As the S&P 500 has flip-flopped between purple and inexperienced, the timing could not be extra auspicious for the Invesco S&P 500 Low Volatility ETF (SPLV), which now has 10 years of efficiency below its belt.

The fund is predicated on the S&P 500® Low Volatility Index and seeks to take a position not less than 90% of its complete property in widespread shares that comprise the Index. The index is compiled, maintained, and calculated by Normal and Poor’s and consists of the 100 shares from the SP 500 Index with the bottom realized volatility over the previous 12 months.

Volatility is a statistical measurement of the magnitude of up-and-down asset worth fluctuations over time. The fund and the index are re-balanced and reconstituted quarterly in February, Could, August, and November.

For the reason that fund’s inception date of Could 5, 2011, the fund has reached some main milestones. For one, SPLV has exhibited 19% much less volatility (11.03% v. 13.65%), a beta of 0.65, versus the S&P 500.

The fund’s low volatility technique throughout a downturn doesn’t suggest it sacrifices efficiency in an upturn. SPLV can carry out throughout market rallies whereas mitigating danger throughout excessive sell-offs with a 69.7% up seize and 55.9% down seize ratio.

With 10 years of efficiency information out there, the fund has confirmed its mettle previously. SPLV has outperformed the S&P 500 by a median of three.90% (-6.24% to -10.14%) in 19 of 21 intervals the place the S&P 500 declined by 5% or extra with a 90.5% win price (19 of 21 occurrences).

A Time-Examined Technique

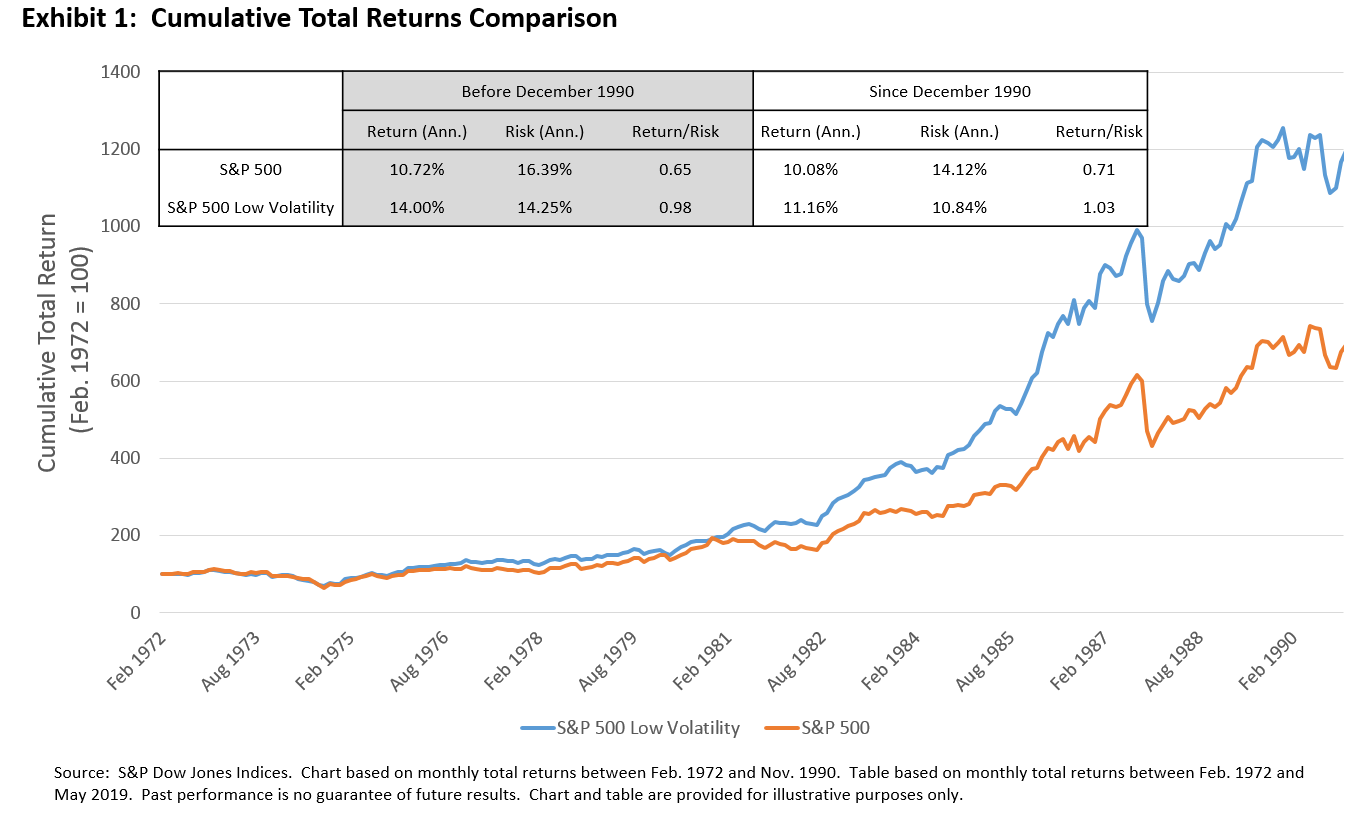

If the final 10 years of efficiency wasn’t sufficient, an Indexology weblog by S&P Dow Jones Indices, back-tested the viability of the index that SPLV tracks all the best way to the early 70s. What they discovered was that the low volatility index was in a position to stand the take a look at of time.

