By Matt Wagner, CFA, Affiliate, Analysis

One of many first classes taught in Intro to Finance is the Capital Asset Pricing Mannequin (CAPM):

ERi = Rf + βi (ERm − Rf)

This mannequin gives an anticipated return for asset i (ERi) as a perform of the risk-free rate of interest (Rf) plus the systematic threat (beta) of asset i (βi) multiplied by the market threat premium (ERm − Rf).

Briefly: excessive beta (riskier) shares ought to be anticipated to have larger returns than low beta (much less dangerous) shares.

Actuality performs out in a different way.

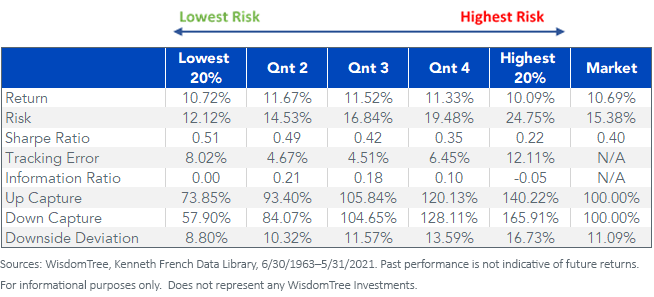

The very best beta shares—the 20% of shares with the very best beta—have lagged the market, and the bottom beta shares—lowest 20%—by 60 foundation factors (bps) and 63 bps, respectively, since 1963.

Quintile Portfolios Sorted by Beta

For definitions of phrases within the chart, please go to the glossary.

Numerous papers have been written with the purpose of bettering this mannequin. However one of many central causes it’s nonetheless taught in Finance 101, except for its ease in calculating, is the significance of its important assumption: in a world of environment friendly markets, riskier shares ought to outperform much less dangerous shares.

This worldview was the launching level for elements like dimension (SMB) and worth (HML) that have been added as enhances to market beta within the seminal three-factor mannequin paper by Eugene Fama and Kenneth French1.

ERi = Rf + β1 (ERm − Rf) + β2 (SMB) + β3 (HML) + α + ε

Fama-French argued that riskier shares do certainly outperform much less dangerous shares, however that market beta isn’t an all-encompassing variable for riskiness.

Worth shares and smaller-cap shares signify threat premiums that improved the statistical significance of the CAPM mannequin in explaining returns.

The High quality Issue: What Is it and Why Does it Exist?

A further educational issue that has gained vital following within the funding group is high quality. In contrast to market beta, dimension and worth, it doesn’t have a simple risk-based story.

Excessive-quality firms—firms with excessive earnings, low debt, low variability in earnings—ought to be extremely valued relative to low-quality firms, leading to decrease anticipated returns.

From a threat perspective, high quality firms have had decrease down seize than the market and decrease draw back deviation. These are traits that loss-averse traders ought to want, and thus environment friendly markets would compensate with below-market returns.

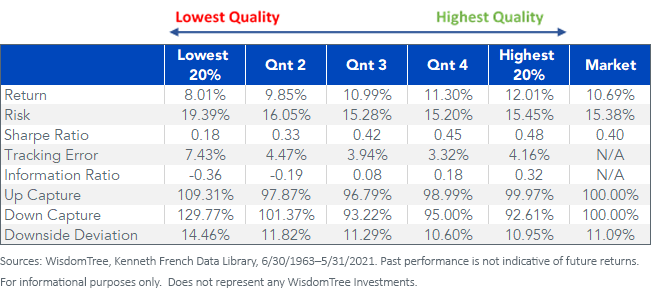

The anomaly of higher-quality shares, measured right here by working profitability, outperforming lower-quality shares by 400 bps annualized seems to be like a case of “a free lunch.”

Quintile Portfolios Sorted by Working Profitability

One concept explaining the anomaly is that these shares could also be riskier, however the threat is harder to look at utilizing measures like commonplace deviation.

For instance, maybe extra of their worth comes from distant earnings, making them extra delicate to fluctuations in rates of interest and/or uncovered to assembly lofty earnings development expectations.

