holdings Inc.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.