All eyes are on the election, what the outcome will likely be and what's going to occur in its afte

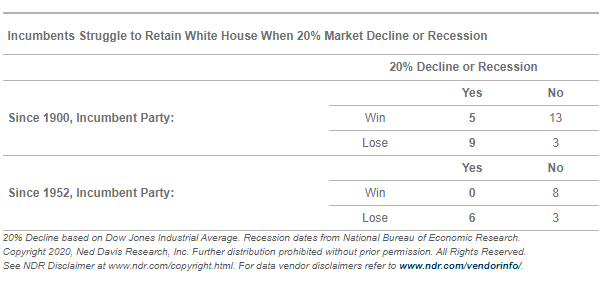

All eyes are on the election, what the outcome will likely be and what’s going to occur in its aftermath. Based on evaluation from our companions at Ned Davis Analysis, since 1952, the incumbent get together has not received when there was both a 20% decline available in the market or a recession within the election yr—each of which occurred in 2020.

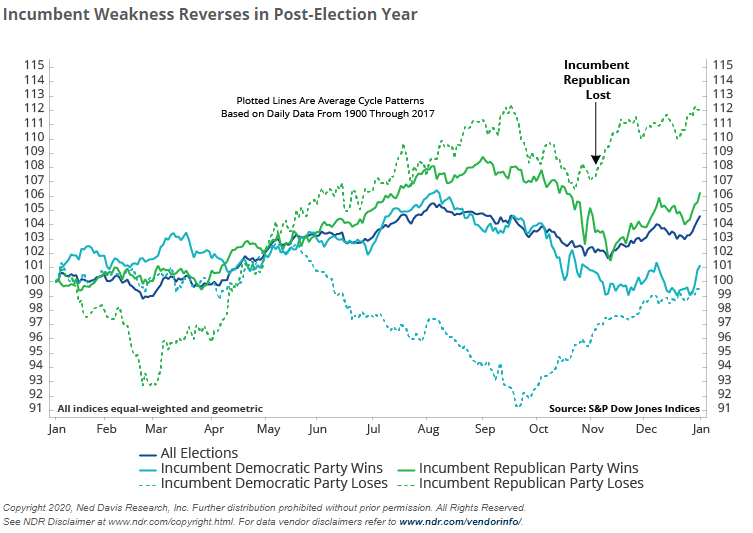

Traditionally, though an incumbent Republican loss doesn’t sometimes end in a good consequence for the marketplace for the remainder of the election yr, markets have had their strongest performances within the following yr.

Whereas we are able to look to those historic traits for some perception, 2020 has additionally been removed from typical. In opposition to this uncertainty, buyers could also be seeking to perceive the potential affect on their funding portfolios.

CEO Jan van Eck typically reminds buyers that it’s onerous to take a position in accordance with politics, so they need to ignore the political noise and decide if there may be going to be a coverage change earlier than shifting property round. In our view, no matter who’s elected, the Federal Reserve (Fed) is unlikely to make a serious coverage shift. We additionally consider a excessive diploma of confidence within the financial restoration must be in place earlier than a fiscal shock like a big tax improve turns into a chance.

To offer buyers additional steerage on how you can handle their portfolios by means of the rest of the yr, we spoke to a bunch of our skilled funding professionals to assemble their insights on what to look out for of their respective asset courses.

What points across the election could have the most important affect in your outlook?

JOE FOSTER, PORTFOLIO MANAGER, GOLD STRATEGY: The election doesn’t materially change our outlook for a powerful gold bull market pushed by extraordinary ranges of systemic, monetary and financial dangers. Regardless of who’s in workplace, the challenges of the pandemic, monumental debt ranges, financial weak point and social dysfunction will likely be overwhelming. Nevertheless, a Democratic sweep would possibly convey these dangers ahead. Democrats have a tendency to lift taxes, improve rules, and improve deficit spending past what Republicans would possibly convey. This may create an extra drag on financial progress.

