The challenge of inflation and

The challenge of inflation and the resurgence of worth inventory ETFs are two scorching matters midway into 2021.

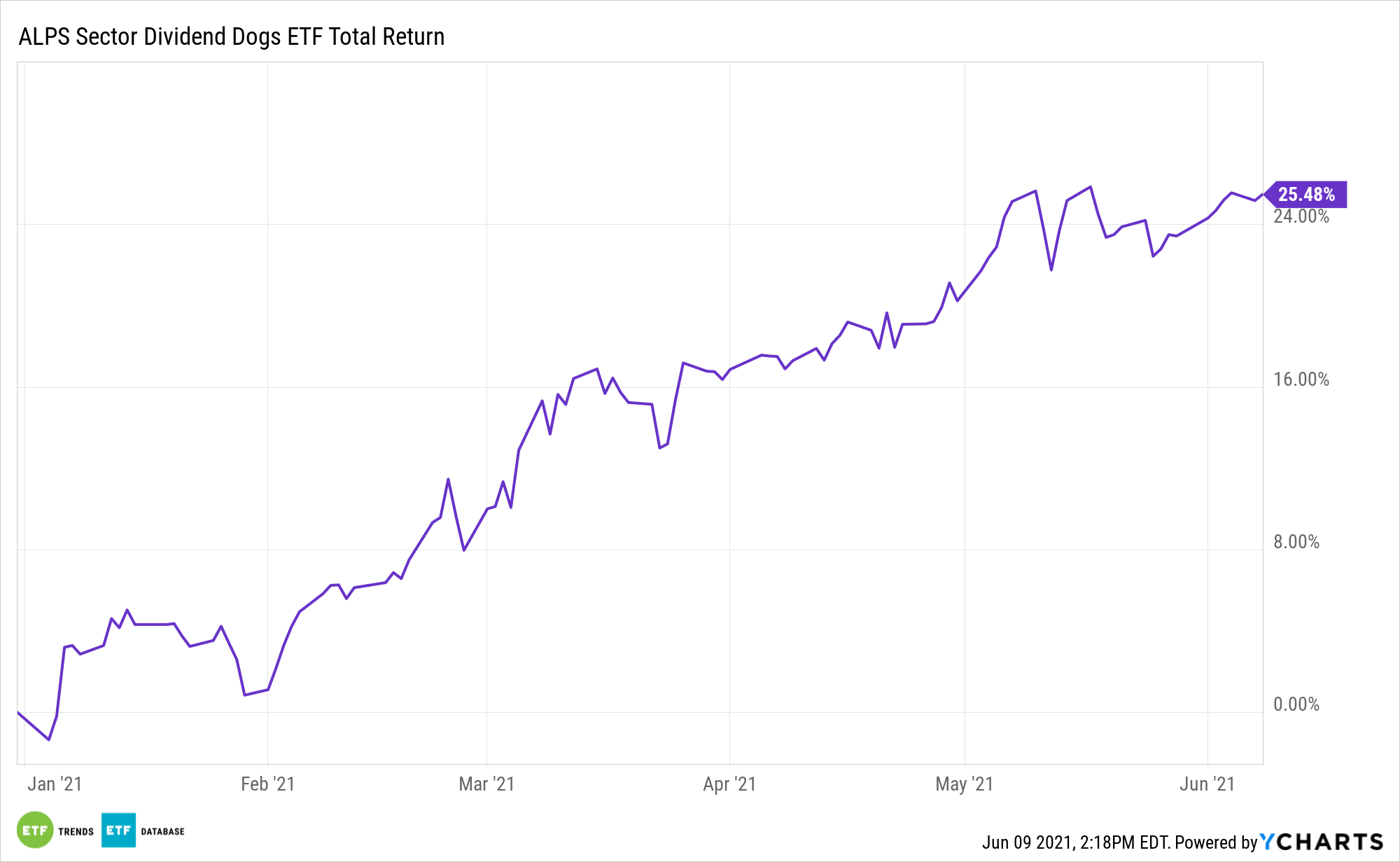

Both state of affairs may benefit the ALPS Sector Dividend Canines ETF (SDOG). The ETF is increased by over 25% year-to-date. That places it forward of the S&P 500 by greater than 1,100 foundation factors.

An apparent motive for SDOG’s dominant exhibiting this 12 months is its ample cyclical worth publicity. The cyclical sectors embrace shopper discretionary, monetary providers, supplies, and actual property. SDOG equally weights its sector exposures, allocating over 30% of its roster to shopper cyclical, financials, and supplies fare (actual property is excluded from the fund). That is a wholesome benefit over the 26.6% the S&P 500 devotes to these sectors.

Inflation Serving to SDOG’s Case Too

Excessive-dividend shares have traditionally been successful inflation-fighting property.

“When bond yields rise, buyers who need a suitable yield on revenue investments hunt down shares with increased yields as a house for no matter cash they’ve out there for equities. Corporations paying increased dividends match the invoice, to allow them to appeal to further shopping for curiosity that lifts their costs,” studies Jacob Sonenshine for Barron’s.

Indicating that there is some round reasoning at play for SDOG within the present surroundings, lots of the sectors that traditionally carry out effectively when inflation arrives are cyclical teams as a result of it is typically a strengthening financial system that stokes inflationary fears within the first place. Cyclical sectors, akin to shopper discretionary and supplies, are levered to enhancing financial settings.

“And through three of the 4 main intervals when worth shares outperformed development in current a long time—2016, 1992, and the early 2000s—corporations with excessive dividends outpaced these providing much less,” Barron’s studies, citing Cirrus Analysis.

Another level in SDOG’s favor is dividend will increase. Whereas the fund is positioned as a high-dividend technique, loads of its parts have enviable dividend improve streaks and that is related as a result of payout development traditionally tops inflation. Over 1 / 4 of SDOG’s holdings additionally reside within the S&P 500 Dividend Aristocrats Index, which requires members companies to have dividend improve streaks of 25 years.

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.