https://www.youtube.com/watch?v=pAsEGbkse1U

By DeFred Folts III, Managing Associate, Chief Funding Strategist, and Eric Biegeleisen, CFA, Managing Director, Analysis Portfolio Supervisor

[wce_code id=192]

Equities:

▶ U.S. Equities: Whereas Fed Chair Powell was capable of assuage fears of inflation taking root within the shorter time period, issues relating to extra persistent inflation within the U.S. stay. Ought to this manifest in a extra significant means it could sign a tighter Fed financial coverage together with the potential for decreasing their bond-buying program (so-called ‘tapering’) and/or a hike of their rate of interest coverage sooner than the market at present anticipates. Traders are additionally involved about whether or not the worldwide financial system could at present be at or close to “peak progress.” Dangers additionally stay relating to the lack of Congress and the Biden Administration to take the present infrastructure bundle over the end line. An extra concern is that U.S. fairness market valuations stay close to all-time highs by our measure.

Nonetheless, the potential for additional upside stays ought to these dangers abate because the backdrop of positively sloped yield curve measures together with their steepening units up the financial system for continued financial progress. General, a combined outlook.

▶ Japan Equities: Whereas Japanese equities have had impartial year-to-date efficiency, on a currency-hedged foundation they’ve carried out a lot better. Peak-to-trough by way of the primary half of this 12 months, the Japanese Yen suffered a large lack of over 8%. Given Japan’s heavy reliance on exporting, this forex depreciation ought to augur effectively with a lag on the fairness part of the financial system as overseas patrons of Japanese items and providers are capable of purchase extra product with their respectively stronger currencies. Japan equities are additionally on the cusp of a behavioral breakout whereby if the market continues to climb it may entice additional capital into the area in a virtuous cycle.

▶ European Equities: As Europe slowly emerges from the worldwide pandemic behind the U.S., it’s anticipated that progress will choose up because it did in the united statesonce vaccinations attain key ranges. The European financial authorities proceed to aggressively stimulate the area with few indicators of that abating. This could assist bolster the area. A key danger to the nascent restoration is the current uptick in inflation measures which whereas nonetheless pretty well-behaved have a a lot decrease threshold in comparison with different economies with regard to dangers of an abrupt change in financial applications.

▶ China Equities: The outlook for China equities stays favorable within the medium-term, given the robust financial ties between China and the U.S. Nonetheless, issues relating to the prospects for a extra persistent rise in U.S. inflation cloud the shorter-term outlook in China. That is compounded additional by current strikes by Chinese language authorities on geopolitical issues relating to Taiwan and Hong Kong.

▶ India Equities: India fairness markets proceed to be evaluated favorably by our mannequin analysis. Whereas gradual, progress on vaccinations and a discount from peak case charges is encouraging. As famous beforehand, upcoming elections ought to encourage continued extremely accommodative financial and monetary insurance policies for an prolonged interval and go away room for financial enchancment as soon as vaccinations ramp up. An space of concern is the potential for widening credit score spreads which we proceed to observe.

Fastened Earnings:

▶ As famous for a while, the chance/return trade-off in charges is unattractive with the overwhelming majority of the Treasury curve yielding lower than the anticipated charge of inflation. Nonetheless, the current decline in yields alongside the strengthening U.S. greenback with respect the Yen and Euro have helped enhance the charges outlook to combined.

▶ The outlook for credit score stays combined. Whereas there was some widening in excessive yield and investment-grade credit score spreads not too long ago, this has been minimal. Credit score spreads are close to all-time slim ranges and the dangers of a speedy unwind, i.e., widening of those spreads, might be damaging to credit score holdings and outweigh the advantages of the additional yield pick-up within the shorter time period.

Actual Belongings:

▶ Gold suffered a setback in June with inflation believed to be short-lived alongside a powerful rebound within the U.S. greenback. Behaviorally, gold could face shorter-term headwinds; nevertheless, gold continues to be supported within the medium-term by destructive and declining actual rates of interest (nominal charges minus inflation expectations).

▶ Like Gold, Commodities could equally face shorter-term behaviorally-driven headwinds as market individuals imagine the specter of inflation has receded considerably. Nonetheless, Commodities stay engaging within the medium-term because of their longstanding relative undervaluation versus equities in addition to the continued prospect for a powerful international financial restoration within the second half of 2021. Continued U.S. greenback strengthening can be a headwind for actual belongings.

