For all the talk of wage inflation and supply chain snarls, S&P 500 profit margins keep rising, reaching 15% during third quarter earnings season.

The doom and gloom predictions that hyperinflation will hit the U.S. has at least one glaring flaw: it seems to take no account of the two-decade trend of higher worker productivity and technological breakthroughs that have helped deliver low inflationary readings.

[wce_code id=192]

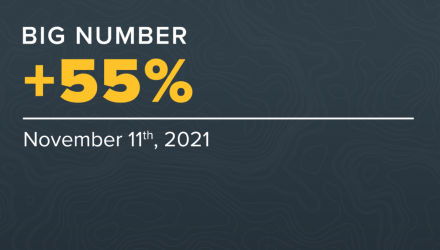

Third quarter corporate earnings reports throw a wrench in the hyperinflation viewpoint. Companies may be complaining about rising costs, but the numbers say they’re successfully managing through it, suggesting that productivity and technology are a potent combination that’s offsetting higher prices for raw materials, shipping or wages.

The operating profit margin for the S&P 500, and a subset of the index that excludes the financial sector, climbed to multi-year highs this week.

Granted, some companies are passing along higher costs to their customers by raising prices, which helps their margins. But remember that corporate costs go up first, then they raise prices. That timeline would suggest margins would need to shrink before the benefit of price hikes kick in. The margin data indicates that there’s no evidence that profitability is being affected.

Productivity is, in our view, an essential aspect of the economic and inflationary future.

In Horizon Investments’ 2022 outlook on inflation, we wrote that the dueling views of inflation rest on the question of whether productivity would be powerful enough to tame rising prices. And we showed that the current increase in productivity far exceeds what was seen during the stagflationary 1970s. While a definitive answer remains months away, third quarter earnings data suggest that the “transitory” view of high inflation is still likely the correct one.

The vocal debate over inflation that’s playing out on TV and in the press (see the response by Ark Investment’s Cathy Wood to Twitter CEO Jack Dorsey) is an example of the noise that goals-based investors may want to consider disregarding if inflation is an issue that’s going to cause them to make rash financial decisions.

The macroeconomic forces at play that influence inflation can be both diffuse and hard to predict. What’s more, trends can rapidly change, as we’ve seen with the plunge in lumber prices. In our experience, bold pronouncements are usually not helpful in guiding goals-based investors. At Horizon, we remain committed to being flexible and adaptable in managing money amid the unprecedented times we are living in.

Read Horizon Investments’ Q3 Focus Report: 2022 Outlook, The Next “Unprecedented” Year

DOWNLOAD THE BIG NUMBER

Originally published by Horizon Investments

This commentary is written by Horizon Investments’ asset management team. For additional commentary and media interviews, contact Chief Investment Officer Scott Ladner at 704-919-3602 or [email protected].

Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Index information is intended to be indicative of broad market conditions. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in an index.

Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent.

Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2021 Horizon Investments LLC

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com