DAVID SEMPLE, PORTFOLIO MANAGER, EMERGING MARKETS EQUITY STRATEGY: For rising markets, the 2 most vital points could be the potential change in U.S.-China relations and the potential affect of upper stimuli and/or election outcome uncertainty on the greenback. For the previous, our base case is {that a} Biden-led administration could initially be extra China pleasant, merely as a result of a extra multilateral and predictable method to coverage. We additionally count on extra concentrate on human rights. For the latter, we are able to clearly see the lengthy finish of the U.S. bond market shifting to accommodate expectations of Democratic wins, however we expect probably the most palpable affect on rising markets fairness is probably going the continued latest development of a weaker greenback. One of many causes for relative lack of enthusiasm for rising markets equities has been the choice sights of the tech-led U.S. fairness market. If Democrats increase company taxes, discourage purchase backs and work to curtail massive tech dominance, rising markets equities could seem comparatively extra enticing.

ERIC FINE, PORTFOLIO MANAGER, EMERGING MARKETS BOND STRATEGY: A very powerful election-related problem for rising markets debt is its affect on U.S. fiscal coverage. Most election outcomes are anticipated to end in a post-election stimulus program, and we are inclined to agree. A fiscal stimulus would have the impact of supporting international financial progress and danger sentiment, a minimum of within the near-term. One danger to stimulus, although, could be a Biden victory with the Senate remaining Republican, as funds reconciliation within the Senate may stymie the large stimulus markets need. The opposite massive election-related problem is the U.S. relationship with China, the place any change could also be in tone solely, given the broadening nationwide safety dimension to that relationship. Additionally, our market will likely be seeking to the potential of new sanctions on Turkey or Russia in a Biden victory, and the chance that human rights points may rise in prominence for different bilateral relationships.

FRAN RODILOSSO, CFA, HEAD OF FIXED INCOME ETF PORTFOLIO MANAGEMENT: For rates of interest the most important query is probably going the election’s affect on the probability for an enormous fiscal stimulus in 2021. In that sense a “blue wave” that covers the Presidency and the Senate will seemingly spur greater charges and a steeper curve. A break up outcome or a pink sweep would seemingly maintain charges decrease within the close to time period because the market waits for extra data. For credit score markets the election could matter lower than the affect of a COVID-19 surge, and information round vaccine growth and rollout timing. After all, a closely disputed election will damage credit score, maintain downward strain on charges and would possibly assist keep the latest development of greenback weak point. That might be blended information for rising markets debt.

JIM COLBY, PORTFOLIO MANAGER AND STRATEGIST, MUNICIPAL BONDS: Both manner, a Republican or Democratic sweep of the Presidency, Senate and Home could have a serious directional affect. For tax exempt securities, a Democratic sweep is more likely to help and enhance curiosity and valuations. The tax legislation from 2017 is perhaps repealed, making municipal bonds extra enticing on an after tax comparability. A Republican sweep will not be good for small counties and municipalities, which aren’t more likely to obtain the monetary help they should maintain workers on the payrolls and pay debt obligations.

SHAWN REYNOLDS, PORTFOLIO MANAGER, NATURAL RESOURCES EQUITY STRATEGY: Tax, regulatory, and commerce insurance policies underpinning wholesome and sustainable financial progress could have the most important affect on the outlook for pure sources and commodities. Sturdy underlying financial exercise nonetheless depends on authorities fortifying circumstances conducive to progress. Regardless of lingering international commerce tensions, we consider the irrepressible forces of globalization proceed to disclose themselves within the resilient pricing for such commodities as iron ore, soybeans and crude oil. Vitality transition incentives will stay a key theme.

What do you view as the most important dangers and alternatives by means of the tip of the yr?

SEMPLE: Progress on a vaccine and the result of the U.S. election are widespread components for all asset courses. China’s ongoing restoration and close to normalization could also be higher appreciated if the main focus within the U.S. is on home points. Continued indicators of reviving mobility—with or with out enhancing medical information—bode fairly nicely for a lot of rising markets international locations.

COLBY: One of many greatest dangers is a contested election, the place the result is so shut that no legislative help (stimulus) is forthcoming. This will imply the 11-15 million unemployed can not get monetary help as winter approaches, whereas COVID-19 continues to develop.