About 3EDGE

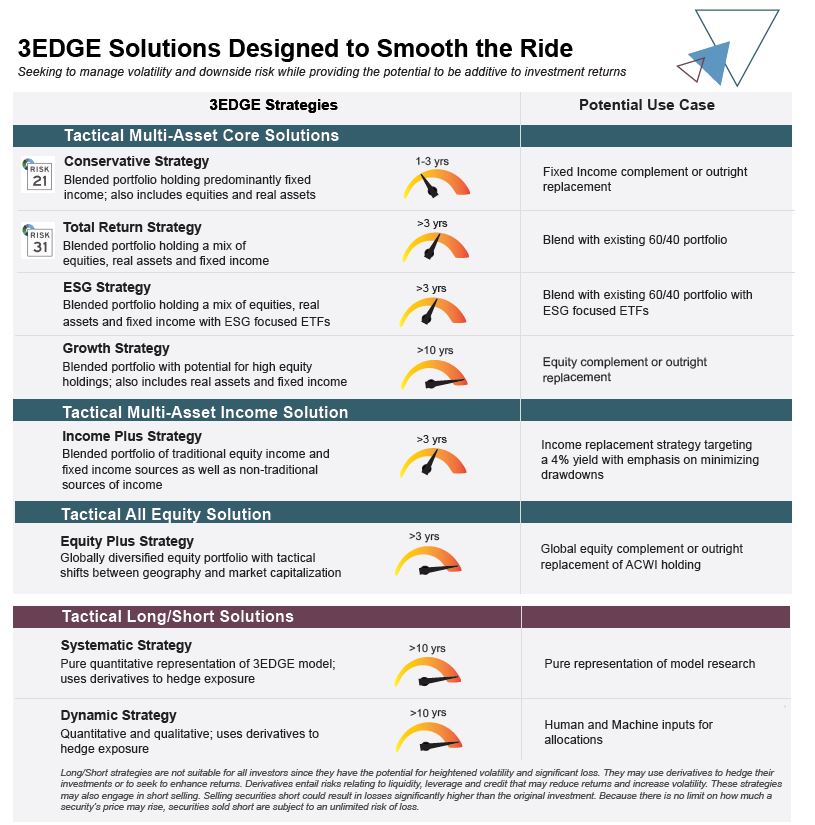

3EDGE Asset Administration, LP, is a world, multi-asset funding administration agency serving institutional buyers and personal shoppers. 3EDGE methods act as tactical diversifiers, looking for to generate constant, long-term funding returns, no matter market situations, whereas managing draw back dangers.

The first funding autos utilized in portfolio development are index Change Traded Funds (ETFs). The funding analysis course of is pushed by the agency’s proprietary international capital markets mannequin. The mannequin is stress-tested over 150 years of market historical past and interprets many years of analysis and funding expertise right into a system of causal guidelines and algorithms to explain international capital market habits. 3EDGE gives a full suite of options, every with a goal charge of return and danger parameters, to fulfill buyers’ totally different goals.

DISCLOSURES: This commentary and evaluation is meant for data functions solely and is as of July 7, 2021. This commentary doesn’t represent a proposal to promote or solicitation of a proposal to purchase any securities. The opinions expressed in View From the EDGE® are these of Mr. Folts and Mr. Biegeleisen and are topic to vary with out discover in response to shifting market situations. This commentary just isn’t meant to supply private funding recommendation and doesn’t take into consideration the distinctive funding goals and monetary scenario of the reader. Traders ought to solely search funding recommendation from their particular person monetary adviser. These observations embrace data from sources 3EDGE believes to be dependable, however the accuracy of such data can’t be assured. Investments together with frequent shares, fastened earnings, commodities, ETNs and ETFs contain the chance of loss that buyers ought to be ready to bear. Funding within the 3EDGE funding methods entails substantial dangers and there could be no assurance that the methods’ funding goals will probably be achieved. Actual Belongings (Gold & Commodities) contains treasured metals akin to gold in addition to investments that function and derive a lot of their income in actual belongings, e.g., MLPs, metals and mining firms, and so on. Intermediate-Time period Fastened Earnings contains fastened earnings funds with a median period of larger than 2 years and fewer than 10 years. Quick-Time period Fastened Earnings and Money contains money, money equivalents, cash market funds, and glued earnings funds with a median period of two years or much less. Previous efficiency just isn’t indicative of future outcomes. Intermediate-Time period Fastened Earnings contains fastened earnings funds with a median period of larger than 2 years and fewer than 10 years.

The Threat Quantity®, a proprietary scaled index developed by Riskalyze to quantify the chance of a portfolio, is calculated based mostly on draw back danger on a scale from 1- 99. The larger the potential loss, the larger the quantity. The Threat Quantity® contains evaluation and proprietary data of Riskalyze. As of 6/30/21. Additional data obtainable at Riskalyze.com.

View from the EDGE is a registered trademark of 3EDGE Asset Administration, LP

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.