Commercial actual property has been dramatically altered by the coronavirus pandemic. Lots of these modifications will probably be long-lasting.

As such, traders could not need to depend on conventional actual property alternate traded funds, which are sometimes sluggish to react to seismic shifts. The ALPS Energetic REIT ETF (NASDAQ: REIT) is an concept for traders when searching for funds with the potential of evolving with the brand new actual property order.

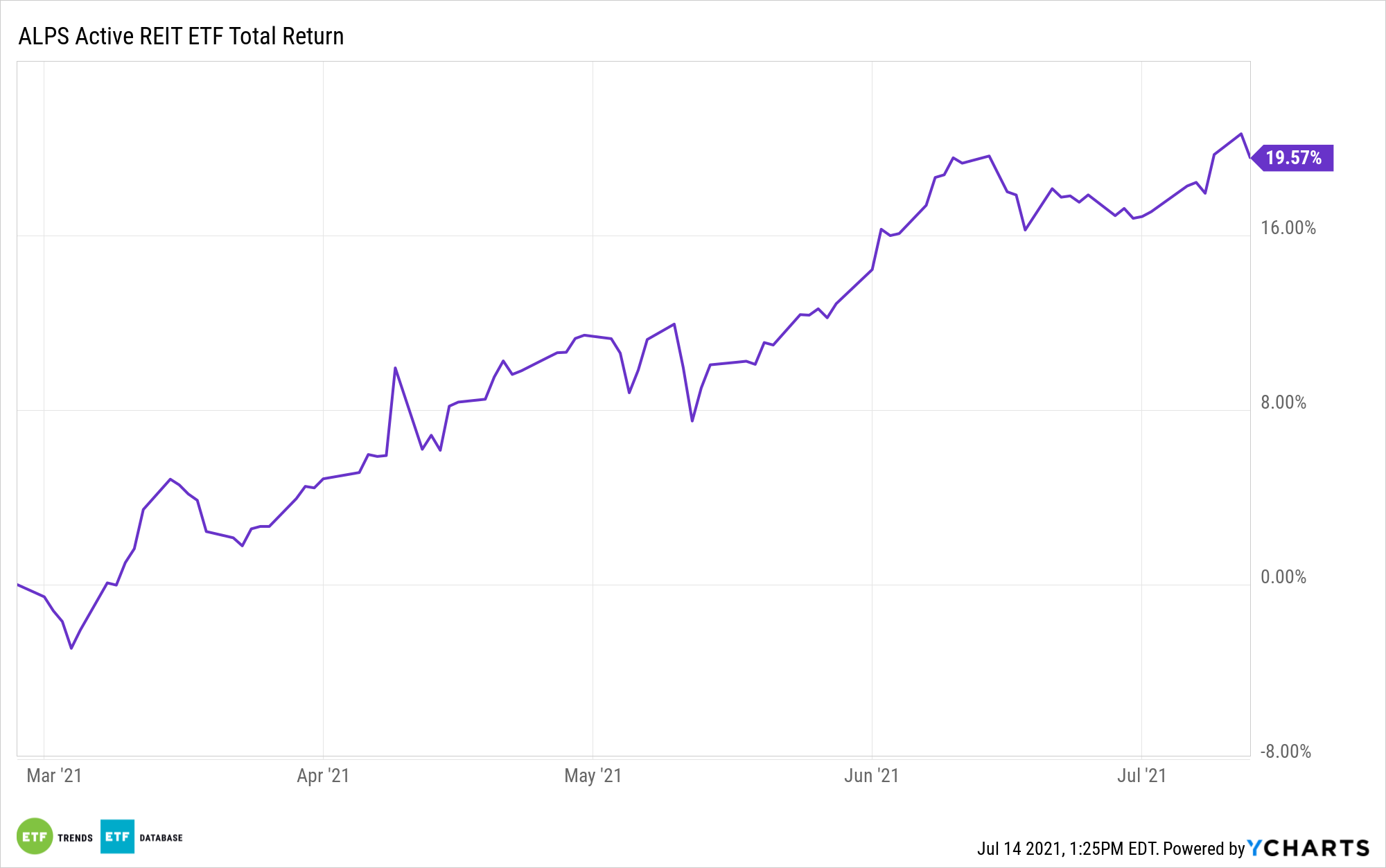

REIT, which is among the extra profitable sector ETFs that debuted within the first half of this 12 months, is actively managed, which means it could possibly extra effectively transition to extra compelling corners of the actual property sector whereas avoiding these which may be laggards.

Lately, one of many prime locations to be within the REIT universe is industrial or warehouse REITs – a class some conventional passive actual property ETFs merely do not present sufficient publicity to.

“Emptiness charges in industrial buildings are close to a report low and new warehouses can’t get constructed rapidly sufficient to satisfy the wants of clothes makers, furnishings sellers and residential equipment producers,” experiences Ari Levy for CNBC. “Actual property agency CBRE stated in its first-quarter report on the economic and logistics market that just about 100 million sq. ft of area was absorbed within the interval, the third-highest quantity ever, and {that a} report 376 million sq. ft is below building.”

REIT Has the Proper Stuff

What makes publicity to industrial REITs compelling is that this phase was taking off previous to the coronavirus pandemic. Whereas the well being disaster quickly accelerated adoption of on-line retail, many shoppers are discovering they like that means of shopping for every part from important groceries to non-public electronics.

But it is not simply e-commerce corporations that underscore the advantages of allocating to industrial actual property. An vital corporate-level lesson from the pandemic is that world provide chains are important, and when disaster strikes, relying an excessive amount of on worldwide markets is problematic. As such, extra corporations are shifting some manufacturing and space for storing again to the U.S., boosting demand for warehouses within the course of.

“Retailers responded by securing extra space for storing to mitigate the impression of future shocks, stated James Koman, CEO of ElmTree Funds, a non-public fairness agency targeted on industrial actual property,” in line with CNBC.

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.