By Ryan Krystopowicz, Affiliate, Asset Allocation, and Kara Marciscano, Senior Analysis Analyst, Wi

By Ryan Krystopowicz, Affiliate, Asset Allocation, and Kara Marciscano, Senior Analysis Analyst, WisdomTree

COVID-19 has sparked a variety of world innovation and market disruption. Quite a lot of thematic ETFs have been in a position to seize publicly traded corporations main the cost, and investor demand for these merchandise has skyrocketed.

It raises the query: Are thematic ETFs only a fad for the “Robinhood” dealer crowds, or ought to strategic asset allocators take thematic ETFs significantly?

We imagine it’s the latter. Thematic ETFs are right here to remain, and buyers of all profiles have seen.

Thematic ETFs search to seize funding alternatives in corporations or sectors created by long-term structural developments. Examples embrace demographic and social shifts corresponding to variety, inclusion and equality; disruptive applied sciences corresponding to cloud computing; geopolitical adjustments corresponding to globalization; and environmental pressures corresponding to local weather change.

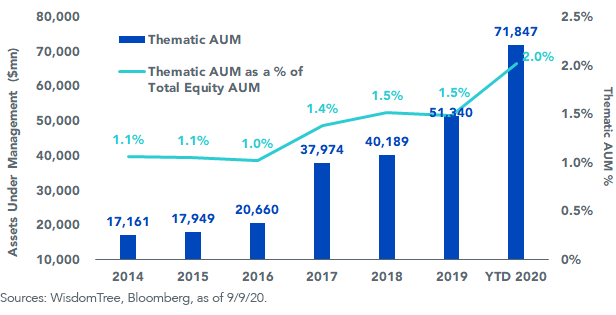

Within the final 5 years, thematic ETF belongings below administration (AUM) have grown 25% yearly, properly above the 17% charge for whole fairness belongings1. This 12 months isn’t any totally different—in truth, the class’s progress has accelerated.

The chart under illustrates how these methods are carving out a rising area of interest of the fairness ETF market.

Thematic Property Below Administration (AUM)

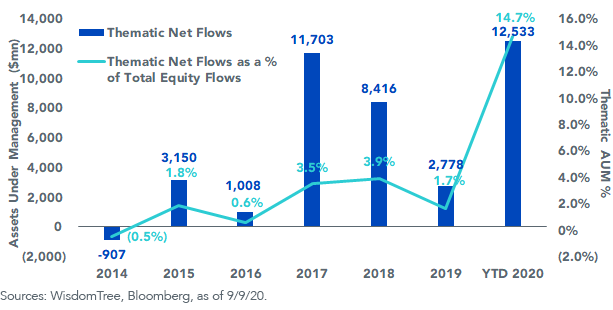

Asset flows have adopted. Thematic ETF AUM have elevated 40% for the reason that finish of 2019, taking in additional than $12.5 billion in belongings. 12 months-to-date internet inflows have exceeded any current 12 months2.

Thematic Web Flows (AUM)

With sturdy internet inflows, it might be no shock that many of those methods have carried out properly in the course of the pandemic.

Is the efficiency sustainable? Are valuations too excessive?

Nobody has a crystal ball, however the funding rationale for thematic methods is anchored in long-term expectations.

We imagine the choice to provoke or add to a thematic place ought to be extra depending on the extent of conviction and fewer depending on precisely timing a market entry level.

Equally, we count on constructive thematic efficiency to be pushed by rising structural shifts, and never reliant on shorter-term cyclical adjustments or technical indicators. Consequently, these methods differ from conventional broad-based exposures in 3 ways:

Focused Publicity: Thematic methods supply focused publicity to a selected secular or financial pattern with the potential for increased risk-adjusted returns verses broader-based methods over the long run.

To Excessive-Conviction Concepts: They allow buyers to implement high-conviction concepts of their portfolios, with out requiring single-stock choices or to dilute the specified publicity with non-theme-related holdings.

Pushed by Lengthy-Time period Structural Modifications: They’re forward-looking, carry excessive expectations for future progress and influence, and are anticipated to develop over the long run.

What are some examples of those revolutionary and market disruptive methods?

WisdomTree launched the WisdomTree Cloud Computing Fund (WCLD) and the WisdomTree Progress Leaders Fund (PLAT)—that are a few of our top-performing methods year-to-date3.

WCLD offers focused publicity to pure-play cloud computing corporations. It was launched on the long-term conviction that cloud-based expertise will develop into the underlying connectivity supply of our world economic system.

We anticipate that the adoption of cloud expertise will proliferate throughout sectors and geographies. Over time, its adoption will lengthen far past the software program market with improvements that rework non-tech sectors. WCLD can exchange or complement growth-oriented and technology-sector funding methods.