FOSTER: The largest danger is an in depth, contested election that may additional divide the nation and trigger an additional deterioration within the U.S.’s standing within the worldwide group. The greenback is perhaps weak to a sell-off. The largest alternative is the weak point within the gold worth because it consolidates beneath its all-time highs. We consider the dangers outlined above will permit gold to rise to new highs in 2021.

REYNOLDS: Continued short-term pandemic restoration and stimulus applications might be helpful. Nevertheless, many drivers of optimistic progress are already in place and will proceed to help demand progress of primary sources. New stimulus that’s not exactly focused might be critically damaging to funds deficits. One concern is that the underinvestment that is been happening in conventional power, oil and fuel, has been so substantial that as we get to the again half of 2021, we’d have an imbalance the opposite manner the place provide will not be assembly a rebounding demand.

RODILOSSO: Higher than anticipated international progress circumstances could spark a extra sustained rally in rising markets. These are locations the place there may be extra danger priced in vs developed markets, with reference to each charges and credit score spreads. The largest danger mendacity forward often is the market realization that 2020 has caused not simply an growth of central financial institution stability sheets however of company debtors as nicely. The a part of the Fed response to circumstances this yr that sought to calm credit score markets has additionally led to an aggressive spate of latest issuance. Firms have added entry to liquidity that they badly wanted, however they’ll emerge with greater leverage on common, and that provides to the dangers in fact, particularly if progress circumstances flip downward once more.

FINE: The largest danger by means of year-end stays the second COVID-19 wave. The associated hit to international progress and danger sentiment comes when lots of our asset costs are at post-COVID highs. The context for this danger is that the majority international locations elevated money owed and deficits, and progress had exhibited a V-shaped restoration till latest weeks. The chance is that this will likely be a second wave of one thing the market has already handled, so it might be mistaken to count on a repeat of the market’s preliminary response to COVID. Additionally, earlier than year-end, we seem set to get optimistic vaccine headlines, which needs to be very positively obtained by the economic system and markets (nonetheless advanced and prolonged the final word supply to rising markets populations). We see rising markets native currencies benefitting particularly from U.S. fiscal stimulus mixed with eventual vaccine headlines, with Mexico and South Africa being higher-beta beneficiaries. We additionally see many winners in a various array of rising markets hard-currency debt.

What ought to buyers contemplate allocating to now?

FOSTER: We live in a rare period of heightened dangers. Because the Tech bust in 2000, monetary dangers have been rising. Geopolitical dangers have been rising since 9/11, and for the reason that Russians invaded Crimea and the Chinese language started occupying the South China Sea. There have been rising ranges of social dangers introduced on by revenue disparity for the reason that monetary disaster and racial unrest. Gold responds to widespread systemic dangers—dangers that adversely affect the monetary system, economic system and general well-being. We don’t see these dangers abating anytime quickly, and we consider these dangers will drive gold to new highs within the coming years. We count on gold shares to considerably outperform gold as gold firms carry earnings leverage to gold. We consider the miners are financially strong with robust money flows and rising dividend payouts.

SEMPLE: Rising markets seem underowned and underappreciated. Bifurcation between the international locations with giant scale and/or innovation will proceed, however general, restoration is solidifying. Many areas look low cost versus different asset courses each domestically and internationally. A greater U.S.-China relationship and lack of options could put a hearth beneath low cost rising markets equities and currencies for 2021.

FINE: Most investor eventualities going out a number of years contain low rates of interest within the developed markets. You possibly can’t actually get excessive nominal or actual yields there. You understand the place you’ll find excessive nominal and actual yields? Within the rising markets. The yield on USD denominated J.P. Morgan Rising Markets Bond Index International Diversified is 4.19%, and the yield on the extra risky EMFX-denominated J.P. Morgan Authorities Bond Index International Diversified is 4.44%.[1] We like each USD- and EMFX-denominated bonds proper now, and each give a considerable pickup in a yield-starved world. Many rising markets economies, furthermore, have stronger fundamentals than you would possibly assume, with a lot decrease authorities debt-to-GDP, for instance.