“We just lately prolonged the returns historical past for the S&P 500 Low Volatility Index again to February 1972, giving us almost 5 many years of perception into the issue’s efficiency and traits,” the weblog famous.

“Exhibit 1 reveals that S&P 500 Low Volatility Index outperformed the U.S. fairness benchmark between February 1972 and November 1990, each in absolute phrases and on a risk-adjusted foundation,” the weblog defined. “Its larger annualized returns and decrease volatility than the S&P 500 resulted in a danger/reward ratio of 0.98, which was just like the ratio noticed in the course of the latter interval. Therefore, the S&P 500 Low Volatility’s returns had been equally compensated for the dangers being taken within the 1970s and 1980s in comparison with the interval since December 1990.”

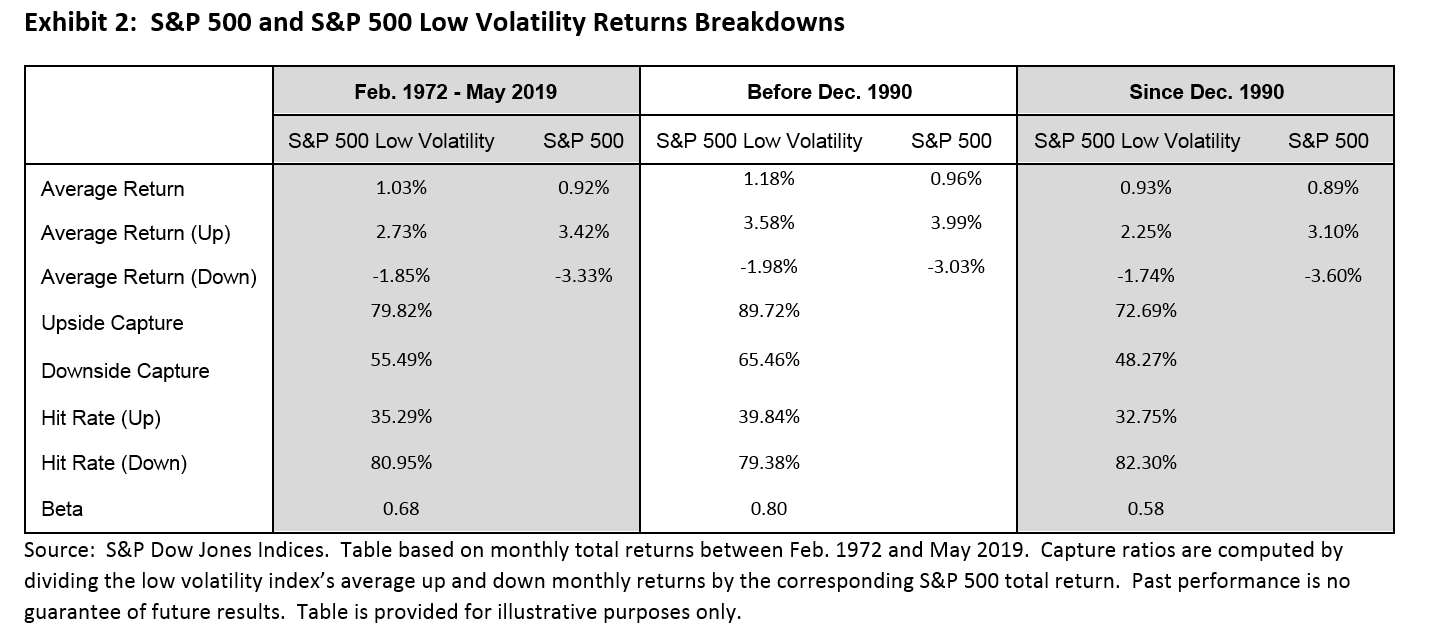

Subsequent, the low volatility index’s efficiency was analyzed inside three distinct time intervals.

“Exhibit 2 gives a breakdown of the S&P 500 and the S&P 500 Low Volatility indices’ returns over three horizons: from February 1972 to Could 2019, between February 1972 and November 1990, and between December 1990 and Could 2019. Up and down months are primarily based on S&P 500’s month-to-month complete returns,” the weblog added.

All in all, it reveals {that a} low volatility technique can maintain up over a long-term horizon.

“Consequently, the important thing traits of low volatility indices remained intact over the 4 many years of (back-tested) index historical past: the S&P 500 Low Volatility Index displayed its standard uneven danger/return traits of upside participation and draw back safety,” the weblog concluded.

For extra information and data, go to the Progressive ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.