PLAT offers focused publicity to corporations working platform-based enterprise fashions. These companies create worth by connecting interdependent teams (e.g., Uber connects a rider with a driver). This, in distinction to conventional companies creating worth by way of linear manufacturing or provide (e.g., Ford or Hertz produce/purchase automobiles on the market/lease).4

Our expectation is for platforms to disrupt aggressive landscapes, and to realize market share on the expense of conventional, linear companies—whereas doing so with higher economies of scale and potential for long-term profitability. PLAT can exchange or complement each energetic and passive growth-oriented funding methods.

With so many disruptive business classes throughout the globe, we created a holistic providing for buyers that invests in a number of themes chosen by our Mannequin Portfolio Funding Committee.

Introducing the WisdomTree Disruptive Progress Mannequin Portfolio, accessible to monetary professionals as a part of our Fashionable Alpha® ETF Mannequin Portfolio choices.

The Disruptive Progress Mannequin Portfolio targets structural progress themes driving innovation and future influence throughout totally different industries and segments of society. The themes and constituent ETFs usually have premium progress projection, in addition to search to keep away from holding overlap amongst each other. The funding goal is to attain most long-term capital appreciation.

Along with cloud-computing and progress leaders utilizing platform-business fashions, the WisdomTree Disruptive Progress Mannequin Portfolio offers publicity to 4 further themes:

On-line Gaming & Esports. Our publicity targets corporations that develop or publish video video games, facilitate the streaming and distribution of video gaming or esports content material, personal and function in aggressive esports leagues, or produce {hardware} utilized in video video games and esports, together with augmented and digital actuality.

Cybersecurity. Our publicity targets corporations whose principal enterprise is within the improvement and administration of safety protocols stopping intrusion and assaults to methods, networks, functions, computer systems and cell units.

Fintech. Our publicity targets corporations main the innovation in cell funds, digital wallets, peer-to-peer lending, blockchain expertise and danger transformation.

Genomics. Our publicity targets corporations which are anticipated to considerably profit from extending and enhancing the standard of human and different life by incorporating technological and scientific developments and developments in genomics into their enterprise.

Total, buyers have many thematic methods at their disposal. WisdomTree may also help monetary advisors navigate this panorama and entry the disruptive themes we imagine ship premium progress potential. These methods are generally used as a complement to core fairness portfolios, typically offering exposures with low overlap to different growth- or technology-focused methods, or as alternative of particular person inventory methods looking for long-term progress.

We imagine thematic ETFs serve a objective exterior the confines of conventional asset allocation. They determine disruptive developments that manifest over a medium- to long-term time horizon, and so they might probably assist buyers, starting from Robinhood merchants to strategic asset allocators, hedge towards transformative forces and place for long-term progress.

Initially revealed by WisdomTree, 10/22/20

1Sources: WisdomTree, Bloomberg, as of 9/9/20

2Sources: WisdomTree, Bloomberg, as of 9/9/20

3Supply: WisdomTree, for the interval 12/31/2019–9/9/2020. The WisdomTree Cloud Computing Fund and the WisdomTree Progress Leaders Fund returned 61.0% and 33.1%, respectively, at NAV.

4As of 9/9/20, PLAT held 1.3% of its weight in Uber; PLAT didn’t maintain Ford or Hertz.

Essential Dangers Associated to this Article

Previous efficiency is just not indicative of future outcomes.

WCLD: There are dangers related to investing, together with doable lack of principal. The Fund invests in cloud computing corporations, that are closely depending on the Web and using a distributed community of servers over the Web. Cloud computing corporations might have restricted product strains, markets, monetary sources or personnel and are topic to the dangers of adjustments in enterprise cycles, world financial progress, technological progress, and authorities regulation. These corporations usually face intense competitors and probably fast product obsolescence. Moreover, many cloud computing corporations retailer delicate shopper data and might be the goal of cybersecurity assaults and different forms of theft, which might have a damaging influence on these corporations and the Fund. Securities of cloud computing corporations are usually extra unstable than securities of corporations that rely much less closely on expertise and, particularly, on the Web. Cloud computing corporations can usually have interaction in vital quantities of spending on analysis and improvement, and fast adjustments to the sector might have a fabric adversarial impact on an organization’s working outcomes. The composition of the Index is closely depending on quantitative and qualitative data and knowledge from a number of third events and the Index might not carry out as meant. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

