Did you hear Joe Biden’s huge announcement?

He not too long ago signed an govt order for half of all new automobile gross sales in America to be electrical by 2030.

That is nice information for electrical automakers like Tesla, proper?

Simply as gas-guzzling vehicles made early Ford and GM shareholders wealthy, the transition to electrical autos will do the identical for a brand new class of electrical automobile (EV) shares.

However I don’t advocate shopping for Tesla, or every other automaker, at the moment.

There’s an much more profitable approach to revenue from the approaching electrical automobile growth. One that can allow you to earn money irrespective of who wins the EV race.

This inventory has already handed Disruption Investor members 183% good points. And my analysis reveals it may triple from right here as electrical vehicles go mainstream.

Do you know EV gross sales are smashing every kind of information?

Three million new battery-powered vehicles have been bought final yr, a 41% leap over 2019.

That’s much more spectacular when you think about gross sales of gasoline guzzlers fell 16%. This momentum has continued into 2021, with gross sales within the first quarter quadrupling.

There are actually a report 10 million electrical vehicles driving on the world’s roads.

Elon Musk’s Tesla has been the one sport on the town with regards to high-performance electrical autos. It’s additionally been one of many best-performing shares over the previous two years, handing out 1,400% good points.

Now the previous guard is lastly leaping into the ring.

Ford’s electrical F-150 truck goes on sale subsequent yr. The primary battery-powered Cadillac is anticipated to hit the roads in 2022, as nicely. GM will debut a chargeable Hummer later this yr. And get this… Mercedes-Benz introduced it’s going all-electric by 2030.

So which auto inventory do you have to purchase?

Tesla?

Ford… Toyota… GM?

The reply is none of them.

You wish to personal the disruptor fueling a lot of the EVs driving on American roads at the moment…

While you pop the hood on an electrical automobile, you received’t discover an engine.

They run on batteries, just like the one in your smartphone… solely 10,000X extra highly effective.

The battery is by far probably the most important a part of an EV. It determines how far you may drive earlier than you need to “refuel” at a charging station.

A decade in the past, most EVs couldn’t journey 70 miles earlier than you needed to plug them right into a socket. And it took as much as eight hours to totally cost.

In the present day high-end EVs like Tesla’s Mannequin S go nicely over 300 miles earlier than you need to plug them in. And Tesla’s new superchargers can fill the battery as much as 85% in below an hour!

In brief, huge breakthroughs in battery know-how are the explanation there are actually 10 million EVs driving on the world’s roads.

One important steel made these achievements doable.

Batteries highly effective sufficient to run a automobile for 300 miles should be capable to retailer large quantities of vitality. However additionally they must be comparatively light-weight.

There’s at all times a tradeoff between measurement and energy with batteries. It might be nice in case your mobile phone held sufficient energy to final an entire month. However the battery could be the dimensions of your fridge.

This tradeoff made lithium—the world’s lightest steel—the proper “gasoline” for electrical vehicles.

Lithium-ion batteries have been round for many years. They energy our wi-fi earbuds, smartphones, and laptops. However now, we’re shifting from phone-sized batteries to car-sized batteries.

Take Tesla’s Mannequin S, for instance. There are roughly 140 lbs of lithium inside its battery.

Bear in mind, thus far, Tesla has been on their lonesome within the high-performance electrical automobile area. Quickly, each automaker on the planet will take part. We’re already seeing it occur with Ford, GM, and Toyota. And so they’ll all want to purchase boatloads of lithium.

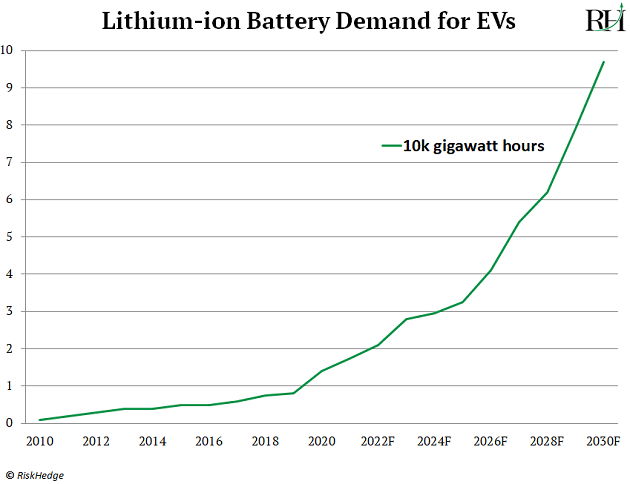

The truth is, by 2030, electrical autos will want as a lot lithium as 250 billion iPhone batteries. That’s a 14X spike in comparison with all of the lithium the world makes use of at the moment!

Supply: BloombergNEF

These projections are seemingly too conservative given Biden’s new plan for electrical vehicles to make up half of all new automobile gross sales in simply 9 years.

Europe not too long ago introduced it desires to ban gasoline guzzlers by 2035 too.

In brief, we’re going to want much more lithium…

Albemarle (ALB), the world’s largest producer of lithium, jumped 10% the day Biden signed his govt order.

Longtime readers know Albemarle is one in all my favourite disruptor shares. The corporate controls 25% of the lithium market and owns the purest lithium mines on the planet.

Bear in mind… carmakers like GM, Ford, and Tesla are going to want truckloads of battery-grade lithium over the approaching decade. Albemarle will likely be their prime provider.

In keeping with high evaluation agency Benchmark Mineral Intelligence, lithium demand will outstrip provide by 200,000 tons over the subsequent 4 years. Lithium costs have already doubled this yr, surging to their highest ranges since late 2018.

Albemarle is constructing two new lithium processing vegetation, which can double its output by the tip of subsequent yr. It’s additionally ramping up operations at its Nevada mine, the one supply of US lithium in manufacturing at the moment.

Disruption Investor subscribers are sitting on a 183% acquire in ALB after accounting for our “free trip.” (A free trip is a method I exploit when one in all my shares shoots up 100%+. The concept is you promote sufficient of a profitable commerce to recoup your authentic stake… and let the remainder “trip without spending a dime.”)

These good points present the facility of proudly owning nice disruptive companies. Common RiskHedge readers know disruptors often invent the longer term and rework complete industries.

Albemarle virtually invented the marketplace for battery-grade lithium. This has allowed it to quickly develop gross sales and seize all of the upside for itself and shareholders. Investing in nice disruptors permits you to sit again and accumulate earnings as they alter the world.

Albemarle is the #1 approach to revenue as EVs take over our roads. As I’ve talked about earlier than, Tesla makes the perfect electrical vehicles available on the market. However selecting a winner within the auto business is extraordinarily laborious.

By proudly owning Albemarle, we don’t must again a horse on this race. We’ll earn money whether or not Tesla, Ford, or GM comes out on high.

Initially printed by Mauldin Economics, 8/16/21

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.