By Invesco Fifth survey of 238 issue traders throughout the

By Invesco

Fifth survey of 238 issue traders throughout the globe finds persistent attraction amid volatility; 95% respondents excited by allocating to fixed-income issue investing.

Invesco at this time launched findings from its fifth annual Invesco International Issue Investing Research, essentially the most complete trade survey monitoring issue investing sentiment. Interviews for this yr’s international issue examine have been performed throughout a interval of unprecedented market situations in April and Could of 2020 pushed by the worldwide pandemic. Regardless of the market turbulence, the findings level to continued adoption of issue investing, particularly inside mounted earnings.

“There’s no query that volatility has been a defining attribute of markets this yr. And whereas this sort of turbulence and ongoing uncertainty can check even essentially the most seasoned institutional traders’ dedication to their long-term methods, we’re very happy to see that issue traders collectively have persevered by means of short-term discomfort,” stated Mo Haghbin, Chief Industrial Officer and COO, Invesco Funding Options. “The evolution of issue investing continues to draw all kinds of traders, which in flip drives the trade to proceed to develop and refine issue choices to fulfill these wants.”

Resiliency of Issue Investing Amid Difficult Macroeconomic Backdrop

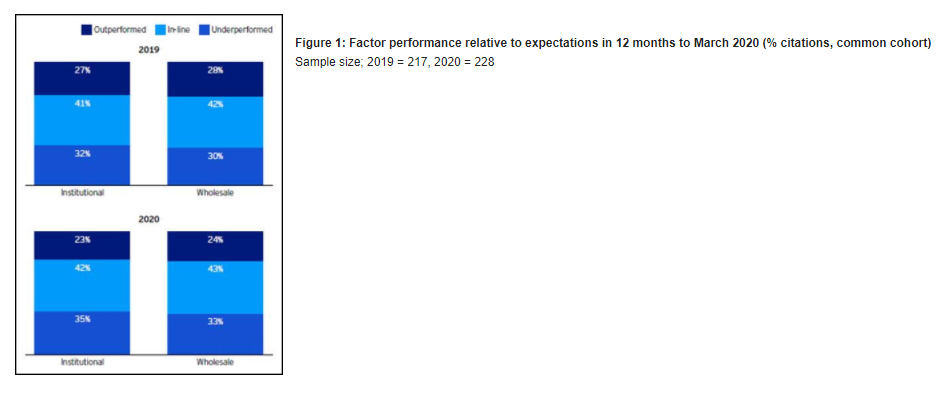

Regardless of the backdrop of COVID-19, traders expressed confidence of their issue allocations – over 65% of traders surveyed reporters’ components assembly or exceeding expectations. Interviews for this examine have been performed following the preliminary shockwaves the pandemic despatched by means of monetary markets. Whereas the issue traders interviewed understood that the complete influence on their portfolios was not but clear, they have been persevering with to extend issue allocations regardless of a difficult interval and divergent issue efficiency. Issue allocations are being assessed in opposition to threat and return aims over a long-term horizon, and most traders surveyed have been happy to see components behaving as anticipated throughout a turbulent interval in international markets. (Determine 1)

This long-term strategy to issue investing is demonstrated in traders’ dedication to worth investing. Regardless of latest underperformance, traders consider within the deserves of sustaining or growing worth publicity inside portfolios: solely 5% of institutional traders and 16% of advisors doubted that worth would carry out over the complete cycle. This continued curiosity within the worth issue occurred on the similar time traders reported barely tilting exposures to the standard and momentum components for tactical causes primarily based on issue metrics.

Confidence in Mounted Revenue Components Continues to Improve

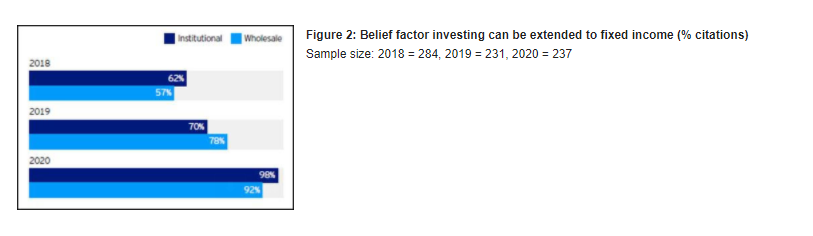

Representing a dramatic improve over the previous two years, almost all respondents on this yr’s examine consider issue investing will be utilized to mounted earnings — a change from 59% in 2018 to 95% this yr. When it comes to precise utility, two-fifths of these surveyed use components in mounted earnings and over two-thirds are actively contemplating introducing them into their portfolios. (Determine 2)

Whereas the applying of issue investing to mounted earnings is new to many issue traders, systemic approaches, resembling issue investing, to mounted earnings have had steadfast attraction. The examine finds a comparatively excessive variety of respondents both investing in mounted earnings through components or contemplating introducing components to their mounted earnings allocations.

For institutional traders, threat discount has persistently been an important driver of adoption, adopted by growing returns. Nevertheless, the elevated concentrate on controlling portfolios and enhancing benchmarking over the past two years means that traders are more and more contemplating components within the context of the entire portfolio, somewhat than in choose sleeves or asset lessons. Buyers additionally cited the potential for an element strategy to shine a highlight on alpha technology by energetic mounted earnings managers and produce extra transparency to the market, much like the benefits they already see with utilizing components in equities.