REYNOLDS: The present and possible extra large financial and monetary stimulus applications world wide have a number of potential outcomes that we consider recommend publicity to pure sources could also be helpful right now. First, if these stimulus applications serve to revive financial exercise to pre-pandemic ranges, we might count on demand for primary sources to speed up. Importantly, the markets for a lot of of those commodities stay strong regardless of the demand response from the disaster suggesting that offer rationalization has additionally occurred. Thus, a rebound in demand may tighten these markets considerably. Second, it’s clear, in our view, that governments are ready so as to add additional stimulus and help if the disaster lingers. We consider such exponential will increase within the provide of cash creates a large coiled spring of inflation that might be launched because the dampening results of the pandemic are alleviated. Lastly, in our opinion, most of the firms and industries we put money into are poised to learn from multi-year restructuring applications which have created compelling funding potential. In fairly a number of of those, they’ve established an especially resilient technique that’s resulting in very giant and sustainable money era which is being returned to shareholders, making these firms/industries among the many greatest available in the market concerning dividend yields.

RODILOSSO: The seek for yield seems to be in place for some time nonetheless. At present ranges for Treasuries, and with about $14 trillion value of bonds yielding lower than 0% globally, demand for greater yielding property is more likely to stay sturdy. The volatility earlier this yr is a stern reminder of the chance that comes together with greater spreads. However patiently including to danger asset courses throughout the fastened revenue universe has usually been a very good method over the previous decade. We see additional alternatives in coming months amid COVID-19 and U.S. election associated volatility to tactically add to excessive yield and rising markets—onerous and native forex—allocations. We’ve just lately seen elevated consideration paid to Chinese language authorities, coverage financial institution and prime quality company bonds. With native yields greater than 230 foundation factors above the U.S. curve, and with China main the early international financial restoration, the carry and forex prospects each help the case for an allocation. And inside excessive yield we proceed to consider that fallen angel methods are comparatively enticing as a result of a mixture of high quality (i.e., excessive BB allocation) and opportunistic shopping for (of just lately downgraded fallen angel bonds) that has labored nicely relative to different excessive yield methods year-to-date.

COLBY: Attributable to traditionally excessive issuance this final half-year, buyers want to concentrate on the rising attractiveness of each excessive yield and funding grade municipal bonds. As the speed of absorption slows, the 7-30 yr a part of the yield curve has change into very enticing for buyers, in comparison with different asset courses. We consider this will likely be true no matter election outcomes.

Be taught extra about our method to investing in these asset courses:

Initially printed by VanEck, 10/29/20

DISCLOSURES

1 Supply: JP Morgan. Knowledge as of 9/30/2020. J.P. Morgan Rising Markets Bond Index International Diversified tracks whole returns for U.S. greenback denominated debt devices issued by rising market sovereign and quasi-sovereign entities. J.P. Morgan Authorities Bond Index International Diversified (GBI-EM GD) tracks native forex bonds issued by rising markets governments.

Please be aware that Van Eck Securities Company (an affiliated broker-dealer of Van Eck Associates Company) could supply investments merchandise that put money into the asset class(es) or industries included on this weblog.

This isn’t a suggestion to purchase or promote, or a advice to purchase or promote any of the securities/monetary devices talked about herein. The data offered doesn’t contain the rendering of personalised funding, monetary, authorized, or tax recommendation. Sure statements contained herein could represent projections, forecasts and different ahead trying statements, which don’t mirror precise outcomes, are legitimate as of the date of this communication and topic to alter with out discover. Info supplied by third get together sources are believed to be dependable and haven’t been independently verified for accuracy or completeness and can’t be assured. The data herein represents the opinion of the writer(s), however not essentially these of VanEck.

All investing is topic to danger, together with the attainable lack of the cash you make investments. As with every funding technique, there isn’t any assure that funding aims will likely be met and buyers could lose cash. Diversification doesn’t guarantee a revenue or shield towards a loss in a declining market. Previous efficiency is not any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.