PLAT: There are dangers related to investing, together with doable lack of principal. International investing includes particular dangers, corresponding to danger of loss from foreign money fluctuation or political or financial uncertainty; these dangers could also be enhanced in rising, offshore or frontier markets. Expertise platform corporations have vital publicity to shoppers and companies and a failure to draw and retain a considerable variety of such customers to an organization’s merchandise, companies, content material or expertise might adversely have an effect on working outcomes. Technological adjustments might require substantial expenditures by a expertise platform firm to change or adapt its merchandise, companies, content material or infrastructure. Expertise platform corporations usually face intense competitors and the event of recent merchandise is a fancy and unsure course of. Considerations relating to an organization’s services or products which will compromise the privateness of customers, or different cybersecurity issues, even when unfounded, might harm an organization’s popularity and adversely have an effect on working outcomes. Many expertise platform corporations presently function below much less regulatory scrutiny however there’s vital danger that prices related to regulatory oversight might enhance sooner or later. The Fund invests within the securities included in, or consultant of, its Index no matter their funding advantage and the Fund doesn’t try and outperform its Index or take defensive positions in declining markets. The composition of the Index is closely depending on quantitative and qualitative data and knowledge from a number of third events and the Index might not carry out as meant. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

WisdomTree Mannequin Portfolio data is designed for use by monetary advisors solely as an academic useful resource, together with different potential sources advisors might think about, in offering companies to their finish purchasers. WisdomTree’s Mannequin Portfolios and associated content material are for data solely and are usually not meant to supply, and shouldn’t be relied on, for tax, authorized, accounting, funding or monetary planning recommendation by WisdomTree, nor ought to any WisdomTree Mannequin Portfolio data be thought of or relied upon as funding recommendation or as a suggestion from WisdomTree, together with relating to the use or suitability of any WisdomTree Mannequin Portfolio, any specific safety or any specific technique. In offering WisdomTree Mannequin Portfolio data, WisdomTree is just not performing and has not agreed to behave in an funding advisory, fiduciary or quasi-fiduciary capability to any advisor or finish shopper, and has no duty in connection therewith, and isn’t offering individualized funding recommendation to any advisor or finish shopper, together with primarily based on or tailor-made to the circumstance of any advisor or finish shopper. The Mannequin Portfolio data is offered “as is,” with out guarantee of any type, categorical or implied. WisdomTree is just not liable for figuring out the securities to be bought, held and/or offered for any advisor or finish shopper accounts, neither is WisdomTree liable for figuring out the suitability or appropriateness of a Mannequin Portfolio or any securities included therein for any third occasion, together with finish purchasers. Advisors are solely liable for making funding suggestions and/or choices with respect to an finish shopper, and will think about the top shopper’s particular person monetary circumstances, funding time-frame, danger tolerance degree and funding objectives in figuring out the appropriateness of a selected funding or technique, with out enter from WisdomTree. WisdomTree doesn’t have funding discretion and doesn’t place commerce orders for any finish shopper accounts. Info and different advertising and marketing supplies offered to you by WisdomTree regarding a Mannequin Portfolio – together with allocations, efficiency and different traits – is probably not indicative of an finish shopper’s precise expertise from investing in a number of of the funds included in a Mannequin Portfolio. Utilizing an asset allocation technique doesn’t guarantee a revenue or shield towards loss, and diversification doesn’t remove the chance of experiencing funding losses. There isn’t any assurance that investing in accordance with a Mannequin Portfolio’s allocations will present constructive efficiency over any interval. Any content material or data included in or associated to a WisdomTree Mannequin Portfolio, together with descriptions, allocations, knowledge, fund particulars and disclosures are topic to vary and is probably not altered by an advisor or different third occasion in any method.

Genomics and Healthcare sector dangers: The well being care sector could also be adversely affected by authorities rules and authorities well being care packages, restrictions on authorities reimbursements for medical bills, will increase or decreases in the price of medical services and products and product legal responsibility claims, amongst different components. Many well being care corporations are closely depending on patent safety and mental property rights and the expiration of a patent might adversely have an effect on their profitability.

WisdomTree primarily makes use of WisdomTree Funds within the Mannequin Portfolios except there isn’t a WisdomTree Fund that’s in keeping with the specified asset allocation or Mannequin Portfolio technique. Consequently, WisdomTree Mannequin Portfolios are anticipated to incorporate a considerable portion of WisdomTree Funds however that there could also be the same fund with a better score, decrease charges and bills, or considerably higher efficiency. Moreover, WisdomTree and its associates will not directly profit from investments made primarily based on the Mannequin Portfolios by way of charges paid by the WisdomTree Funds to WisdomTree and its associates for advisory, administrative and different companies.

The WisdomTree Mannequin Portfolio Funding Committee can also be generally known as the Asset Allocation Committee.

References to particular securities and their issuers are for illustrative functions solely and are usually not meant to be, and shouldn’t be interpreted as, suggestions to buy or promote such securities.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.