An alternate, extra generally accepted, concept is that traders have an array of behavioral biases that trigger them to be under-weight in high quality shares2. For instance:

- Conservativism bias suggests traders are sluggish to replace their opinions/forecasts primarily based on new info, like robust or weak earnings

- Overconfidence bias could lead on traders to over-weight their forecast of future earnings prospects over present income

- Affirmation bias leads individuals to disregard new info that contradicts earlier beliefs

Defining High quality

The standard issue is topic to better differentiation in definition than elements like beta, worth and dimension.

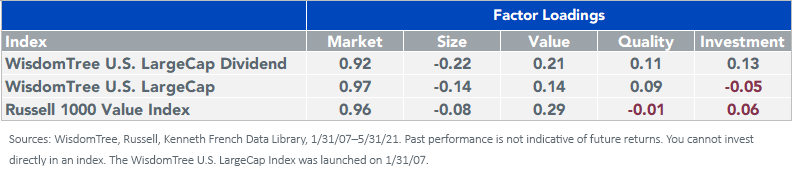

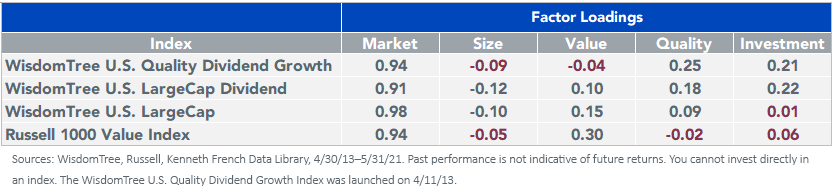

At WisdomTree, our dividend- and earnings-weighted indexes have been constructed with value-focused tilts to larger dividend yields and decrease P/E ratios, respectively. As a by-product of their cash-flow primarily based methodologies, each have had statistically vital publicity to high quality (crimson numbers within the desk under point out statistically insignificant issue loadings).

This contrasts with the damaging publicity to high quality usually present in worth indexes that target price-to-book, just like the Russell Worth indexes.

Fama-French Issue Loadings (Chart 1 of two)

For definitions of indexes within the chart, please go to our glossary.

WisdomTree U.S. High quality Dividend Progress Index (WTDGI)

WisdomTree U.S. LargeCap Dividend Index

WisdomTree U.S. LargeCap Index

Fama-French Issue Loadings (Chart 2 of two)

For definitions of indexes within the chart, please go to our glossary.

Conclusion

In a market surroundings the place sure “meme shares” are clearly buying and selling with out regard to fundamentals like earnings, maybe we’re seeing a real-time instance of how behavioral biases could cause some traders to be under-exposed to high quality of their portfolios.

Initially revealed by WisdomTree, 7/8/21

1 Fama, Eugene F., and Kenneth R. French. “The Cross-Part of Anticipated Inventory Returns.” The Journal of Finance, vol. 47, no. 2, 1992, pp. 427–465.

2 Thesmar, David & Bouchaud, Jean-Philippe & Stefano, Ciliberti & Landier, Augustin & Simon, Guillaume, 2016. “The Extra Returns of ‘High quality’ Shares: A Behavioral Anomaly,” HEC Analysis Papers Collection 1134, HEC Paris.

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which accommodates funding aims, dangers, costs, bills, and different info; learn and think about fastidiously earlier than investing.

There are dangers concerned with investing, together with attainable lack of principal. International investing includes forex, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms might expertise better value volatility. Investments in rising markets, forex, fastened revenue and different investments embrace further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency isn’t indicative of future outcomes. This materials accommodates the opinions of the creator, that are topic to vary, and may to not be thought-about or interpreted as a suggestion to take part in any specific buying and selling technique, or deemed to be a proposal or sale of any funding product and it shouldn’t be relied on as such. There isn’t any assure that any methods mentioned will work below all market situations. This materials represents an evaluation of the market surroundings at a particular time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety particularly. The consumer of this info assumes the complete threat of any use manufactured from the data supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax or authorized recommendation. Buyers looking for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly said in any other case the opinions, interpretations or findings expressed herein don’t essentially signify the views of WisdomTree or any of its associates.

The MSCI info might solely be used on your inside use, might not be reproduced or re-disseminated in any kind and might not be used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a suggestion to make (or chorus from making) any sort of funding resolution and might not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the consumer of this info assumes the complete threat of any use manufactured from this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Celebration have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or some other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Companies, LLC.

WisdomTree Funds are distributed by Foreside Fund Companies, LLC, within the U.S. solely.

You can’t make investments immediately in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.