As firms throughout industries try to cut back their carbon emissions, some corporations have taken to releasing their inside ESG evaluations in a bid for transparency. One such firm is The Residence Depot, which launched its annual ESG report right this moment, revealing a number of sudden wins and new targets.

The Residence Depot (HD) is the world’s largest dwelling enchancment firm. Within the newest report, Residence Depot introduced that it had lowered Scope 1 and Scope 2 carbon emissions by greater than 127,000 metric tons, amounting to a 22% discount in carbon depth.

In that very same time-frame, the enterprise nonetheless grew an extra 20%, proving that an organization might each decrease carbon footprint and preserve sturdy development.

The Residence Depot has additionally introduced that it deliberate to transform all of its services to 100% renewable electrical energy by 2030. Additionally, the corporate has joined the Science Based mostly Targets Initiative, which seeks to cut back international emissions, as nicely.

“Our dedication to lowering our affect on the planet, caring for our folks, and constructing robust, sustainable communities is foundational to who we’re,” stated Craig Menear, chairman and CEO of The Residence Depot in a press launch.

“Greater than 40 years in the past, our founders gave us eight core values that proceed to information our enterprise right this moment. The progress we made in 2020 demonstrates the dedication of our associates and suppliers to those values, as they prioritized caring for our associates, clients and communities, in addition to the surroundings, whereas navigating a yr not like another,” Menear stated.

Low Emissions Investing with ‘LOWC’

As firms worldwide make strides towards lowering their carbon footprints, the corporations which have already begun to implement higher emissions practices could have a leg up on the competitors.

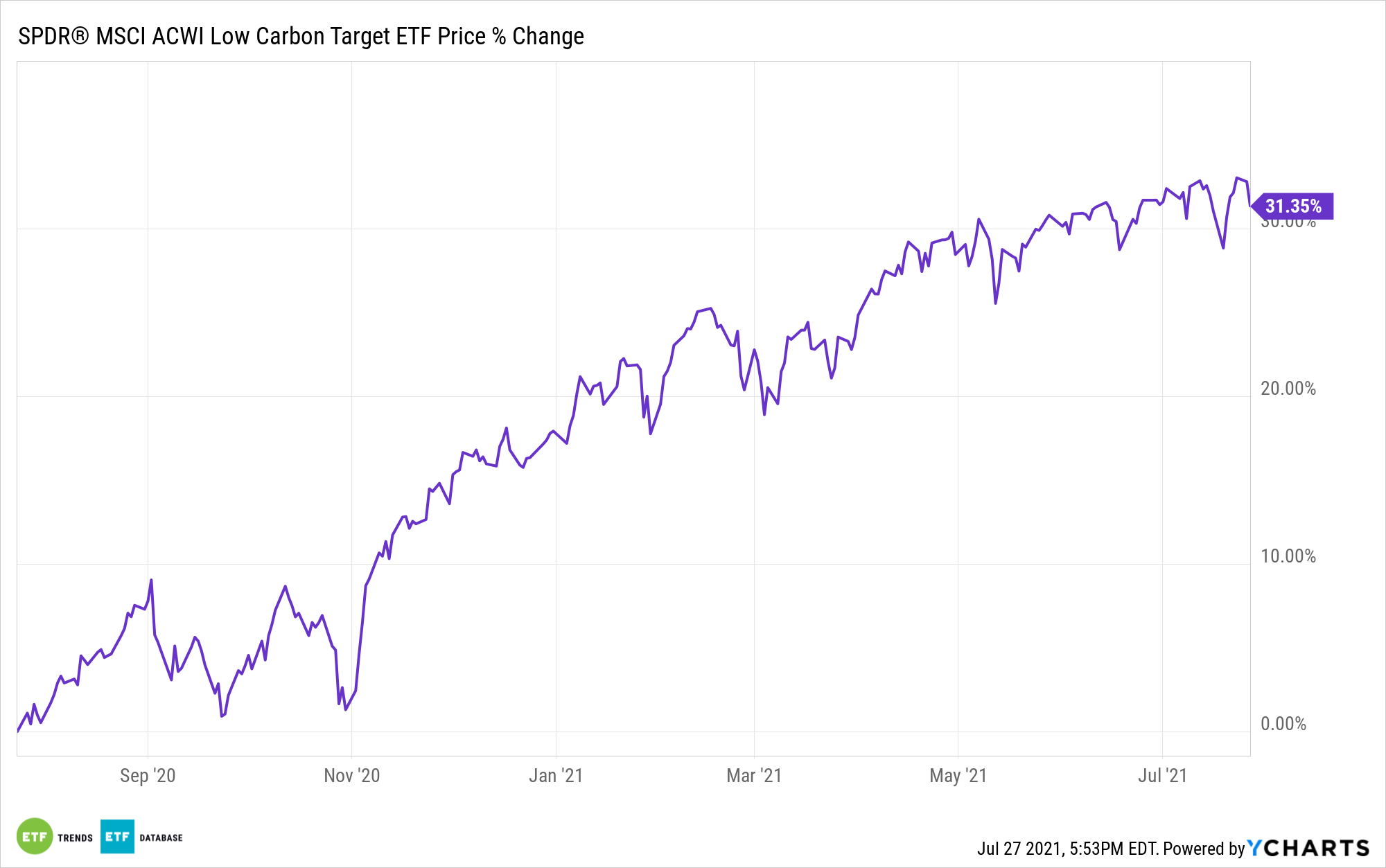

The SPDR MSCI ACWI Low Carbon Goal ETF (LOWC) provides traders publicity to firms with low carbon emissions and fossil gas reserves.

The fund tracks the MSCI ACWI Low Carbon Index. It’s an index that re-weights securities within the MSCI All-Nation World Index (ACWI) to favor decrease carbon emissions, in addition to these firms with smaller or no fossil gas reserves.

The benchmark overweights firms with low carbon emissions relative to gross sales, and in addition firms with low potential carbon emissions, providing decrease carbon publicity when in comparison with the broad market.

LOWC’s holdings embody The Residence Depot (HD) at 0.512% weight, in addition to Apple (AAPL) at 3.72% weight and Microsoft (MSFT) at 3.06% weight.

The ETF carries an expense ratio of 0.20%.

For extra information, info, and technique, go to the ESG Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.