Some challenges nonetheless act as a barrier to investor adoption. For greater than half of institutional traders, a scarcity of consensus round definitions and terminology stays a problem (56%). Some additionally pointed to the difficulties of working with completely different exterior managers throughout mounted earnings issue mandates and the shortage of unified definitions when discussing mounted earnings components internally.

Rising Sophistication of Issue Buyers Boosts Dynamic Allocation

Buyers are transferring past merely shopping for issue methods, recognizing the necessity to adapt and evolve issue methods as capabilities develop or the market atmosphere adjustments. 93% of institutional traders and 82% of advisors look to replace their approaches frequently, whether or not by making incremental adjustments to information sources and execution or by making extra basic adjustments to allocations.

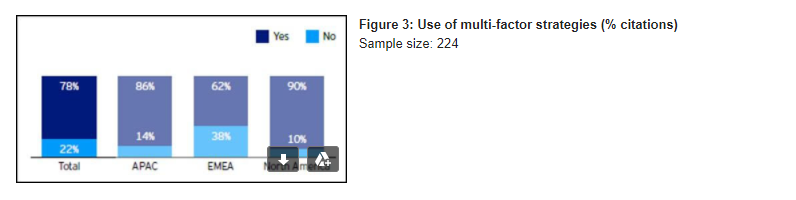

One instance of this rising sophistication is the continued adoption of multi-factor methods, using which is now a several-year pattern. Multi-factor methods have turn into the norm, utilized by 81% of surveyed institutional traders and 73% of responding advisors. Virtually half of the examine’s respondents run methods the place multi-factor allocations are constructed up utilizing quite a few single-factor allocations. (Determine 3)

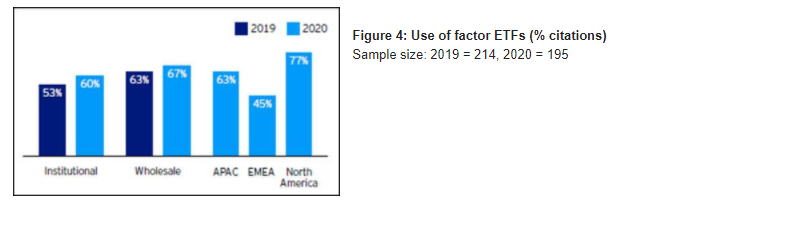

Buyers are additionally growing their utilization of ETFs as they seek for extra tactical instruments in opposition to a difficult financial backdrop. For wealth managers, ETFs are often the first car for gaining issue publicity, making up three-quarters of the common issue allocation. A majority of institutional traders now use ETFs, accounting for a median of 14% of their issue portfolios. Within the wholesale phase, greater than two-thirds of traders make use of ETFs, accounting for half of issue portfolios total. This consists of using low volatility methods to assist handle total portfolio volatility, with these cited often as an vital driver of the pattern in the direction of ETF use amongst each institutional and wholesale traders. (Determine 4)

Respondents said the underlying index methodology is commonly an vital choice criterion, with completely different ETFs focusing on the identical issue or components not all the time seen as equals. Buyers highlighted the significance of rigorous due diligence when deciding on an ETF, in addition to the necessity for full transparency and schooling relating to composition and methodology from funds suppliers. This was seen as notably vital when deciding on multi-factor and multi-asset merchandise, the place similar-looking merchandise can differ broadly by way of definitions, weightings and rebalancing methodologies.

“Buyers’ confidence of their issue allocations, even within the depths of the COVID-19 disaster, is a testomony to each the rising attraction of issue allocations and traders’ dedication to long-term approaches,” stated Marcus Axthelm, Director of Issue Investing, Americas, Invesco. “That sentiment may be very a lot aligned with the overarching findings from this yr’s examine: issue investing is continuous on its development trajectory, and traders are more and more open to adopting new issue methods — resembling mounted earnings and multi-factor — to assist meet their final funding aims. Larger adoption of those methods demonstrates the worth within the trade’s continued funding in associated product growth and schooling for institutional traders and advisors.”

Pattern and Methodology

The fieldwork for this examine was performed by NMG’s technique consulting follow. Invesco selected to have interaction a specialist unbiased agency to make sure high-quality goal outcomes. Key parts of the methodology embody:

- A concentrate on the important thing resolution makers conducting interviews utilizing skilled consultants and providing market insights.

- In-depth (usually one hour) videoconference and telephone interviews utilizing a structured questionnaire to make sure quantitative in addition to qualitative analytics have been collected.

- Outcomes interpreted by NMG’s technique crew with related consulting expertise within the international asset administration sector.

In 2020, the fifth yr of the examine, interviews have been performed with 238 completely different pension funds, insurers, sovereign traders, asset consultants, wealth managers and personal banks globally. Collectively these traders are accountable for managing $25.Four trillion in belongings (as of 31 March 2020).

On this yr’s examine, all respondents have been ‘issue customers’, outlined as any respondent investing in an element product throughout their complete portfolio and/or utilizing components to observe exposures. We intentionally focused a mixture of investor profiles throughout a number of markets, with a desire for bigger and extra skilled issue customers. The breakdown of the 2020 interview pattern by investor phase and geographic area is displayed within the report. Invesco isn’t affiliated with NMG Consulting.

To entry the complete Invesco International Issue Investing Research please go to the Invesco Issue Investing Web site.

Appendix

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.